- United States

- /

- Airlines

- /

- NasdaqGS:ULCC

Frontier Group Holdings, Inc.'s (NASDAQ:ULCC) Popularity With Investors Under Threat As Stock Sinks 26%

The Frontier Group Holdings, Inc. (NASDAQ:ULCC) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

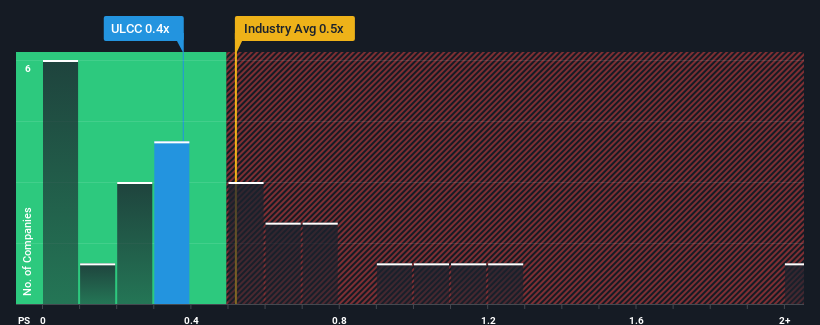

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Frontier Group Holdings' P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Airlines industry in the United States is also close to 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Frontier Group Holdings

How Frontier Group Holdings Has Been Performing

There hasn't been much to differentiate Frontier Group Holdings' and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Frontier Group Holdings.Is There Some Revenue Growth Forecasted For Frontier Group Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Frontier Group Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.9% last year. The latest three year period has also seen an excellent 187% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 16% each year over the next three years. With the industry predicted to deliver 96% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's curious that Frontier Group Holdings' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Following Frontier Group Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Frontier Group Holdings' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Frontier Group Holdings, and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ULCC

Frontier Group Holdings

Provides low-fare passenger airline services to leisure travelers in the United States and Latin America.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success