- United States

- /

- Airlines

- /

- NYSE:CPA

These 4 Measures Indicate That Copa Holdings (NYSE:CPA) Is Using Debt Reasonably Well

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Copa Holdings, S.A. (NYSE:CPA) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Copa Holdings

How Much Debt Does Copa Holdings Carry?

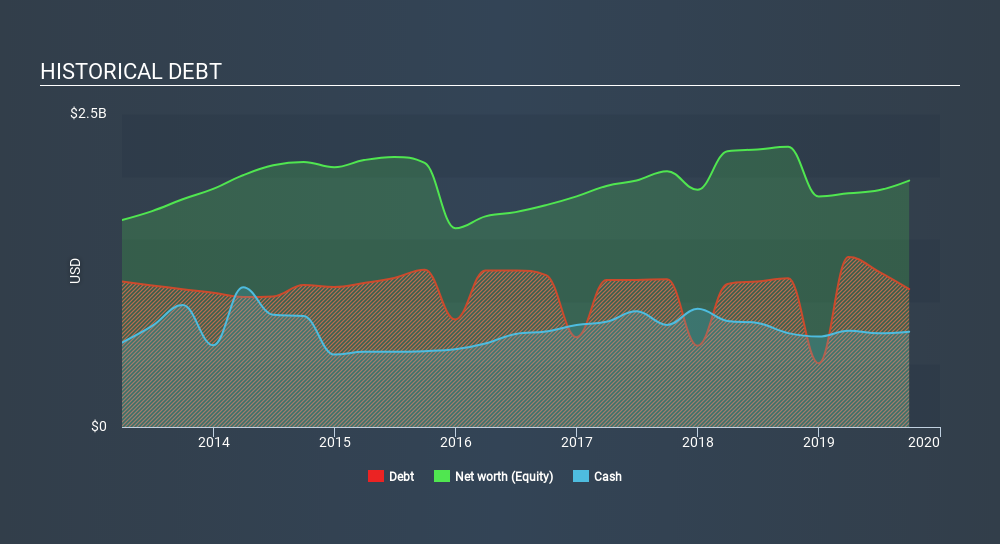

The image below, which you can click on for greater detail, shows that at September 2019 Copa Holdings had debt of US$1.10b, up from US$1.2k in one year. However, because it has a cash reserve of US$761.4m, its net debt is less, at about US$340.1m.

A Look At Copa Holdings's Liabilities

We can see from the most recent balance sheet that Copa Holdings had liabilities of US$1.03b falling due within a year, and liabilities of US$1.42b due beyond that. Offsetting these obligations, it had cash of US$761.4m as well as receivables valued at US$141.1m due within 12 months. So its liabilities total US$1.55b more than the combination of its cash and short-term receivables.

Copa Holdings has a market capitalization of US$4.32b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Copa Holdings's net debt is only 0.61 times its EBITDA. And its EBIT easily covers its interest expense, being 15.4 times the size. So we're pretty relaxed about its super-conservative use of debt. On the other hand, Copa Holdings saw its EBIT drop by 2.0% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Copa Holdings can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Copa Holdings recorded free cash flow worth a fulsome 85% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

The good news is that Copa Holdings's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But truth be told we feel its EBIT growth rate does undermine this impression a bit. Taking all this data into account, it seems to us that Copa Holdings takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Copa Holdings is showing 4 warning signs in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:CPA

Copa Holdings

Through its subsidiaries, provides airline passenger and cargo transport services.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives