- United States

- /

- Transportation

- /

- NasdaqGS:LSTR

Assessing Landstar System's (LSTR) Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

Landstar System (LSTR) shares have climbed roughly 2% after a stretch of modest losses over the past few months. This has drawn attention from investors who track transportation stocks for near-term momentum shifts and potential value opportunities.

See our latest analysis for Landstar System.

After drifting lower in recent months, Landstar System’s share price has perked up with a strong 1-week gain of nearly 8%. That sharp move stands in contrast to the stock’s steeper declines earlier in the year, with total shareholder return still down about 23% over the past twelve months. Investors are watching closely to see if this recent momentum marks the beginning of a meaningful turnaround or just a brief relief rally in a tougher phase for the sector.

If you’re weighing what else could be catching a bid as trends shift in transportation, it’s worth broadening your horizons and discovering fast growing stocks with high insider ownership

With Landstar System bouncing back lately despite lagging returns over the past year, investors now face a classic value puzzle: is the recent recovery a sign that the stock is undervalued, or have improving prospects already been fully priced in?

Most Popular Narrative: 2% Overvalued

With shares closing at $136.78, just above the narrative's fair value estimate of $134.14, the market seems slightly ahead of itself on Landstar System. The stage is set for a debate about whether underlying business changes can deliver growth that the market is beginning to price in.

Robust growth in infrastructure-related and data center freight, fueled by domestic investment and the AI/data center buildout, is expected to drive continued strength in Landstar's specialized heavy haul segment. This supports higher revenue per load and overall earnings growth.

This narrative banks on pivotal shifts, such as emerging freight demand and operational transformation. Want to know which one metric could justify a strong premium? Only the full narrative exposes the quantitative linchpin for the valuation.

Result: Fair Value of $134.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak freight demand and rising insurance costs could quickly undermine confidence in Landstar System’s ability to reclaim consistent growth.

Find out about the key risks to this Landstar System narrative.

Another View: Deep Value or Value Trap?

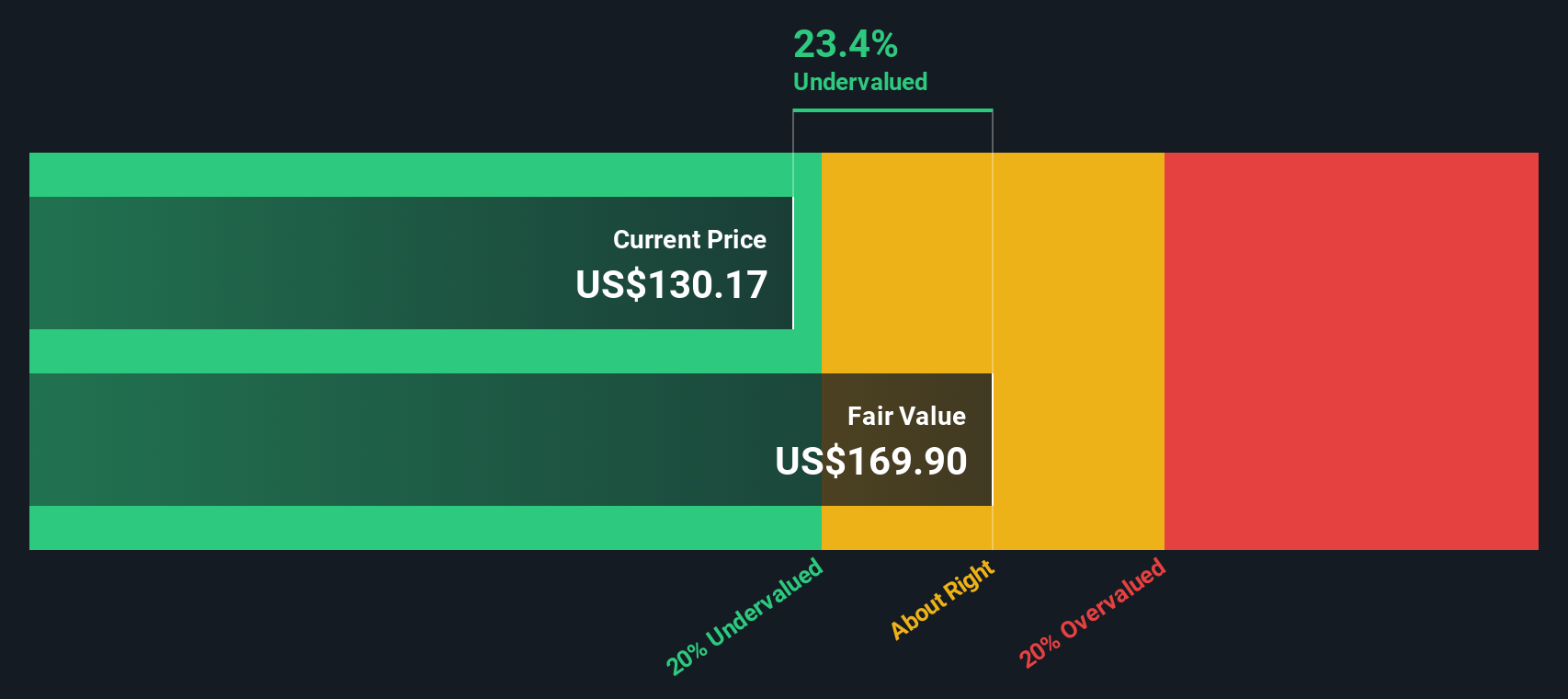

On the other hand, our DCF model suggests Landstar System is trading 19.5% below its fair value, with a fair value estimate of $169.89 versus the current price of $136.78. This points to real upside and challenges the consensus that the stock is already fairly priced. Can two respected approaches both be right, or is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Landstar System for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Landstar System Narrative

If you see things differently or want to dive deeper into the data yourself, creating your own narrative takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Landstar System.

Looking for More Investment Ideas?

Make your next investment move count by acting on timely opportunities that others might overlook. Give yourself a real edge by checking out these hand-picked stock ideas now:

- Capture steady cash flow and reliable income by tapping into these 17 dividend stocks with yields > 3% with attractive yields over 3%.

- Leap ahead of market trends and ride the artificial intelligence wave. Start spotting winners among these 24 AI penny stocks before the crowd catches on.

- Boost your returns by targeting value. In today's market, there are these 879 undervalued stocks based on cash flows hiding overlooked upside on strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LSTR

Landstar System

Provides integrated transportation management solutions in the United States, Canada, Mexico, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives