- United States

- /

- Marine and Shipping

- /

- NYSE:CMRE

Costamare Inc. (NYSE:CMRE) Stock Catapults 28% Though Its Price And Business Still Lag The Market

The Costamare Inc. (NYSE:CMRE) share price has done very well over the last month, posting an excellent gain of 28%. The last 30 days bring the annual gain to a very sharp 86%.

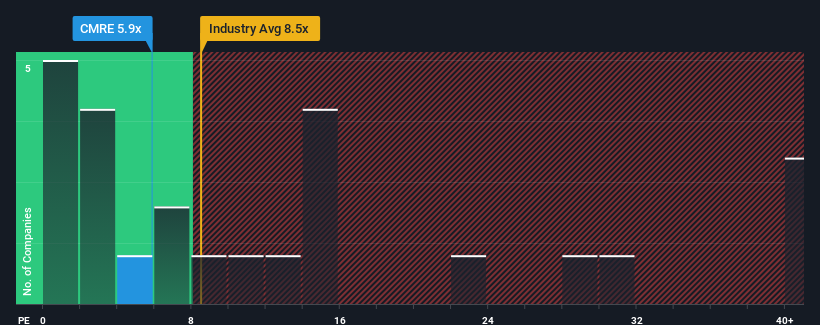

Although its price has surged higher, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may still consider Costamare as a highly attractive investment with its 5.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times haven't been advantageous for Costamare as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Costamare

How Is Costamare's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Costamare's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 43%. Still, the latest three year period has seen an excellent 2,245% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 2.9% per annum during the coming three years according to the two analysts following the company. Meanwhile, the rest of the market is forecast to expand by 10.0% per year, which is noticeably more attractive.

In light of this, it's understandable that Costamare's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Costamare's P/E

Costamare's recent share price jump still sees its P/E sitting firmly flat on the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Costamare maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Costamare (of which 2 are a bit concerning!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CMRE

Costamare

Owns and operates containerships and dry bulk vessels that are chartered to liner companies providing transportation of cargoes worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives