- United States

- /

- Marine and Shipping

- /

- NasdaqGS:SBLK

Star Bulk Carriers (NasdaqGS:SBLK) Sees 7% Decline Following Mixed Earnings Report

Reviewed by Simply Wall St

Star Bulk Carriers (NasdaqGS:SBLK) saw a 7% decline in share price last quarter, amid several impactful events. The company's decision to decrease its quarterly dividend to $0.09 per share, coupled with a mixed earnings report—where revenue increased yet diluted EPS fell—likely dampened investor enthusiasm. Additionally, the repurchase of 893,474 shares during this period was significant, although the broader market decline influenced by global trade tensions may have overshadowed this corporate action. As the Nasdaq Composite entered bear market territory, Star Bulk's share performance reflected broader investor sentiment and economic concerns.

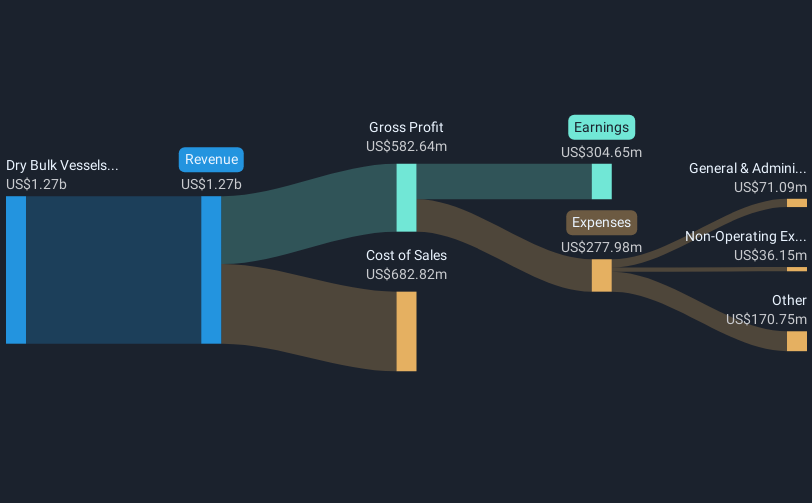

Star Bulk Carriers' impressive five-year total return of 332.97% highlights the company's adaptation to market demands through various initiatives. One key factor was successive earnings growth, with revenue reaching US$1.27 billion in 2024, considerably higher than the previous year. The integration of Eagle Bulk, generating synergies and operational efficiencies, potentially boosted net margins. The capital allocation policy amendment allowing up to 60% of cash flow towards dividends further signified the company's commitment to shareholder value.

Despite recent underperformance against the US shipping industry, the past year's activities—such as significant share buybacks starting in late 2024—have been integral in supporting share price resilience. Additionally, operational efficiency improvements through fleet modernization and energy-saving upgrades are intended to align with evolving environmental standards, potentially setting the groundwork for long-term performance improvements. Though challenges with high debt and operational costs persist, the company’s initiatives may enhance its competitive edge over time.

Gain insights into Star Bulk Carriers' future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBLK

Star Bulk Carriers

A shipping company, engages in the ocean transportation of dry bulk cargoes worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives