- United States

- /

- Airlines

- /

- NYSE:JOBY

Joby Aviation (JOBY) Is Down 10.8% After $514 Million Equity Raise for Manufacturing Scale-Up – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Joby Aviation completed a follow-on equity offering in the past week, raising approximately US$514 million by issuing over 30 million common shares at a discount to the prevailing market price to support its aircraft certification and manufacturing scale-up.

- This significant capital injection follows recent public demonstrations of Joby's all-electric aircraft and new air taxi service collaborations, underscoring the company's dual approach of advancing operations and securing funding for commercialization.

- We'll look at how this substantial fundraise for certification and manufacturing could reshape Joby Aviation's investment narrative as it pursues commercialization.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Joby Aviation's Investment Narrative?

Owning Joby Aviation requires confidence in the company’s ability to turn cutting-edge technology and ambitious partnerships into commercial success, despite an early-stage revenue base and ongoing operating losses. The recent US$514 million equity raise is a clear signal that Joby is leaning into the capital-intensive phase required for aircraft certification and manufacturing scale-up, but it also brought about immediate dilution and a pullback in the share price. This fresh cash could help Joby navigate regulatory milestones and support its move toward operations in key markets like the UAE and Japan, possibly accelerating key short-term catalysts tied to product launches and international expansion. At the same time, it exposes shareholders to renewed concerns about further dilution, cash burn, and uncertainty around the path to profitability. While the raise strengthens the balance sheet, the risk remains that future equity offerings might be needed unless the business can transition quickly toward recurring revenue and scale.

However, dilution risk after this funding round is a real concern investors should keep an eye on.

Exploring Other Perspectives

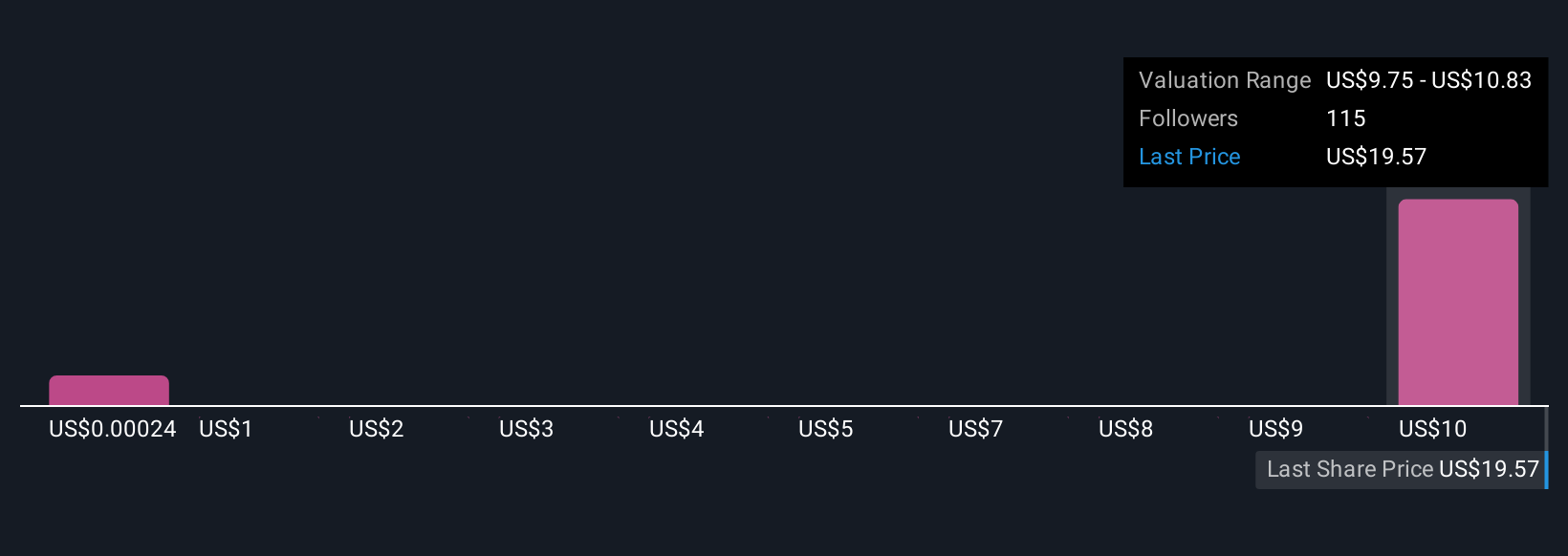

Explore 15 other fair value estimates on Joby Aviation - why the stock might be worth as much as $10.83!

Build Your Own Joby Aviation Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Joby Aviation research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Joby Aviation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Joby Aviation's overall financial health at a glance.

No Opportunity In Joby Aviation?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JOBY

Joby Aviation

A vertically integrated air mobility company, engages in building an electric vertical takeoff and landing aircraft optimized to deliver air transportation as a service in the United States and Dubai.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives