- United States

- /

- Transportation

- /

- NasdaqGS:LSTR

Assessing Landstar System (LSTR)’s Valuation After Its One-Time Special Dividend Announcement

Reviewed by Simply Wall St

Landstar System (LSTR) just handed investors a clear win, with the Board declaring a one time 2 dollar per share special cash dividend, payable in January to shareholders of record in early January.

See our latest analysis for Landstar System.

The special dividend comes as Landstar’s 7 day share price return of 7.39 percent and 30 day share price return of 9.15 percent have helped claw back some of this year’s weakness. Even though the 1 year total shareholder return is still down 21.62 percent, this suggests momentum has recently turned more constructive after a softer stretch.

If this kind of shareholder friendly move has you rethinking your portfolio, it could be a good moment to see what else is working and explore fast growing stocks with high insider ownership

Yet with shares still down sharply over the past year but trading modestly above analyst targets, the key question now is whether Landstar remains undervalued or if the market is already pricing in the next leg of growth?

Most Popular Narrative Narrative: 8.4% Overvalued

With Landstar System’s fair value pinned at 131 dollars against a 142.04 dollar close, the most followed narrative leans toward a premium pricing story.

Analysts have modestly reduced their price targets on Landstar System, trimming expectations by roughly 2 dollars to 12 dollars per share across recent updates, as they point to a still challenging truckload cycle, weak industrial demand, and ongoing oversupply, even amid early signs of stabilization in carrier capacity.

Curious what justifies paying above intrinsic value in a soft freight cycle? The narrative leans on rising margins, accelerating earnings, and a surprisingly punchy long term multiple. Want to see how those moving parts add up?

Result: Fair Value of $131 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering freight softness and rising insurance and claims costs could still compress margins and derail the premium valuation that the market currently implies.

Find out about the key risks to this Landstar System narrative.

Another View: Cash Flows Tell a Different Story

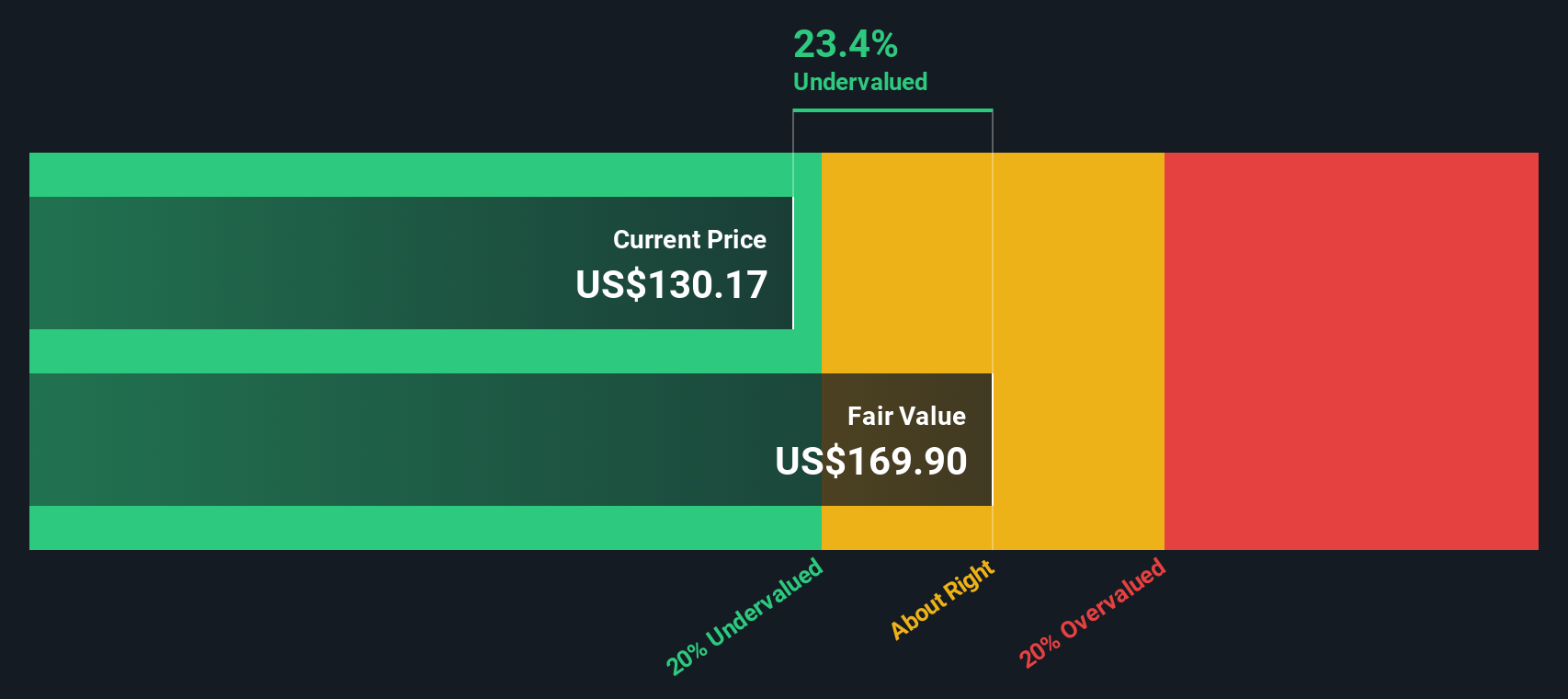

Our DCF model points in the opposite direction, suggesting Landstar is trading about 19.5 percent below its fair value of 176.37 dollars per share. If cash flows are right and multiples are wrong, is today’s skepticism actually setting up a value opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Landstar System for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Landstar System Narrative

If you would rather draw your own conclusions or dig into the numbers directly, you can build a personalized view in just minutes: Do it your way

A great starting point for your Landstar System research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put Simply Wall Street’s screener to work so you do not miss high conviction opportunities hiding beyond Landstar’s story.

- Capture potential cash flow mispricings by scanning these 903 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Explore the next wave of intelligent automation by targeting these 26 AI penny stocks positioned at the heart of real world AI adoption.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that can help support long term, resilient returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LSTR

Landstar System

Provides integrated transportation management solutions in the United States, Canada, Mexico, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026