- United States

- /

- Airlines

- /

- NYSE:ALK

What Do Recent Flight Groundings Mean for Alaska Air Group’s Stock Valuation?

Reviewed by Bailey Pemberton

If you have got money in Alaska Air Group or you are eyeing it for your portfolio, you are probably wondering what to make of its wild price swings lately. One moment, Alaska Air shares are up 1.3% in a week, looking like they are ready to regain altitude. Hopes start building about growth potential, especially after the stock rose an impressive 14.8% over the past year and 27.5% in five years. But then, suddenly, reality bites, with shares down 22.8% over the last month and still trailing their start-of-year level by 23.6%. It feels like the market cannot quite decide whether the risks outweigh the recovery story or if this turbulence is just temporary.

Part of this rollercoaster comes from big headlines. Temporary fleet groundings due to software glitches, industry-wide scheduling headaches linked to FAA disruptions, and ongoing legal ripples from last year’s 737 MAX 9 panel blowout all contribute to the uncertainty. While some of these issues may be short-lived, they inject extra uncertainty and sometimes opportunity into the stock’s price.

With all that action, the big question is whether Alaska Air Group is undervalued or not right now. According to a common value scoring system, the company meets just 2 out of 6 major undervaluation checks. On one hand, that is not a strong buy signal. On the other, it leaves room for a deeper dive into what those valuation methods do and do not reveal about Alaska Air's true worth. Keep reading for a closer look at these value checks and insights on evaluating fair value for this stock.

Alaska Air Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Alaska Air Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today based on its projected future cash flows, all adjusted for the time value of money. In Alaska Air Group’s case, the analysis looks at how much free cash the company is expected to generate over the next decade and brings those amounts back to today’s dollars.

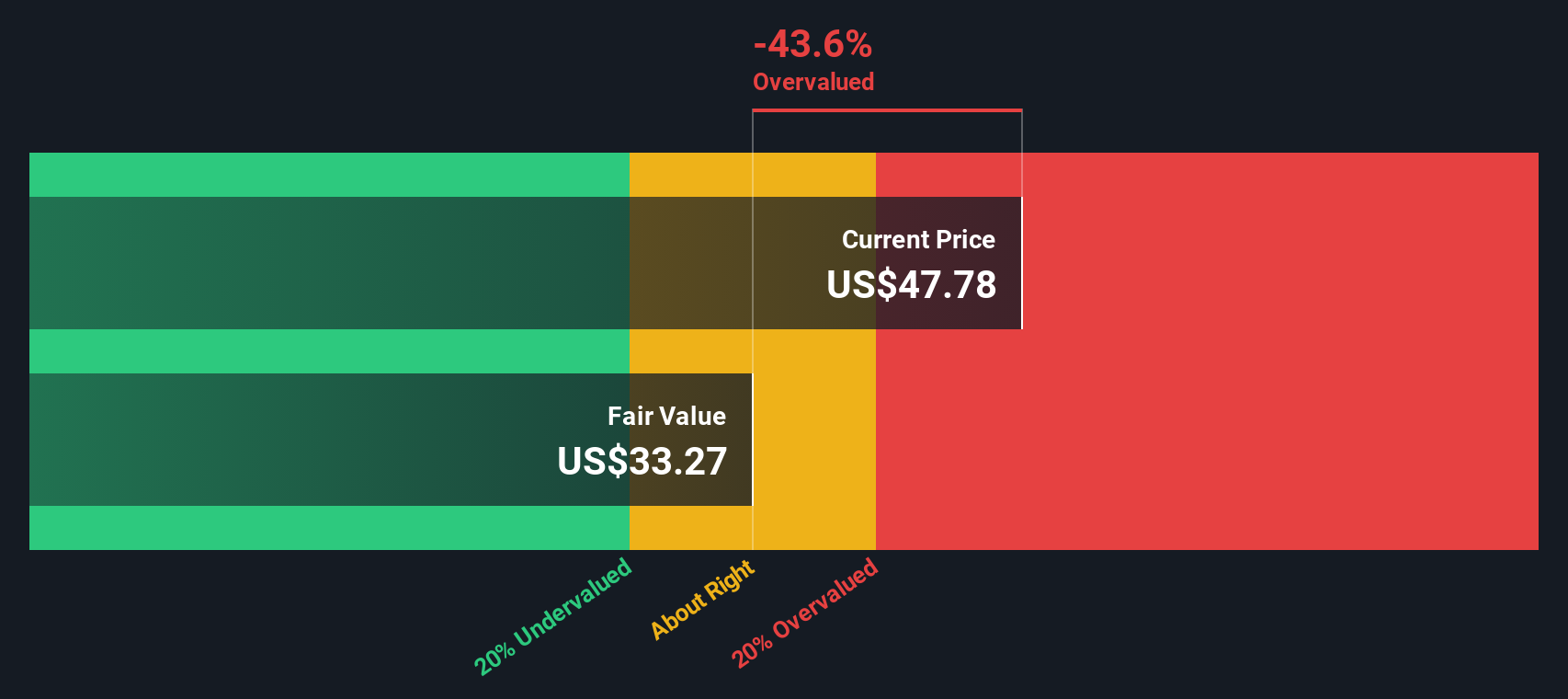

Currently, Alaska Air Group is reporting negative Free Cash Flow (FCF) at -$358.3 million. Looking ahead, analyst estimates point to a recovery, with FCF expected to reach $385.9 million in 2027. Projections then taper slightly, with Simply Wall St extrapolating around $338.1 million by 2035. These numbers are all in US dollars and reflect millions, not billions, in yearly cash flow.

After discounting these projections, the DCF model calculates an intrinsic value of $31.25 per share. This figure is 57.3% lower than the current share price, which implies that Alaska Air Group stock is significantly overvalued according to this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alaska Air Group may be overvalued by 57.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Alaska Air Group Price vs Earnings

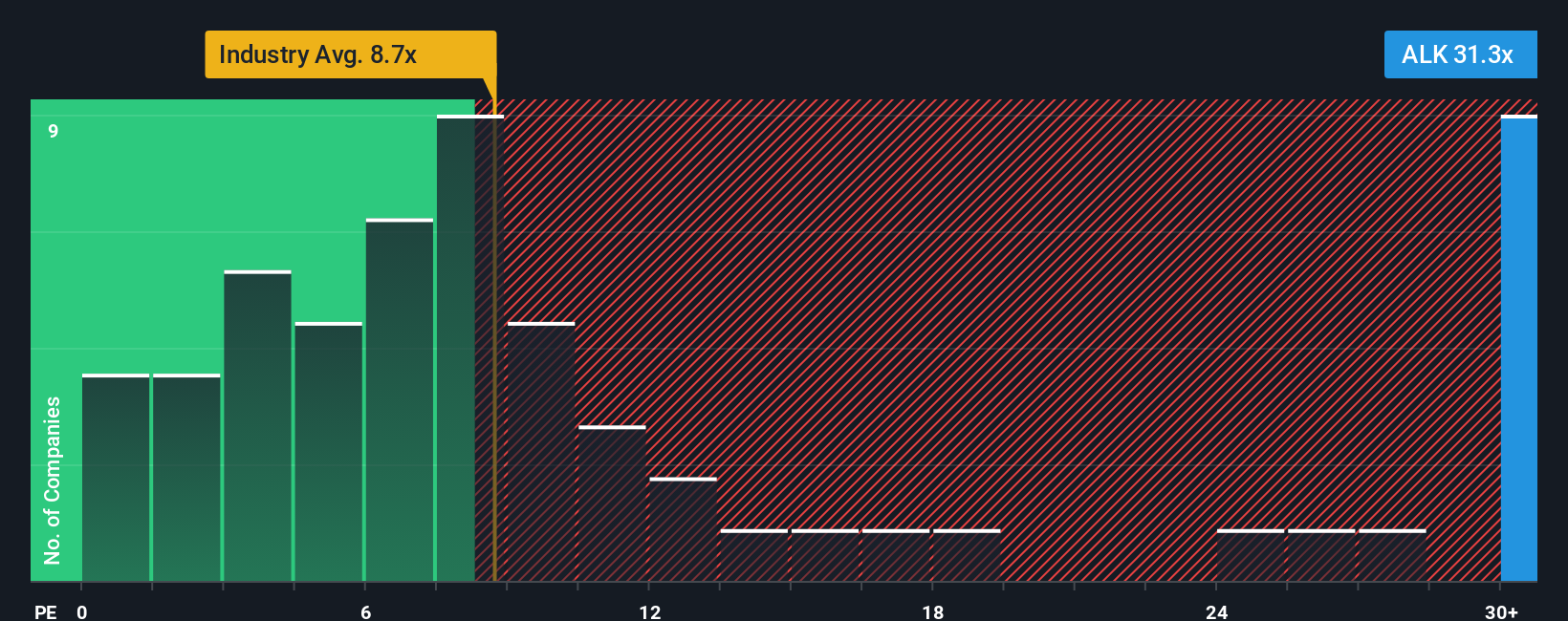

When valuing profitable companies like Alaska Air Group, the Price-to-Earnings (PE) ratio is often a preferred metric. This is because it directly reflects how much investors are willing to pay for each dollar of reported earnings, offering a clear picture of the market’s expectations relative to the company’s actual profitability.

What counts as a “normal” or “fair” PE ratio can vary based on a company’s future growth prospects and risk profile. Companies with higher expected earnings growth or lower risk typically command higher PE ratios, while slower-growing or riskier businesses trade at lower multiples.

Currently, Alaska Air Group trades at a PE ratio of 18.1x, which is a little below the peer group average of 18.8x and substantially above the Airlines industry average of just 9.3x. In addition to simple averages, Simply Wall St calculates a Fair Ratio of 31.7x for Alaska Air Group, based on a proprietary model that weighs factors like earnings growth, profit margin, risk, industry sector and company size. This Fair Ratio provides a more tailored benchmark than industry or peer averages, making it a more reliable reference for valuation.

Comparing the Fair Ratio of 31.7x to Alaska Air’s actual PE ratio of 18.1x, the stock appears undervalued on this basis. The significant gap suggests investors may be getting a bargain relative to the company’s fundamentals and expected performance.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alaska Air Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just a collection of numbers; it is the story behind your investment perspective, combining your assumptions about Alaska Air Group’s future revenue, profit margins and potential fair value into a cohesive outlook. Narratives make it easy for investors to link the company's unique story, such as expansion plans, integration strategies, or risk factors, to a financial forecast and a current fair value estimate. This approach is accessible to everyone on Simply Wall St’s Community page, where millions of investors create and share their own Narratives with just a few clicks.

With Narratives, you can decide when to buy or sell by watching for gaps between your Fair Value and the market price. Because Narratives update dynamically as new company news or earnings are released, you always have the latest view. For example, some investors may believe Alaska Air Group deserves a future share price of $80.00 thanks to strong international expansion and synergies from integrating Hawaiian Airlines. Others foresee $56.00 due to rising costs and industry risks. Your Narrative helps you decide which story makes the most sense for you, pairing context with numbers for smarter decision making.

Do you think there's more to the story for Alaska Air Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALK

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives