- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

Lyft (NasdaqGS:LYFT) Reports Q1 Sales of US$1450M With Return to Profitability

Reviewed by Simply Wall St

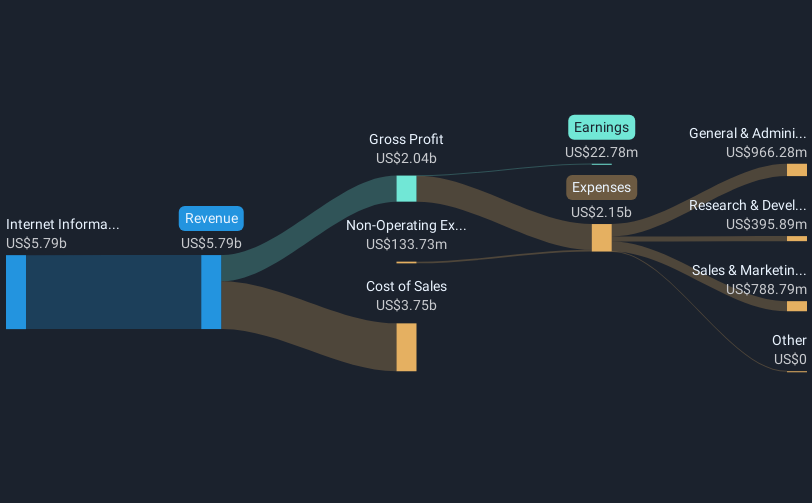

Lyft (NasdaqGS:LYFT) recently reported a favorable earnings announcement for Q1 2025, showing a substantial improvement in net income to $2.57 million from a prior loss. This financial turnaround coincided with a 30% rise in Lyft's stock price over the last month. The positive earnings, featuring revenue growth of 13.5%, likely bolstered investor confidence. Meanwhile, the broader market experienced volatility around trade talks, but Lyft's gains appear well-aligned with the market's positive trend, contributing to the company's notable rise. Investor proposals addressing governance may have added insight, but were not majorly disruptive amidst market movements.

Buy, Hold or Sell Lyft? View our complete analysis and fair value estimate and you decide.

Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

Lyft's recent earnings announcement for Q1 2025, showcasing an increase to a net income of US$2.57 million, underscores a significant turnaround from previous losses. This financial enhancement and a reported 13.5% revenue growth appear to have boosted investor sentiment, contributing to a 30% rise in Lyft's stock price over the past month. However, it's important to consider the company's overall performance in the prior year, during which its total shareholder return declined by 24.59%. This dip highlights ongoing challenges, despite short-term gains.

Against the backdrop of broader market conditions, where Lyft underperformed both the US market and the Transportation industry, it is evident that while recent performance is encouraging, longer-term metrics still reflect hurdles. Lyft's one-year return did not match the 8.2% gain of the US market. This suggests the resurgence in its stock price may require sustained performance improvements to align more closely with market expectations.

Looking forward, the recent news raises considerations for Lyft's revenue and earnings forecasts. Analysts project a 9.6% annual revenue growth, and although the short-term results are promising, the exit of key partnerships and potential competitive pressures could temper these projections. The stock's recent price movement, reaching US$12.54, remains below the analysts' price target of US$16.04, indicating potential for upside if the company meets expected operational improvements.

Review our growth performance report to gain insights into Lyft's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LYFT

Lyft

Operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives