- United States

- /

- Marine and Shipping

- /

- NasdaqCM:SHIP

Revenues Tell The Story For Seanergy Maritime Holdings Corp. (NASDAQ:SHIP) As Its Stock Soars 26%

Seanergy Maritime Holdings Corp. (NASDAQ:SHIP) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 65% in the last year.

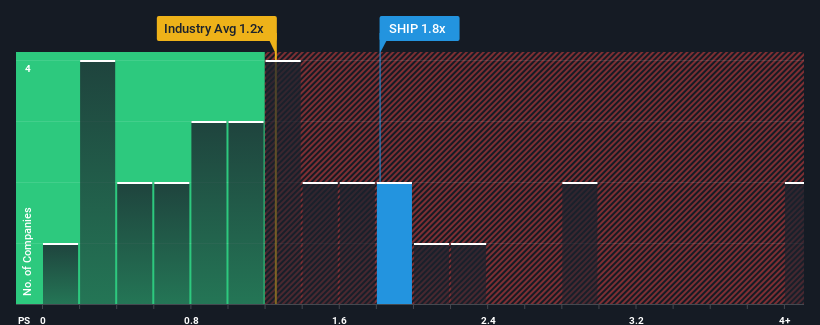

Following the firm bounce in price, when almost half of the companies in the United States' Shipping industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Seanergy Maritime Holdings as a stock probably not worth researching with its 1.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Seanergy Maritime Holdings

What Does Seanergy Maritime Holdings' P/S Mean For Shareholders?

Seanergy Maritime Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Seanergy Maritime Holdings.How Is Seanergy Maritime Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Seanergy Maritime Holdings' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 35% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 42% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 30% as estimated by the four analysts watching the company. That would be an excellent outcome when the industry is expected to decline by 1.8%.

In light of this, it's understandable that Seanergy Maritime Holdings' P/S sits above the majority of other companies. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

What Does Seanergy Maritime Holdings' P/S Mean For Investors?

Seanergy Maritime Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we anticipated, our review of Seanergy Maritime Holdings' analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Seanergy Maritime Holdings that we have uncovered.

If these risks are making you reconsider your opinion on Seanergy Maritime Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SHIP

Seanergy Maritime Holdings

A shipping company, engages in the seaborne transportation of dry bulk commodities worldwide.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives