- United States

- /

- Airlines

- /

- NasdaqGS:SKYW

SkyWest (SKYW): Assessing Valuation Following Fresh Analyst Upgrades and Strong Buy Ratings

Reviewed by Simply Wall St

If you have been following SkyWest (SKYW), you might have noticed a new wave of optimism swirling around the stock. Several analysts recently raised their earnings estimates for the year ahead and re-affirmed strong buy ratings, painting a picture of rising confidence in SkyWest’s outlook. These moves, along with high marks in value, growth, and momentum, are fueling questions for investors about what comes next for SkyWest’s share price.

Looking back, the past year has been quite impressive for SKYW holders: the stock is up 57%, including a 16% gain over the past three months. That momentum appears to be building, especially in the wake of positive analyst sentiment and recent estimate revisions. While other transportation names have delivered steady returns, SkyWest’s performance stands out when comparing both short- and longer-term trends.

Given this strong run and the market’s enthusiastic response to fresh analyst optimism, should investors read this as a sign that SkyWest is still undervalued, or is the market already pricing in all the future growth?

Most Popular Narrative: 9.5% Undervalued

The most widely followed narrative suggests that SkyWest is undervalued by about 9.5% versus its fair value estimate, driven by robust earnings growth and improvements in the company's fleet and operating model.

Fleet modernization through significant orders of new, fuel-efficient E175 aircraft under long-term, flexible contracts is expected to improve cost structure, enhance asset utilization, and boost net margins as newer planes replace older, less efficient models and support new multiyear agreements with major carriers.

Why are analysts so confident SkyWest deserves a higher price? The foundation of this valuation is hiding in plain sight: fresh fleet investments, bold margin forecasts, and a future profit multiple that rivals some market leaders. Hungry for the behind-the-scenes projections that justify that premium price target? The narrative’s numbers are bigger, bolder, and could surprise even seasoned investors.

Result: Fair Value of $131.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing pilot shortages and heavy reliance on major airline contracts remain key risks that could upend the current thesis for SkyWest.

Find out about the key risks to this SkyWest narrative.Another View: Are Market Signals Sending a Different Message?

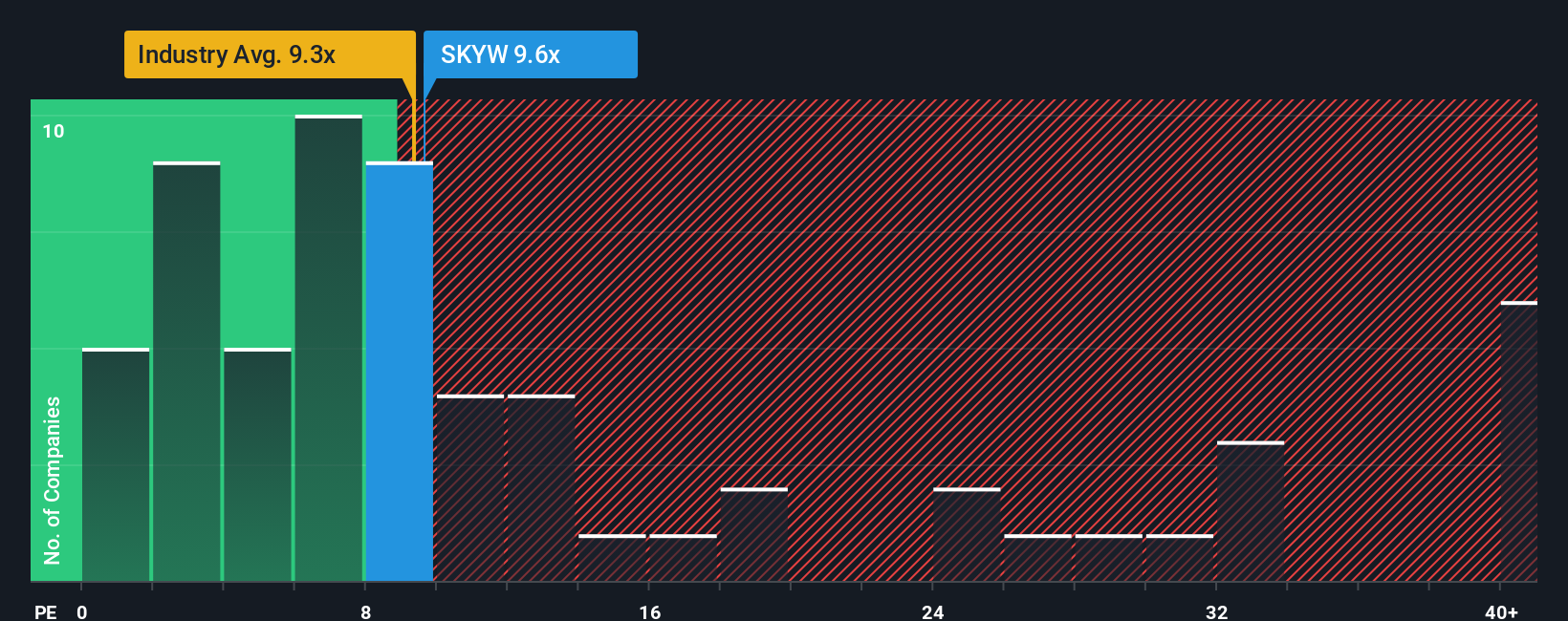

Looking from another angle, a comparison to the global airline industry using a common valuation gauge paints SkyWest as pricier than its wider sector. Does this challenge the fair value case, or does it reflect unique strengths?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding SkyWest to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own SkyWest Narrative

If you see the numbers differently or want to dive deeper on your own terms, creating your own narrative takes just a few minutes. Why not explore the data and Do it your way

A great starting point for your SkyWest research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t limit your portfolio. Uncover standout opportunities with Simply Wall Street’s powerful tools and see what the market’s best-kept secrets could do for you.

- Spot penny stocks with strong financials that are gaining momentum by checking out penny stocks with strong financials as they climb the charts and surprise the market.

- Unlock the surge in healthcare innovation by tapping into companies powering medical AI breakthroughs through healthcare AI stocks and catch the next wave before it becomes mainstream.

- Boost your income strategy by targeting reliable businesses offering generous yields via dividend stocks with yields > 3% and secure your financial goals faster.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:SKYW

SkyWest

Through its subsidiaries, engages in the operation of a regional airline in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)