- United States

- /

- Transportation

- /

- NasdaqGS:PAL

3 US Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As U.S. markets show mixed performances amid fluctuating economic data and interest rate concerns, investors are closely watching for signals that could impact Federal Reserve decisions. In such a volatile environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.7% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 49% |

| Travelzoo (NasdaqGS:TZOO) | 38% | 34.7% |

| ARS Pharmaceuticals (NasdaqGM:SPRY) | 19.1% | 60.1% |

| Myomo (NYSEAM:MYO) | 13.7% | 56.7% |

Let's uncover some gems from our specialized screener.

Oddity Tech (NasdaqGM:ODD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Oddity Tech Ltd. is a consumer tech company that creates digital-first brands for the beauty and wellness sectors in the United States and internationally, with a market cap of approximately $2.48 billion.

Operations: The company generates revenue of $620.65 million from its Personal Products segment, focusing on beauty and wellness industries both domestically and internationally.

Insider Ownership: 32.5%

Return On Equity Forecast: 23% (2027 estimate)

Oddity Tech demonstrates strong growth potential with earnings expected to grow significantly over the next three years, outpacing the US market. Despite revenue growth forecasts being slower than 20% annually, Oddity's earnings grew by 92% last year. The company is trading at a substantial discount to its estimated fair value and has announced a $100 million share repurchase program. Recent financial results show robust performance, with Q3 sales reaching US$119 million and net income rising markedly year-over-year.

- Take a closer look at Oddity Tech's potential here in our earnings growth report.

- Our valuation report here indicates Oddity Tech may be undervalued.

CarGurus (NasdaqGS:CARG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CarGurus, Inc. operates an online automotive platform for buying and selling vehicles both in the United States and internationally, with a market cap of approximately $3.81 billion.

Operations: The company's revenue primarily comes from its U.S. Marketplace segment, generating $709.19 million, and its Digital Wholesale segment, contributing $120.31 million.

Insider Ownership: 16.9%

Return On Equity Forecast: 40% (2027 estimate)

CarGurus is poised for significant growth, with earnings expected to rise 42.37% annually and revenue projected to grow faster than the US market at 14.8%. The company trades at a substantial discount to its estimated fair value and has initiated a $200 million share repurchase program. Recent Q3 results show increased sales of US$204.02 million, though net income remained stable year-over-year. CarGurus also expanded its digital retail solution in Canada, enhancing dealer-consumer connections.

- Dive into the specifics of CarGurus here with our thorough growth forecast report.

- Our expertly prepared valuation report CarGurus implies its share price may be too high.

Proficient Auto Logistics (NasdaqGS:PAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Proficient Auto Logistics, Inc. specializes in auto transportation and logistics services across North America, with a market cap of approximately $250.57 million.

Operations: Revenue segments for the company are not provided in the given text.

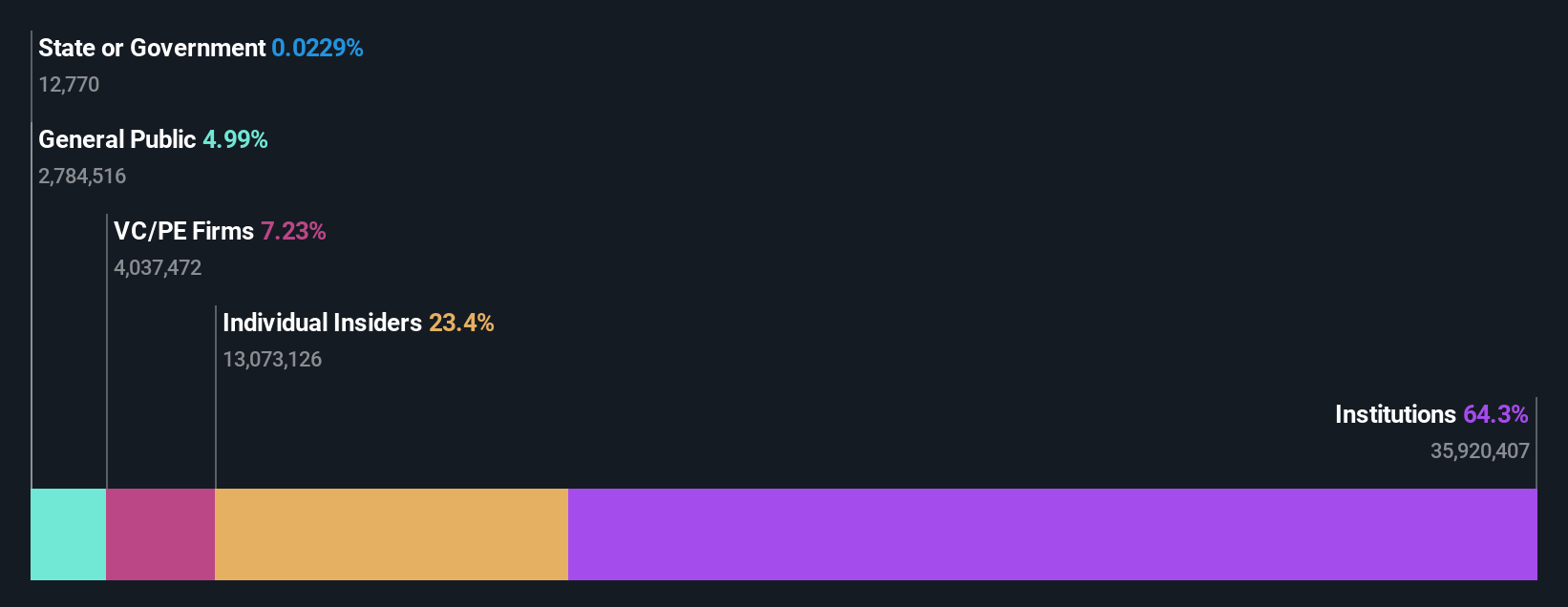

Insider Ownership: 25.1%

Return On Equity Forecast: N/A (2027 estimate)

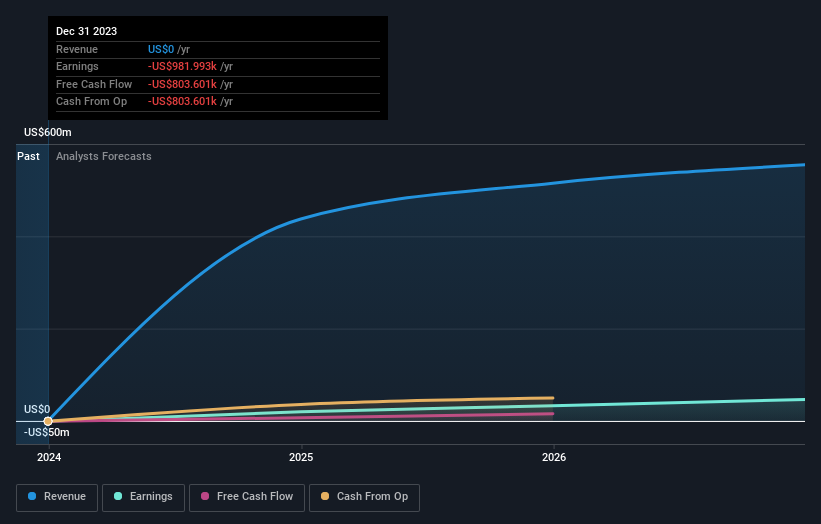

Proficient Auto Logistics is set for substantial growth, with earnings forecast to increase 86.87% annually and revenue expected to grow at 36.5% per year, surpassing the US market's pace. The stock trades significantly below its estimated fair value, and recent insider activity shows substantial buying with no major selling in the past three months. Despite a net loss of US$1.37 million in Q3 2024, strategic board appointments aim to strengthen governance and oversight.

- Delve into the full analysis future growth report here for a deeper understanding of Proficient Auto Logistics.

- Upon reviewing our latest valuation report, Proficient Auto Logistics' share price might be too optimistic.

Summing It All Up

- Click through to start exploring the rest of the 199 Fast Growing US Companies With High Insider Ownership now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAL

Proficient Auto Logistics

Focuses on providing auto transportation and logistics services in North America.

Very undervalued with high growth potential.

Market Insights

Community Narratives