- United States

- /

- Airlines

- /

- NYSE:DAL

Delta Air Lines (DAL): Valuation in Focus as Lawsuits Raise Questions Over Window Seat Fees

Reviewed by Simply Wall St

Delta Air Lines (DAL) is back in the headlines, but not for the reasons you might expect. The company, along with United Airlines, is facing class-action lawsuits from passengers who allege they were charged extra for window seats that lacked actual windows. While this might sound like a detail only avid travelers would notice, the legal claims seek millions in damages and raise broader questions about how airlines communicate value to their customers. Investors may want to watch how this unfolds, as it could have implications for ancillary revenue streams and customer loyalty at a time when the airline industry is otherwise enjoying a surge in demand.

This legal overhang arrives just as Delta’s shares have attracted attention with their recent performance. The stock is up over 12% in the past month and nearly 25% over the past three months, contributing to a solid 52% gain in the last year. Despite some fluctuations linked to earnings outlooks, Delta has outpaced both the broader market and many sector peers. The company’s steady revenue growth, even in the face of a modest dip in net income, points to a business that is still adapting to a changing travel landscape.

With travel demand high and Delta’s stock outperforming, the question remains whether the market is still underestimating future earnings, or if current valuations are already factoring in the next stage of growth.

Most Popular Narrative: 3.1% Overvalued

According to PittTheYounger, Delta Air Lines’ current share price is slightly above what may be justified by recent performance and future outlook, based on retail investor analysis.

True, the carrier had to jettison its record guidance for 2025 it had issued in January. Still, Delta made a gross profit of roughly 1 cent per available seat mile in the traditionally weak winter quarter when other airlines struggle to turn any profit at all (my calculations from an adjusted total revenue per seat mile (TRASM) of 18.97 cents and adjusted cost per available seat mile (CASM including fuel) of 17.96 cents). Thus, the carrier made an almost exact landing at where I had estimated its margins a couple of weeks ago.

Think Delta’s fair value is simple math? The analysis suggests otherwise. This narrative relies on significant assumptions about margin strength, management discipline, and what really drives the bottom line. What might these figures signal about Delta’s staying power and the future shape of airline profits? The answers might surprise you.

Result: Fair Value of $59.84 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sudden shifts in travel demand or economic disruptions could quickly challenge Delta’s margins and the current valuation outlook.

Find out about the key risks to this Delta Air Lines narrative.Another View: Cash Flow Perspective

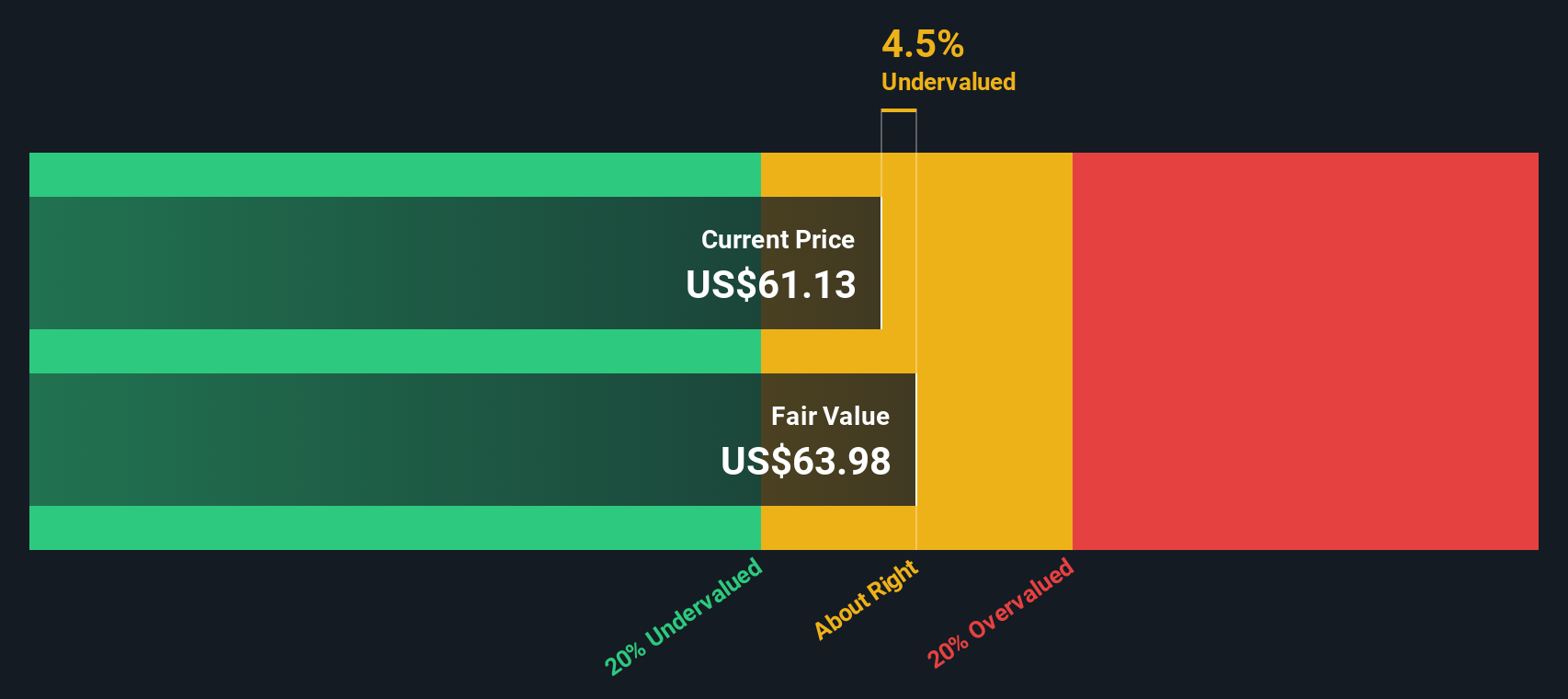

Looking at Delta through our DCF model, the results suggest a different take, with the shares appearing modestly undervalued. While one approach sparks caution, this method could hint at hidden value or perhaps just optimism.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Delta Air Lines Narrative

If these views do not align with your own, or if you prefer to dive deeper into the numbers, know that you can easily craft your own narrative in just a few minutes. do it your way.

A great starting point for your Delta Air Lines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There are countless opportunities beyond Delta, and you do not want to miss out on stocks that could elevate your portfolio. Make your next move confidently by using these powerful tools to uncover investment opportunities tailored to your goals:

- Amplify your potential returns by targeting dividend stocks with yields > 3%. This tool is designed to help you collect reliable income and spot companies offering attractive yields above 3%.

- Jump ahead of the curve by tapping into AI penny stocks. Here, you can track innovative firms riding the surge in artificial intelligence-driven growth.

- Strengthen your strategy with an eye on undervalued stocks based on cash flows. This resource connects you with stocks priced below their true worth based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives