- United States

- /

- Airlines

- /

- NYSE:LUV

Southwest Airlines (LUV): Evaluating Valuation as New Routes and Premium Upgrades Redefine Its Strategy

Reviewed by Kshitija Bhandaru

Southwest Airlines (LUV) is rolling out a major update to its route network and product offerings, highlighted by the launch of new international destinations and a shift toward assigned and premium seating. This evolution could reshape how the airline competes and grows revenue.

See our latest analysis for Southwest Airlines.

Southwest’s strategy shift has sparked some renewed interest, but the past year’s momentum remains muted. The 1-year total shareholder return comes in at just 7.4%. Despite recent route launches and tech innovation, the share price is still down about 4.4% year-to-date. This suggests investors are watching for clearer signs of consistent long-term growth as new initiatives take hold.

If change at Southwest makes you curious about broader industry trends, now’s the perfect moment to explore See the full list for free.

With so much in transition, is Southwest Airlines now trading at a bargain for value investors, or has the market already factored in the upside from its strategic upgrades and expanding route network?

Most Popular Narrative: 3.5% Undervalued

The most widely followed narrative points to a fair value of $33.06, a modest 3.5% premium to Southwest Airlines’ last closing price of $31.90. This signals analyst expectations for incremental upside driven by current strategic shifts, as market participants weigh short-term trading and longer-term transformation.

Planned introduction of premium and assigned seating, along with basic economy offerings, can enhance revenue yield through differentiated pricing strategies catering to varied consumer preferences. This may potentially boost net margins and overall earnings.

Want to know what powers this narrative premium? Analysts are betting on big earnings growth, leaner margins, and a profit trajectory that hints at a major industry re-rating. The financial blueprint behind this target might surprise you. Don’t miss out on the real story fueling this fair value estimate.

Result: Fair Value of $33.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and softer booking trends in leisure travel could present challenges for Southwest as it works to maintain its current earnings momentum.

Find out about the key risks to this Southwest Airlines narrative.

Another View: Market Ratios Raise Caution

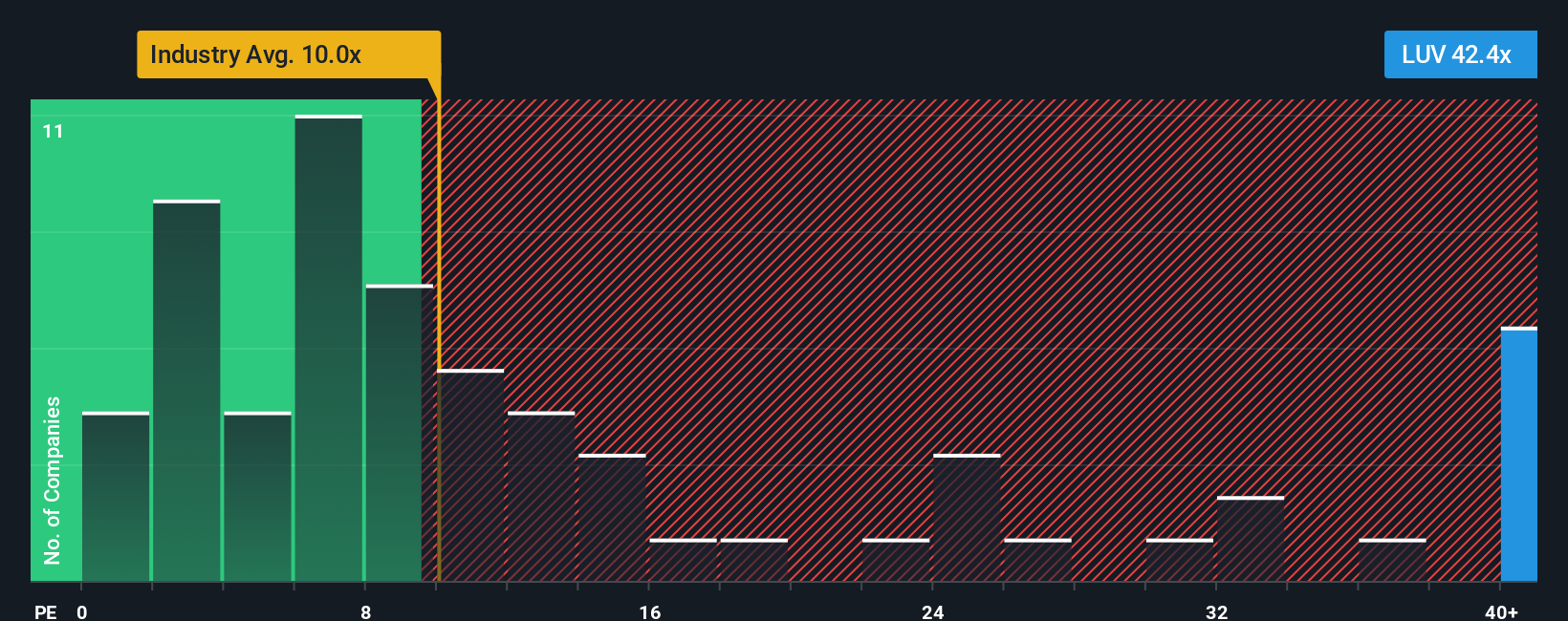

While the prevailing narrative suggests Southwest Airlines is modestly undervalued, a closer look at its price-to-earnings ratio presents a more cautious picture. Southwest trades at 42.7x, which is far above the industry average of 9.3x and the peer average of 12.3x. Even compared to the fair ratio of 28x, the current price appears stretched and this points to valuation risk if performance does not catch up. Do these elevated multiples signal hidden optimism, or are they a warning for value-focused investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southwest Airlines Narrative

Curious to see if your perspective lines up differently? Dive into the data and craft a personalized story around the numbers in just minutes. Do it your way

A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity when you could uncover others poised for growth? The market moves quickly, and the right screen could reveal tomorrow’s leaders today.

- Unlock high potential by targeting strong performers trading below their worth with these 891 undervalued stocks based on cash flows.

- Tap into the unstoppable momentum of artificial intelligence with opportunities surfaced through these 25 AI penny stocks.

- Earn while you wait by spotting reliable income payers using these 18 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUV

Southwest Airlines

Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives