- United States

- /

- Airlines

- /

- NasdaqGS:UAL

Can United Airlines (UAL)–Travelport NDC Push Quietly Reshape Its Margin Story And Corporate Moat?

Reviewed by Sasha Jovanovic

- In December 2025, United Airlines and Travelport announced a multi-year collaboration that gives Travelport early access to United’s NDC roadmap, co-develops new retailing capabilities for the Travelport+ platform, and phases in features from early 2026 to enhance agency and corporate booking tools.

- A particularly material element is United’s plan to embed its Online Booking Tool extras into Travelport’s Deem platform, potentially making it easier for corporate travelers to pool unused credits, enroll in MileagePlus, and use Jetstream amenity funds directly within agency workflows.

- We’ll now examine how this deeper NDC-focused collaboration with Travelport could influence United’s modernization-led investment narrative and long-term margins.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

United Airlines Holdings Investment Narrative Recap

To own United, you need to believe its modernization spending and partnerships can translate into durable, higher quality earnings without letting debt and operating complexity get out of hand. The new Travelport deal looks incrementally helpful for near term revenue mix by supporting higher margin corporate and ancillary sales, but it does not fundamentally change the key short term swing factor, which is how well United manages costs and reliability across its congested hubs.

The Travelport collaboration sits alongside United’s Blue Sky tie up with JetBlue, which also focuses on improving access, merchandising and loyalty economics across partners. Both moves reinforce a catalyst already on investors’ radar: United is trying to use technology enabled retailing and partnerships to deepen high value customer relationships, a theme that matters if premium business travel growth remains uneven and competitors keep responding aggressively on fares.

Yet, in contrast to the upbeat retailing story, investors should also be aware of how United’s heavy, debt funded fleet and network investments could...

Read the full narrative on United Airlines Holdings (it's free!)

United Airlines Holdings' narrative projects $67.6 billion revenue and $4.2 billion earnings by 2028. This requires 5.2% yearly revenue growth and about a $0.9 billion earnings increase from $3.3 billion today.

Uncover how United Airlines Holdings' forecasts yield a $122.90 fair value, a 13% upside to its current price.

Exploring Other Perspectives

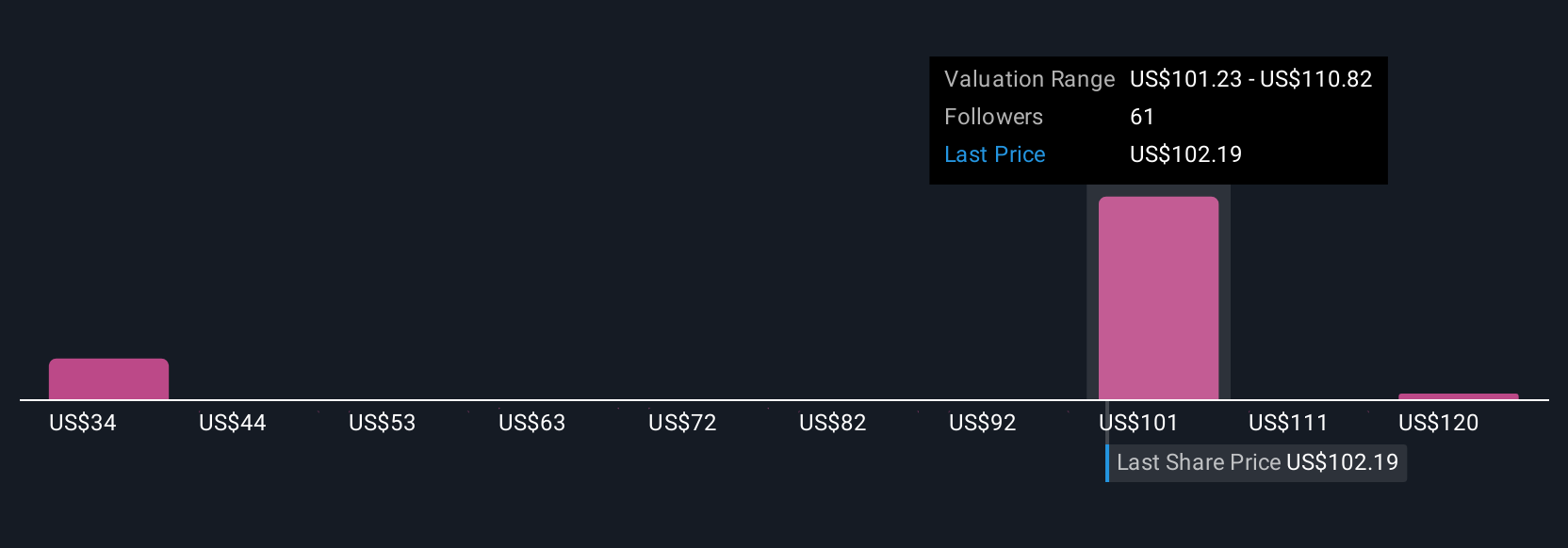

Five members of the Simply Wall St Community see fair value for United between US$105.10 and US$209.24, underscoring how far views can stretch. Set those opinions against United’s ongoing reliance on debt funded fleet and network spending, and you can see why it pays to weigh several perspectives on the company’s future resilience.

Explore 5 other fair value estimates on United Airlines Holdings - why the stock might be worth just $105.10!

Build Your Own United Airlines Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Airlines Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Airlines Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Airlines Holdings' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UAL

United Airlines Holdings

Through its subsidiaries, provides air transportation services in the United States, Canada, Atlantic, the Pacific, and Latin America.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026