- United States

- /

- Transportation

- /

- NasdaqGS:LSTR

Does Landstar System’s (LSTR) Board Refresh and Dividend Steadiness Reveal Its Strategic Priorities?

Reviewed by Sasha Jovanovic

- Landstar System, Inc. recently reported third quarter results showing a decline in net income to US$19.36 million and earnings per share to US$0.56, and its Board announced the addition of Barr Blanton and Melanie Housey Hart, both experienced in technology and finance, to its Board of Directors with appointments effective October 31, 2025.

- Despite the earnings drop, the company continued its shareholder return program with the affirmation of a US$0.40 per share quarterly dividend and disclosed repurchasing 308,709 shares for US$40.21 million between June and September 2025.

- We'll explore how the brief drop in earnings, alongside new board appointments, could influence Landstar System's long-term investment case.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Landstar System Investment Narrative Recap

To be a shareholder in Landstar System, you need to believe that the company can turn around its recent earnings decline by capitalizing on growth in specialized freight, resilience from its asset-light model, and operational improvements. The latest addition of experienced leaders to the Board may help mitigate long-term business risks, but for now, the immediate impact on the most important short term catalyst, stabilizing revenue growth in a soft freight market, appears limited, while margin compression remains the biggest current concern.

Among the recent announcements, Landstar’s affirmation of its regular US$0.40 quarterly dividend is especially relevant. This suggests a continued commitment to returning capital to shareholders despite soft financial performance, and is an important signal in the context of the company’s ongoing challenges with earnings stability and cyclical end-market exposure.

Yet, despite the company’s efforts to maintain shareholder confidence, investors should pay close attention to the ongoing cost pressures in insurance and claims, because…

Read the full narrative on Landstar System (it's free!)

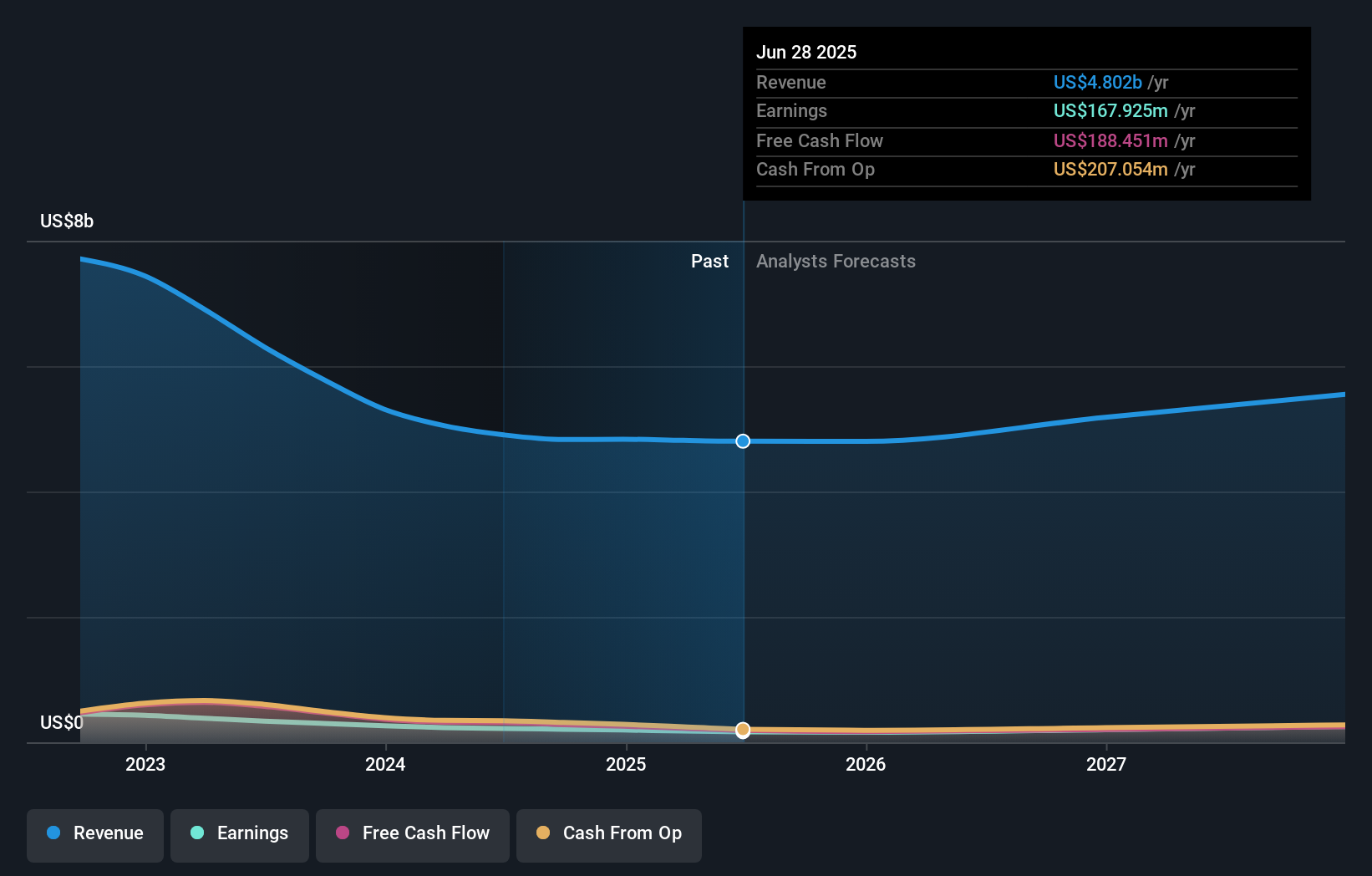

Landstar System is projected to reach $5.8 billion in revenue and $270.5 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 6.3% and a $102.6 million increase in earnings from the current level of $167.9 million.

Uncover how Landstar System's forecasts yield a $131.07 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members have published two distinct fair value estimates for Landstar, ranging from US$131 to US$192 per share. Revenue headwinds and margin risks remain central to debate over future performance, so check several viewpoints before making up your mind.

Explore 2 other fair value estimates on Landstar System - why the stock might be worth just $131.07!

Build Your Own Landstar System Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Landstar System research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Landstar System research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Landstar System's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LSTR

Landstar System

Provides integrated transportation management solutions in the United States, Canada, Mexico, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives