- United States

- /

- Transportation

- /

- NasdaqGS:WERN

Is Werner Enterprises, Inc. (NASDAQ:WERN) As Strong As Its Balance Sheet Indicates?

Small and large cap stocks are widely popular for a variety of reasons, however, mid-cap companies such as Werner Enterprises, Inc. (NASDAQ:WERN), with a market cap of US$2.4b, often get neglected by retail investors. However, generally ignored mid-caps have historically delivered better risk adjusted returns than both of those groups. WERN’s financial liquidity and debt position will be analysed in this article, to get an idea of whether the company can fund opportunities for strategic growth and maintain strength through economic downturns. Note that this information is centred entirely on financial health and is a top-level understanding, so I encourage you to look further into WERN here.

View our latest analysis for Werner Enterprises

Does WERN Produce Much Cash Relative To Its Debt?

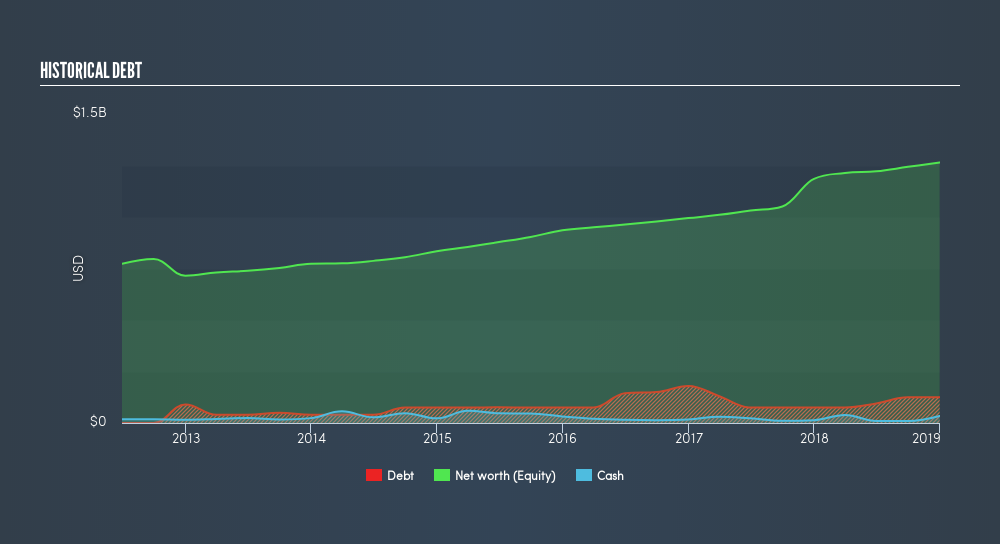

WERN has built up its total debt levels in the last twelve months, from US$75m to US$125m – this includes long-term debt. With this rise in debt, WERN currently has US$34m remaining in cash and short-term investments , ready to be used for running the business. Additionally, WERN has produced US$418m in operating cash flow in the last twelve months, leading to an operating cash to total debt ratio of 335%, signalling that WERN’s operating cash is sufficient to cover its debt.

Can WERN pay its short-term liabilities?

At the current liabilities level of US$310m, it appears that the company has been able to meet these obligations given the level of current assets of US$457m, with a current ratio of 1.47x. The current ratio is the number you get when you divide current assets by current liabilities. For Transportation companies, this ratio is within a sensible range since there is a bit of a cash buffer without leaving too much capital in a low-return environment.

Is WERN’s debt level acceptable?

With a debt-to-equity ratio of 9.9%, WERN's debt level is relatively low. This range is considered safe as WERN is not taking on too much debt obligation, which may be constraining for future growth.

Next Steps:

WERN has demonstrated its ability to generate sufficient levels of cash flow, while its debt hovers at a safe level. In addition to this, the company exhibits proper management of current assets and upcoming liabilities. I admit this is a fairly basic analysis for WERN's financial health. Other important fundamentals need to be considered alongside. You should continue to research Werner Enterprises to get a more holistic view of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for WERN’s future growth? Take a look at our free research report of analyst consensus for WERN’s outlook.

- Valuation: What is WERN worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether WERN is currently mispriced by the market.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:WERN

Werner Enterprises

Engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026