- United States

- /

- Logistics

- /

- NYSE:FDX

Should the Elemica Partnership Reframe FedEx’s (FDX) Operational Efficiency Outlook?

Reviewed by Sasha Jovanovic

- Elemica announced in the past week that its ProcessWeaver shipping execution platform has integrated with FedEx Surround, combining AI-powered shipment intelligence with Elemica’s global network to offer enhanced predictive visibility and automated workflows for critical shipments.

- This collaboration aims to give manufacturers and logistics leaders proactive control and reduce manual tracking, signaling an expanded role for FedEx’s technology in addressing complex industry challenges.

- We’ll explore how FedEx’s AI-powered logistics visibility partnership with Elemica may influence the company’s long-term operational efficiency outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

FedEx Investment Narrative Recap

To own FedEx, investors need confidence in the company's ability to drive operational efficiency and handle cost pressures while managing shifting industrial demand. The integration of AI-powered logistics with Elemica brings potential for process efficiencies, but is unlikely to materially shift the dominant short-term catalyst, which currently centers on the company's multi-year cost reduction initiatives. The greatest near-term risk remains weak B2B volumes and pricing pressure, especially if industrial demand falters or adverse conditions persist.

Among recent announcements, FedEx’s DRIVE initiative stands out, with ambitions to deliver over US$2.2 billion in cost savings for fiscal 2025. This initiative directly addresses cost efficiency, a key catalyst underpinning expectations for improved margins and earnings resiliency since both macroeconomic and operational pressures remain forefront concerns. As FedEx adopts new technologies and partnerships, cost discipline and operational leverage will likely remain vital for supporting its wider transformation goals.

On the flip side, investors should be aware of the ongoing risk associated with industrial economy weakness, especially if...

Read the full narrative on FedEx (it's free!)

FedEx's outlook anticipates $95.1 billion in revenue and $5.2 billion in earnings by 2028. This forecast assumes 2.6% annual revenue growth and an increase in earnings of $1.1 billion from the current $4.1 billion.

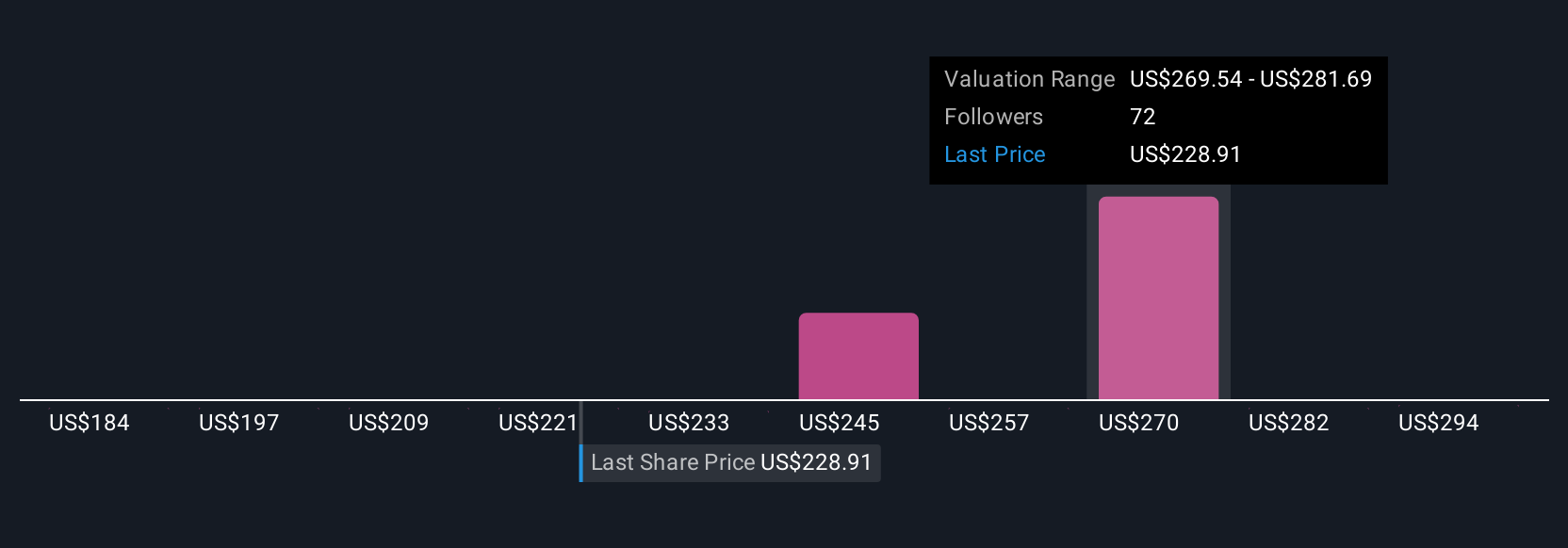

Uncover how FedEx's forecasts yield a $266.17 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community estimate fair values for FedEx ranging from US$266 to US$388 per share. As many focus on DRIVE initiative cost savings, the wide spectrum of opinions highlights why it pays to consider multiple sources before committing to a position.

Explore 5 other fair value estimates on FedEx - why the stock might be worth just $266.17!

Build Your Own FedEx Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FedEx research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FedEx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FedEx's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDX

FedEx

Provides transportation, e-commerce, and business services in the United States and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives