- United States

- /

- Marine and Shipping

- /

- NYSE:CMRE

Costamare (NYSE:CMRE): Examining Valuation Dynamics After Recent 25% Return Surge

Reviewed by Kshitija Bhandaru

See our latest analysis for Costamare.

This surge marks an impressive rebound for Costamare, especially after a quieter start to the year. While recent volatility suggests momentum may be building, the stock’s 1-year total shareholder return of 10.7% highlights steady gains across both short-term and long-term horizons.

If rising shipping demand has you thinking about what else could deliver, take a moment to discover fast growing stocks with high insider ownership.

Yet with mixed financial signals and recent gains, is Costamare trading below its true value? Or has the market already factored in all the future growth you could expect from the stock?

Most Popular Narrative: 15.9% Overvalued

Costamare’s current market price sits well above the fair value calculated by the most widely followed narrative. The narrative highlights a disconnect between investor optimism and some looming challenges, inviting a closer look at what drives this assessment.

The recent long-term charters for new containership orders and forward fixtures (with $310 million incremental contracted revenues and $2.5 billion total contracted revenues) may be leading the market to expect sustained high earnings and cash flow visibility. This could overstate future earnings if market conditions weaken. The company's emphasis on stable counterparties and near 100% fleet employment into 2025, along with a 3.2-year average charter duration, could cause investors to underestimate counterparty risk or the potential for rate renegotiations in a downturn. This may result in optimistic expectations for net margins and cash flows.

What’s really driving this pricing? There’s a battle between ambitious contracted revenues and the risk of shrinking top-line growth. The narrative’s core thesis is built on razor-thin financial tradeoffs and a future profit profile that could surprise even seasoned investors. Want to know the quantitative forecasts and margin assumptions at the heart of this story? Dig into the full narrative to see the numbers most investors are missing.

Result: Fair Value of $10.15 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, resilient contracted revenues and strategic fleet upgrades could offset some downside risks. This may potentially challenge the current overvaluation narrative for Costamare.

Find out about the key risks to this Costamare narrative.

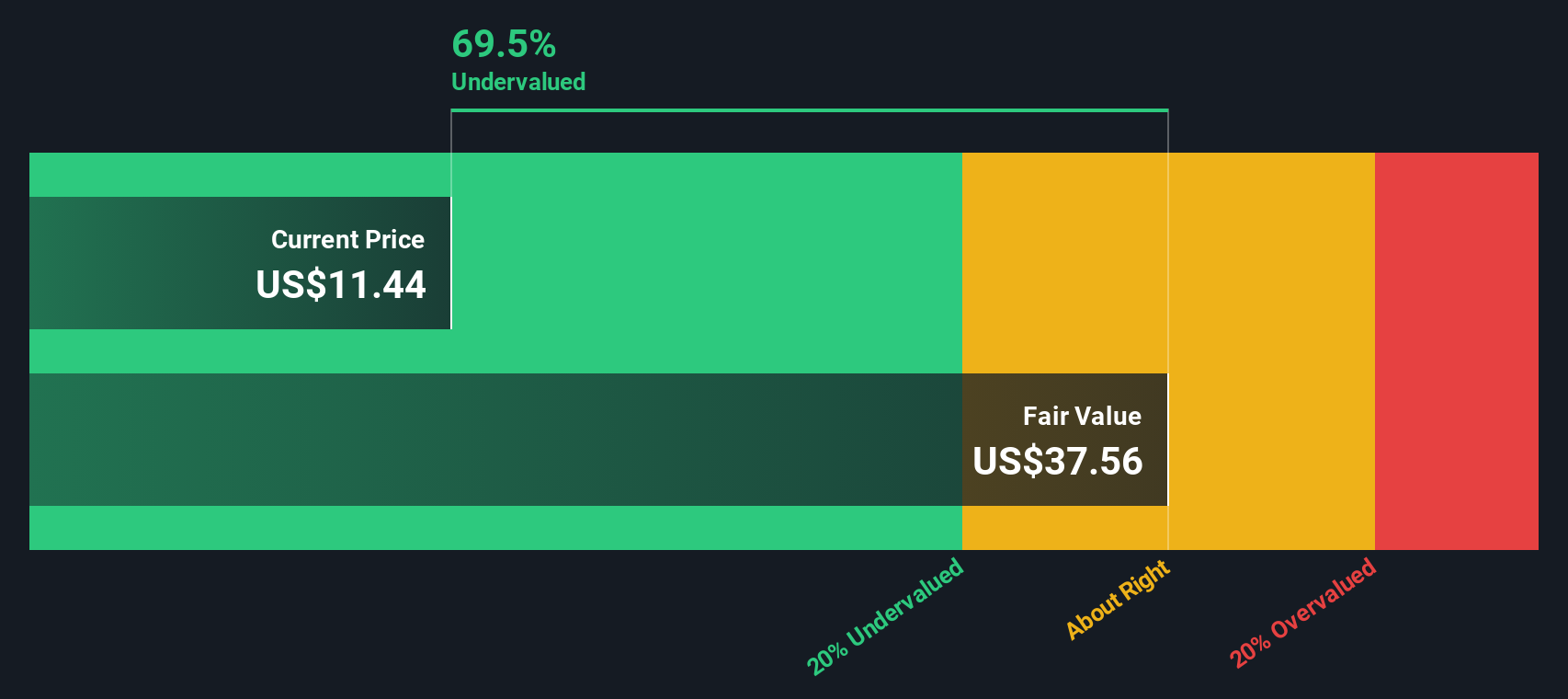

Another View: Discounted Cash Flow Suggests Major Upside

While the most popular narrative sees Costamare as overvalued, our DCF model points in the opposite direction. According to the SWS DCF model, Costamare’s shares are actually trading well below an estimated fair value of $38.30. This suggests significant upside. How can two respected methods tell such different stories? Which scenario is closer to reality as market forces evolve?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Costamare Narrative

If the analysis above doesn’t match your view or if you’re keen on running your own numbers, you can dive in and craft your take in just minutes with Do it your way.

A great starting point for your Costamare research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart moves start with finding tomorrow's winners ahead of the crowd. Make sure you check out these unique stock lists before the next big trend leaves you behind:

- Harness explosive technology shifts by powering up your search with these 25 AI penny stocks, offering the most exciting artificial intelligence prospects right now.

- Capture high yields and steady income streams by tapping into these 19 dividend stocks with yields > 3%, which consistently deliver strong dividend payouts above the market average.

- Uncover hidden value by zeroing in on these 894 undervalued stocks based on cash flows, set to outperform and priced at a discount based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMRE

Costamare

Owns and operates containerships and dry bulk vessels worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives