- United States

- /

- Logistics

- /

- NYSE:FDX

Will Grounded Cargo Jets During Peak Season Change FedEx's (FDX) Efficiency-Focused Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent weeks, FedEx and UPS were forced to ground many aging cargo aircraft after a tragic explosion, cutting air capacity during the critical holiday shipping period and heightening reliance on alternative carriers such as the U.S. Postal Service and Amazon.

- This disruption underscores how concentrated fleets and older aircraft can amplify supply-chain risk, testing FedEx’s operational resilience just as peak-season efficiency matters most for customers and margins.

- We’ll now explore how these aircraft groundings, and the resulting peak-season capacity strain, could affect FedEx’s previously optimistic efficiency-focused investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

FedEx Investment Narrative Recap

To own FedEx, you generally have to believe its global scale, cost-efficiency programs, and integrated air and ground network can support resilient earnings, even when volumes or pricing wobble. The forced grounding of aging cargo aircraft directly challenges that belief in the near term by stressing peak-season reliability, but it does not yet appear to alter the longer term thesis that cost and network efficiency are the key earnings drivers and the main near term catalyst, while execution risk around Freight separation remains a major overhang.

The most relevant recent development here is FedEx’s ongoing DRIVE and Network 2.0 efficiency push, which targets billions in structural cost savings and better asset utilization, including aircraft density. This air-capacity disruption is an early test of whether those initiatives can offset temporary cost spikes and revenue pressure during a critical shipping period, or whether operational setbacks will feed through to earnings and challenge the upbeat efficiency-focused narrative investors have been watching so closely.

Yet investors should be aware that execution risk around the FedEx Freight separation and restructuring costs could...

Read the full narrative on FedEx (it's free!)

FedEx's narrative projects $95.1 billion revenue and $5.2 billion earnings by 2028. This requires 2.6% yearly revenue growth and about a $1.1 billion earnings increase from $4.1 billion today.

Uncover how FedEx's forecasts yield a $271.93 fair value, in line with its current price.

Exploring Other Perspectives

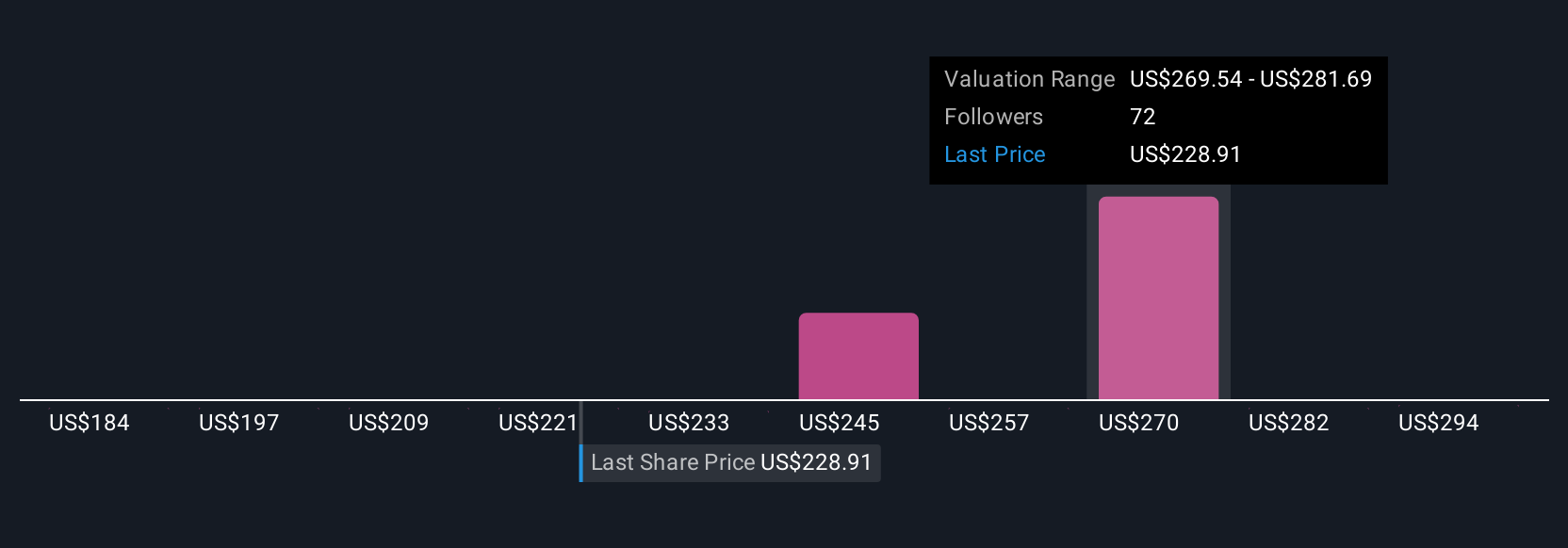

Five members of the Simply Wall St Community value FedEx between US$271.93 and US$352.96 per share, showing a wide spread of individual expectations. When you set those side by side with the current focus on DRIVE cost savings as a key catalyst, it becomes clear why reviewing several viewpoints can help you weigh how much short term disruption might matter for longer term performance.

Explore 5 other fair value estimates on FedEx - why the stock might be worth just $271.93!

Build Your Own FedEx Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FedEx research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FedEx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FedEx's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDX

FedEx

Provides transportation, e-commerce, and business services in the United States and internationally.

Undervalued established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026