- United States

- /

- Marine and Shipping

- /

- NasdaqGS:SBLK

Star Bulk Carriers (NasdaqGS:SBLK) Reports Lower Q1 Earnings and Declares Dividend

Reviewed by Simply Wall St

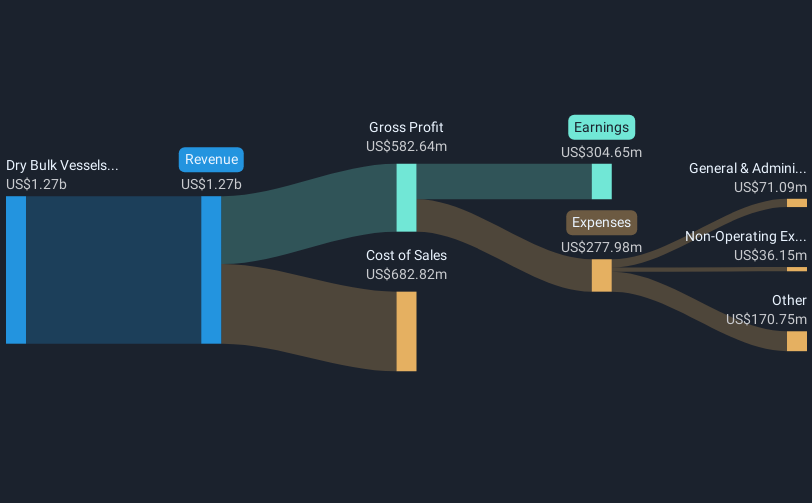

Star Bulk Carriers (NasdaqGS:SBLK) recently announced a quarterly dividend decrease and reported a significant drop in both revenue and net income for Q1 2025. Despite these events, the company's stock price increased by 15% over the last month. This price movement happened against a backdrop of broader market gains, as reflected by rising indices like the S&P 500 and Nasdaq Composite, although the drop in earnings and dividend reduction might have weighed against these positive trends. Changes in company bylaws and ongoing market dynamics likely played nuanced roles in influencing investor sentiment during this period.

Be aware that Star Bulk Carriers is showing 1 risk in our investment analysis.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

Star Bulk Carriers' recent announcement of decreased quarterly dividends alongside a significant revenue and net income drop could initially seem concerning. Yet, the company's stock price gained 15% over the past month, suggesting a complex investor sentiment dynamic. This increase contrasts with the broader one-year underperformance against both the US Shipping industry, which declined 16.6%, and the US Market with a 10.6% increase. Over the longer term, however, the shares present a different picture, boasting a very large total return of over 400% over the past five years, signaling a strong historic performance.

The short-term rise in share price, despite earnings pressure, could reflect optimism towards the company’s initiatives in fleet modernization and energy efficiency. However, it remains essential to consider potential impacts on revenue and earnings forecasts. The strategic move towards fleet upgrades and enhanced compliance may bolster profit margins, yet the high debt levels and operational costs pose risks to achieving projected improvements. Considering these factors, the stock’s current price of US$14.69, undervalued according to analysts' price target of US$21.81, suggests room for growth if the forecasted improvements materialize as expected.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBLK

Star Bulk Carriers

A shipping company, engages in the ocean transportation of dry bulk cargoes through the ownership and operation of dry bulk carrier vessels worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion