- United States

- /

- Airlines

- /

- NYSE:DAL

Delta (DAL) Margin Miss Reinforces Market Caution on Growth and Profitability

Reviewed by Simply Wall St

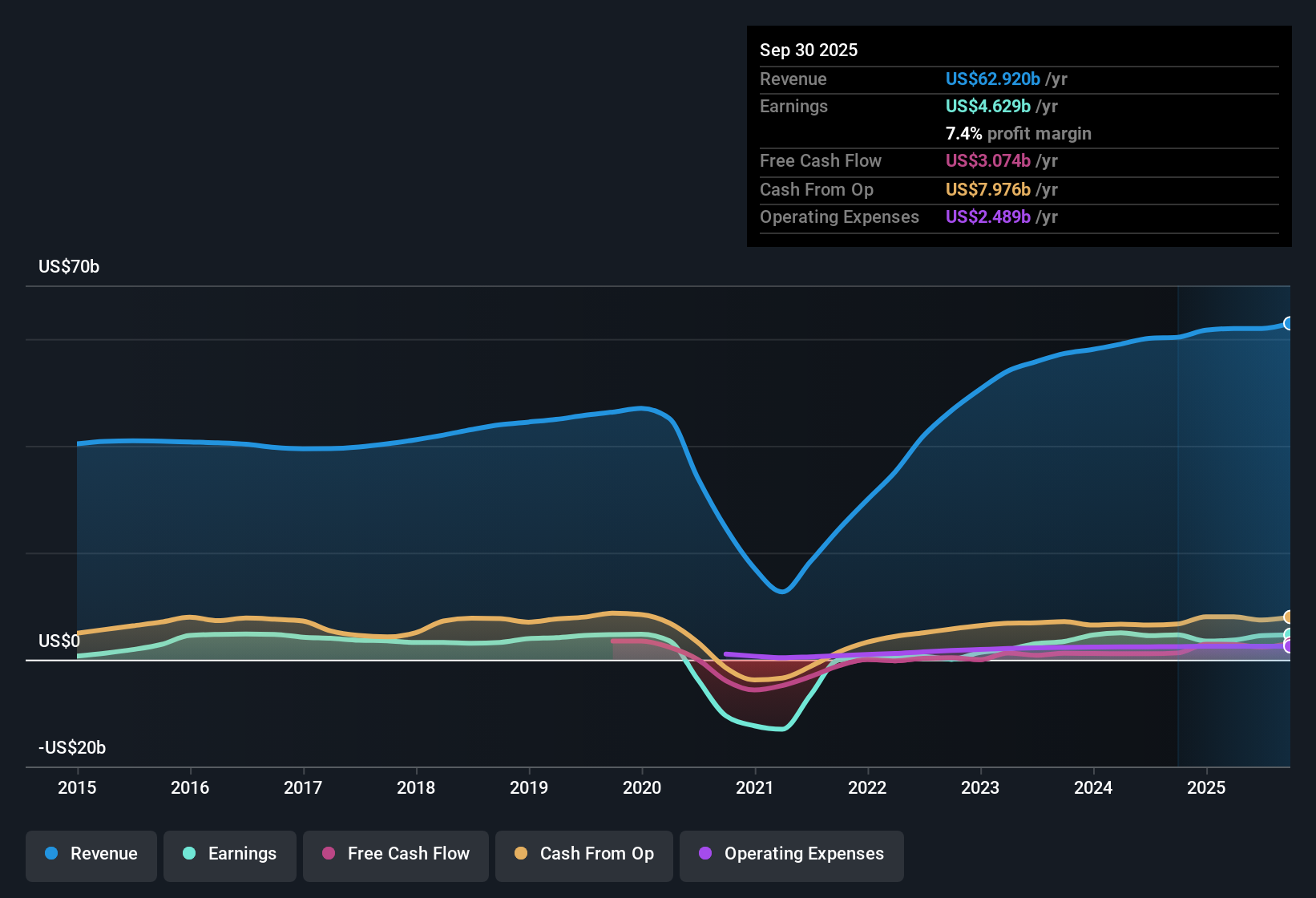

Delta Air Lines (DAL) reported net profit margins of 7.4%, a slight dip from last year’s 7.7%. This marks the end of a notable five-year stretch where earnings averaged 73.2% annual growth. However, recent earnings growth has reversed course, with forecasts pointing to a yearly decline of 7.1% over the next three years. Revenue is expected to grow by just 2.8% per year, which is well below the US market’s 10% pace. Margin pressure and slowing growth are likely to shape perceptions as investors weigh these results against Delta’s steadily discounted valuation.

See our full analysis for Delta Air Lines.Next, we will put these fresh earnings in the context of leading market narratives to see which stories hold up and which might need a rethink.

See what the community is saying about Delta Air Lines

Flat Capacity Drives Margins, but Growth Trails Market

- Average revenue growth is forecast at just 2.8% per year for Delta, trailing the broader US market's expected 10% growth pace.

- Analysts' consensus view notes Delta’s cost management and focus on premium services are expected to support net margins. However, economic pressures and cautious expansion plans limit upside compared to industry momentum.

- Consensus narrative highlights Delta's strategy of maintaining flat capacity and targeting resilient premium and loyalty streams. This approach could help preserve net margins despite limited overall revenue growth.

- With projected annual revenue growth well below the market average and ongoing macro headwinds, Delta appears set for a slower trajectory than most US peers.

- The current share price of $59.57 sits below the analyst price target of $70.91. This suggests the market remains cautious on forward growth despite relative margin stability.

Profit Margins Feel the Squeeze

- Net profit margins have slipped from 7.7% to 7.4% over the last year, breaking Delta's multi-year trend of robust profitability.

- Consensus narrative points to the growing risk that margin pressure will intensify if competitive forces and weak corporate travel persist.

- While Delta leverages partnerships and international exposure to bolster revenues, stagnant main cabin demand and the threat of new tariffs on aircraft could further erode margins.

- If economic uncertainty drags on, the consensus warns that shrinking margins may dampen Delta’s ability to hit even modest growth targets.

Discounted Valuation Faces Sector Skepticism

- Delta’s price-to-earnings ratio of 8.3x not only sits below the airlines industry average (9.5x), but is far under the peer group average (21x). This signals the stock trades at a clear discount.

- Analysts' consensus view notes the attractive headline valuation, but flags that without a meaningful growth catalyst, the low multiple may reflect market doubts about Delta’s ability to outperform.

- Despite the DCF fair value of $159.33 offering sizable theoretical upside, consensus expects only modest appreciation absent a shift in growth prospects.

- The modest analyst price target of $70.91, which is just above the current price, encapsulates this tempered outlook despite the discounted multiple.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Delta Air Lines on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Take a couple of minutes to turn your insights into a narrative and share your perspective. Do it your way.

A great starting point for your Delta Air Lines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Delta’s tepid revenue growth and slipping margins highlight its struggle to keep pace with the broader market’s earnings potential and resilience.

If you want exposure to companies delivering sustained expansion, check out stable growth stocks screener to pinpoint those outpacing Delta on consistent growth and performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives