- United States

- /

- Airlines

- /

- NasdaqGS:UAL

United Airlines Holdings, Inc.'s (NASDAQ:UAL) Price Is Right But Growth Is Lacking After Shares Rocket 27%

Despite an already strong run, United Airlines Holdings, Inc. (NASDAQ:UAL) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 61% in the last year.

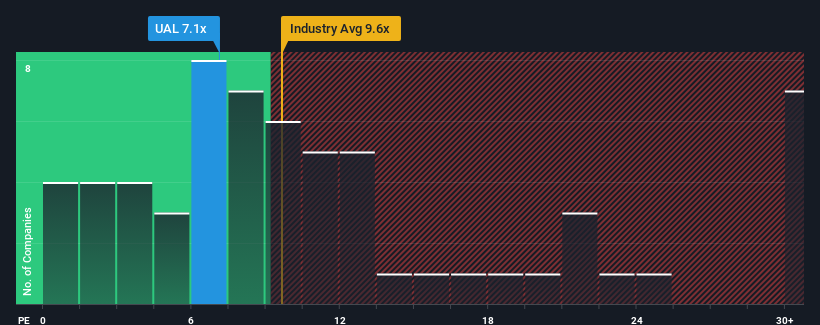

Even after such a large jump in price, United Airlines Holdings may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.1x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 35x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for United Airlines Holdings as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for United Airlines Holdings

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as United Airlines Holdings' is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a decent 9.8% gain to the company's bottom line. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 8.0% each year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 10% per annum growth forecast for the broader market.

In light of this, it's understandable that United Airlines Holdings' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From United Airlines Holdings' P/E?

Shares in United Airlines Holdings are going to need a lot more upward momentum to get the company's P/E out of its slump. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that United Airlines Holdings maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware United Airlines Holdings is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than United Airlines Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade United Airlines Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:UAL

United Airlines Holdings

Through its subsidiaries, provides air transportation services in North America, Asia, Europe, Africa, the Pacific, the Middle East, and Latin America.

Good value with proven track record.