- United States

- /

- Transportation

- /

- NasdaqGS:SAIA

Should Investors Reassess Saia Shares After 33% Drop and Freight Demand Shifts?

Reviewed by Bailey Pemberton

Deciding what to do with Saia stock right now? You are not alone. With shares recently closing at $297.42, Saia has kept investors guessing. Short-term moves have been a roller coaster, bouncing up 0.9% this past week but still down 5.0% over the past month. When you zoom out, the picture gets even more interesting: the stock has slid a notable 33.2% year-to-date, or 30.0% over the past twelve months. If you rewind a bit further, those five-year holders are still sitting on gains of more than 100%.

There has been some industry chatter about evolving supply chain strategies sparking optimism for freight carriers like Saia. That might help explain those wild swings in risk perception, as investors weigh the potential for growth against recent hurdles.

Now, let us get to the heart of it: what is Saia actually worth today? Taking an initial look, Saia scores a 3 out of 6 on our valuation checkup, which is surprisingly solid for a company with some rough near-term performance. In the next section, we will break down what these valuation methods reveal and, later on, introduce an even more powerful way to judge Saia’s true value in the market.

Why Saia is lagging behind its peers

Approach 1: Saia Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic approach used to estimate what a company is truly worth by projecting its future free cash flows and discounting them back to their present value. Essentially, it asks what all those potential future profits are worth in today’s dollars, giving investors an intrinsic value to compare against the market price.

For Saia, the DCF uses a “2 Stage Free Cash Flow to Equity” method. Analysts estimate that Saia’s current Free Cash Flow sits at negative $112 million, but projections turn positive from 2027 onward, reaching $227 million by the end of 2029. These yearly cash flows are modeled out and, starting after 2029, further extrapolated by financial analysts. All cash flow figures are in USD and remain under a billion, so they are shown in millions.

The result of this DCF analysis is an estimated intrinsic value of $391.37 per share. With shares last closing at $297.42, the valuation suggests the stock is trading at a 24.0% discount to its calculated fair value. That indicates that, even after some rocky performance, Saia may be attractively undervalued at current levels for long-term investors willing to look beyond recent setbacks.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Saia is undervalued by 24.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

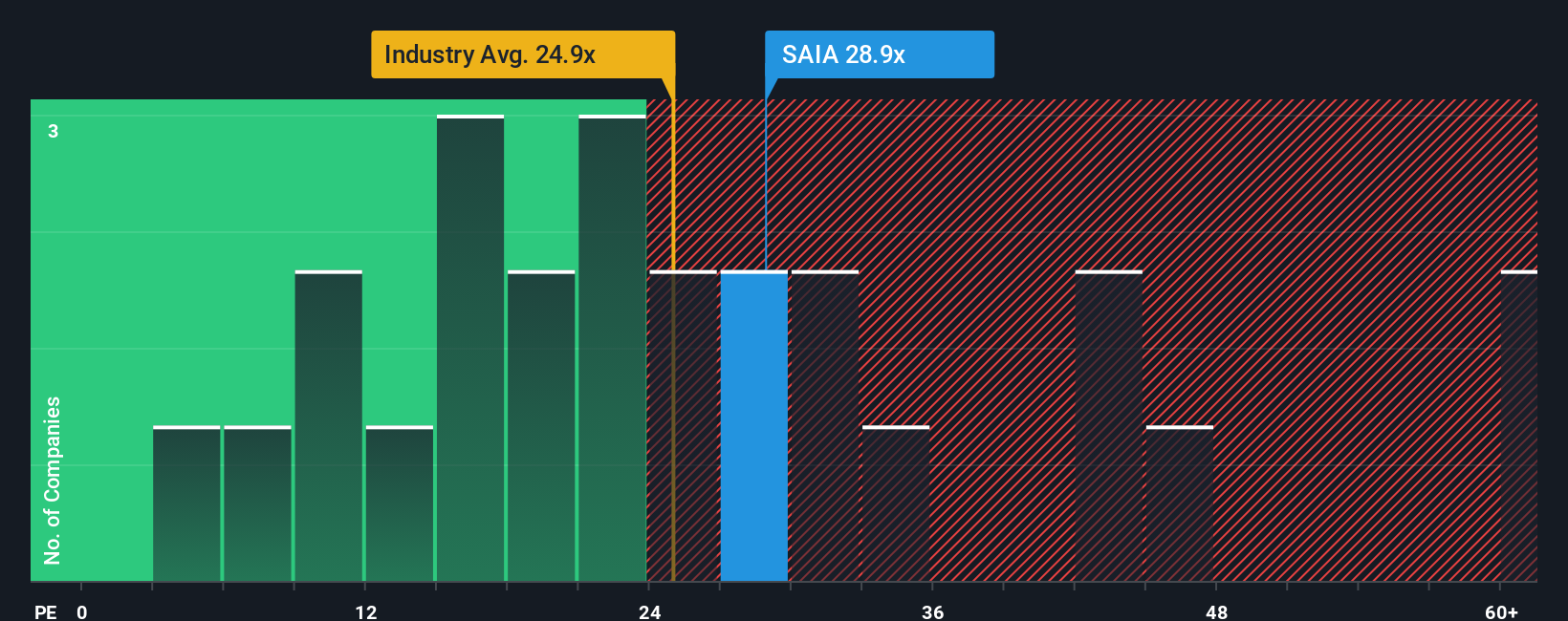

Approach 2: Saia Price vs Earnings (PE Ratio)

The price-to-earnings (PE) ratio is a popular valuation tool, especially for profitable companies like Saia, because it shows how much investors are willing to pay today for each dollar of the company’s earnings. PE is a useful metric when earnings are positive and relatively stable, as it helps signal how the market values the business’s profit-generating ability compared to its peers and the broader industry.

Growth expectations and risk play a big role in what qualifies as a "fair" PE ratio. Higher growth companies usually command higher PEs, as investors expect profits to increase. In contrast, heightened risks, such as economic uncertainty or inconsistent profits, can hold the PE ratio back.

Saia currently trades at a PE ratio of 27.2x, modestly above the transportation industry average of 24.1x but lower than its peer group average of 34.0x. Simply Wall St’s proprietary Fair Ratio for Saia is 14.5x, which factors in specifics like its earnings growth outlook, profit margins, risks, and market capitalization. Unlike a simple industry or peer comparison, the Fair Ratio uses a more nuanced approach by synthesizing all these variables to estimate the earnings multiple that is truly justified for Saia’s profile.

Given Saia’s current 27.2x PE compared to the Fair Ratio of 14.5x, the stock appears to be trading above what Simply Wall St’s model considers fair, tipping it into overvalued territory on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Saia Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. In investing, a Narrative is your story about a company, your perspective on where it is headed, what numbers are actually possible for its business, and what all of that means for today’s fair value. Narratives connect what you believe about a business and its future (revenue, margins, and risks) to a financial forecast and, ultimately, a fair value estimate.

The Narratives feature on Simply Wall St’s Community page makes this process straightforward and accessible, allowing millions of investors to create, share, and review perspectives for any company, including Saia. When you use Narratives, you can clearly see the logic behind each forecast, compare your assumptions to others, and instantly check how your view of fair value stacks up against the current market price. This can help you decide when to buy or sell with more confidence.

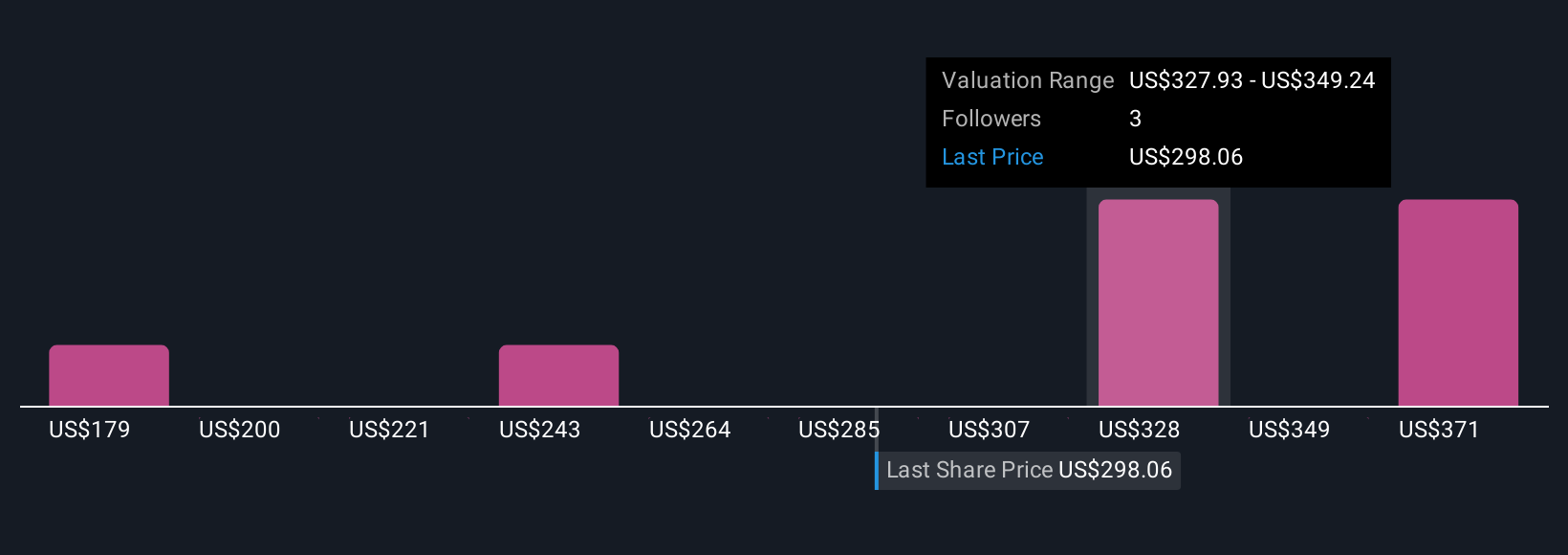

What sets Narratives apart is that they automatically update whenever new information, like earnings reports or industry news, is released, so your analysis stays relevant and actionable. For example, one Saia Narrative might focus on “expanding the terminal network and gaining cost efficiencies,” assuming earnings rise to $456.7 million by 2028 and yielding a fair value of $405 per share, while a more conservative Narrative could focus on margin pressures and project just $341.6 million in earnings, suggesting a fair value closer to $250.

Do you think there's more to the story for Saia? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAIA

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives