- United States

- /

- Transportation

- /

- NYSE:KNX

Did Rising Insurance and Claims Costs Just Shift Knight-Swift (KNX) Transportation’s Long-Term Investment Narrative?

Reviewed by Sasha Jovanovic

- Knight-Swift Transportation Holdings Inc. reported third-quarter 2025 earnings with net income dropping to US$7.86 million, impacted by impairment charges and higher insurance costs; revenues rose modestly to US$1.93 billion.

- While the less-than-truckload segment showed signs of improvement, overall margins and guidance missed analyst expectations due to persistent cost pressures and claims expenses.

- We'll explore how elevated insurance and claims costs in the latest earnings report could alter Knight-Swift's long-term investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Knight-Swift Transportation Holdings Investment Narrative Recap

To own Knight-Swift Transportation Holdings, an investor needs to believe that ongoing improvements in the less-than-truckload (LTL) segment and the company’s scale will ultimately outweigh current cost headwinds, paving the way for margin recovery. The recent third-quarter results, marked by a sharp drop in net income due to impairment charges and heightened insurance and claims expenses, reinforce that cost pressures remain the most important near-term risk for the business rather than the catalyst, which is LTL integration progress. The persistent claims costs represent a material challenge to earnings leverage in the short term.

One relevant announcement is the voluntary $28.8 million impairment charge in the third quarter, associated with rebranding Midwest Motor Express and DHE Transportation under the AAA Cooper Transportation name. This action signals the company’s ongoing effort to create a unified LTL platform, directly tied to the central catalyst of operational integration and scale benefits, but also highlights the degree of upfront costs yet to be absorbed as these changes are implemented.

By contrast, investors should be aware of ongoing insurance and claims costs, especially as...

Read the full narrative on Knight-Swift Transportation Holdings (it's free!)

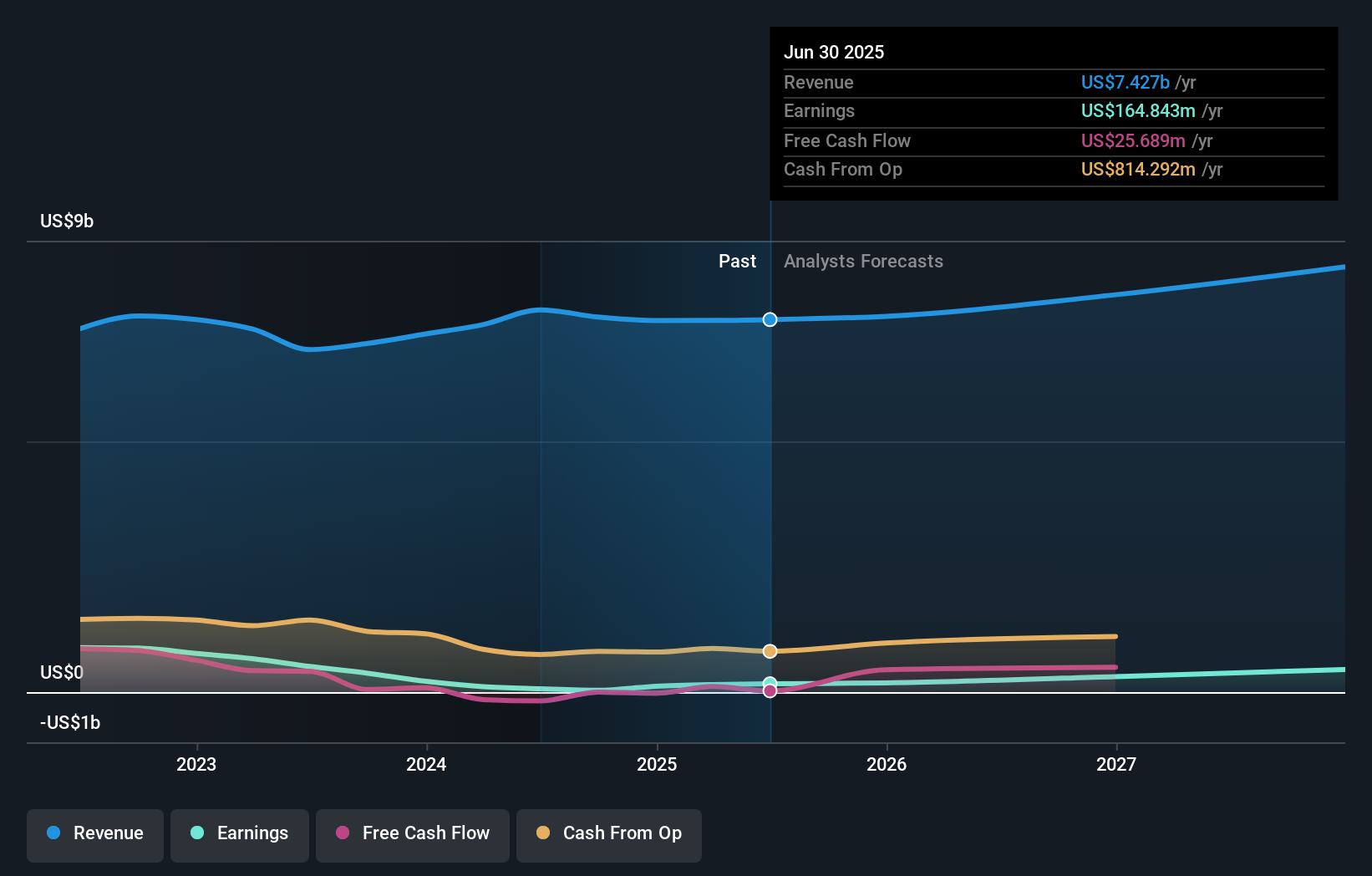

Knight-Swift Transportation Holdings' outlook projects $8.7 billion in revenue and $524.7 million in earnings by 2028. This is based on a 5.3% annual revenue growth rate and an increase in earnings of $359.9 million from the current $164.8 million.

Uncover how Knight-Swift Transportation Holdings' forecasts yield a $53.25 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Fair value estimates for Knight-Swift from Simply Wall St Community members range from US$53.25 to US$66.05 based on two independent analyses. While views are diverse, the latest claims-related costs and near-term margin pressures could influence how you assess the company’s risk profile and long-term prospects.

Explore 2 other fair value estimates on Knight-Swift Transportation Holdings - why the stock might be worth as much as 46% more than the current price!

Build Your Own Knight-Swift Transportation Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Knight-Swift Transportation Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Knight-Swift Transportation Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Knight-Swift Transportation Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knight-Swift Transportation Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNX

Knight-Swift Transportation Holdings

Provides freight transportation services in the United States and Mexico.

Proven track record average dividend payer.

Market Insights

Community Narratives