- United States

- /

- Airlines

- /

- NasdaqGS:JBLU

JetBlue (JBLU) Valuation in Focus Following Major Route Expansion and New Leisure Destinations Announcement

Reviewed by Simply Wall St

JetBlue Airways (JBLU) just announced a sweeping expansion to its route network, adding more flights to leisure hotspots and rolling out brand new destinations across Florida, the Caribbean, and Latin America. With enhanced service from its critical Boston and New York hubs alongside a bold push into underserved sunbelt cities like Vero Beach and Daytona Beach, JetBlue is making it clear that it is doubling down on its strengths in key vacation corridors. For investors watching the skies, this move signals not just a growth ambition but a strategy that is tightly aligned with the enduring demand for leisure travel in the post-pandemic landscape.

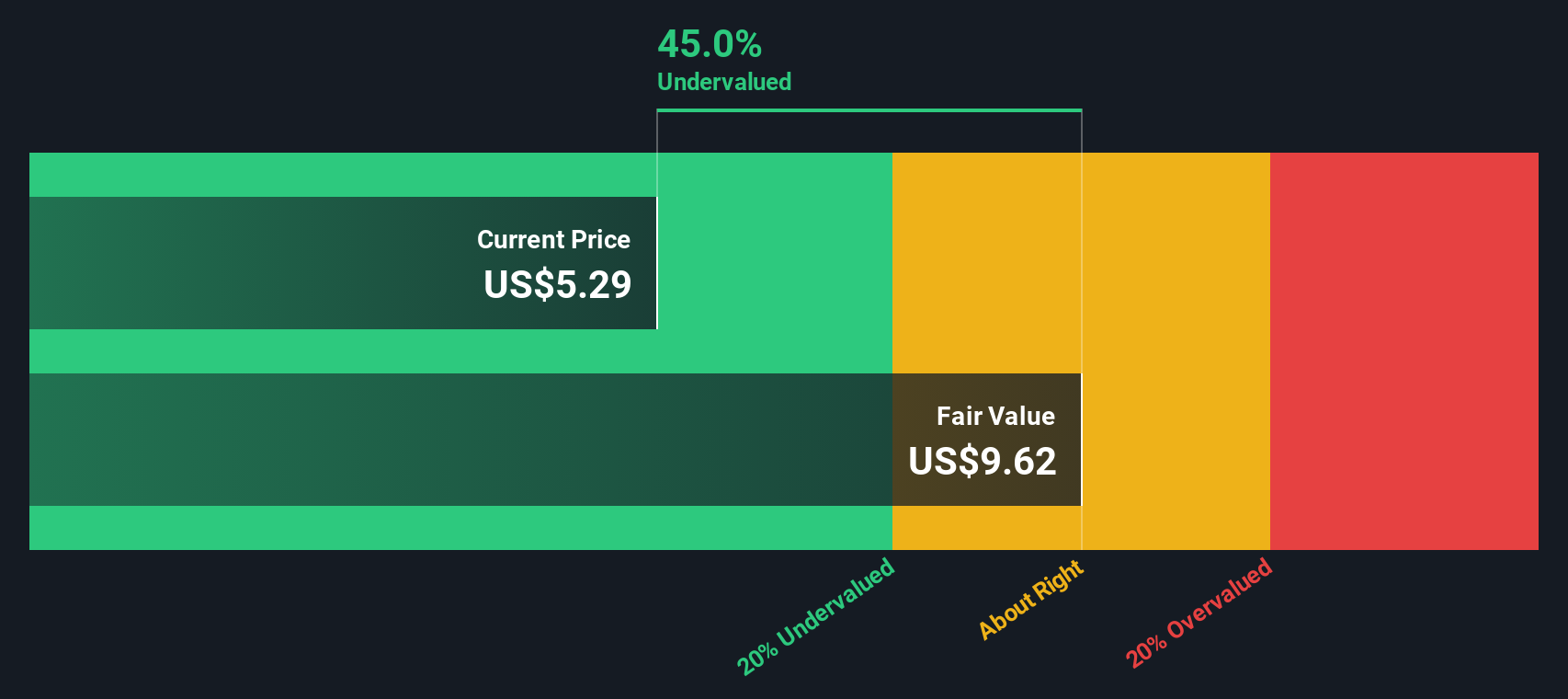

This expansion is landing at a time when JetBlue’s stock has delivered a modest 11% gain over the past year but remains well below where it traded just a few years ago. While this year’s ride has been bumpy, with a nascent recovery in the past month contrasting with a year-to-date decline, momentum shows some signs of returning. JetBlue’s mix of renewed international routes and domestic upgrades comes after a stretch marked by competitive pressures, cost headwinds, and a multi-year lag behind rivals. This network announcement could be the spark investors have been waiting for or just another waypoint on the road to recovery.

So, is this the moment when JetBlue stock takes flight, or has the market already factored in all the growth these routes might bring?

Most Popular Narrative: 27.2% Undervalued

According to community narrative, JetBlue is seen as significantly undervalued, with analysts expecting robust recovery and structural improvements to power long-term gains for the stock.

The rebound in leisure travel and resilient demand, especially among Millennials and Gen Z who prioritize experiences, continues to drive close-in bookings and support premium cabin and loyalty revenue growth. This trend is likely to result in higher ticket revenues and topline expansion.

Curious what’s fueling this bullish valuation? The narrative claims JetBlue’s future is not just about increasing the number of destinations. It suggests a major leap in profit margins, renewed operating leverage, and revenue streams that extend beyond traditional flights. What are the bold growth rates and profit milestones analysts are relying on? Discover which key assumptions support this fair value target.

Result: Fair Value of $4.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent uncertainty in travel demand and rising labor costs could challenge JetBlue's optimistic projections and limit anticipated earnings growth in the coming years.

Find out about the key risks to this JetBlue Airways narrative.Another View: DCF Model Offers a Different Perspective

While the multiples approach highlights JetBlue as undervalued, our DCF model raises a flag by suggesting the stock could be trading well below its true worth. Could these conflicting signals point to hidden risks or overlooked opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own JetBlue Airways Narrative

If the current narrative does not match your perspective or you want to see the numbers for yourself, you can generate your personal outlook in just a few minutes and do it your way.

A great starting point for your JetBlue Airways research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Stock Picks? See Where Opportunity Is Now

Making one smart choice is great, but building a truly successful portfolio means always looking for the next edge. Why settle for just one airline story when whole sectors are bursting with possibility? Take action now and seize your next investment advantage with these powerful stock ideas:

- Uncover reliable income streams by scanning the market for dividend stocks with yields > 3%, which could boost your portfolio’s yield beyond the standard 3% threshold.

- Explore the frontiers of technology by keeping up with the latest trends in AI penny stocks, which are shaping how companies use artificial intelligence to drive tomorrow’s breakthroughs.

- Strengthen your strategy by focusing on undervalued stocks based on cash flows. These may be trading below their true worth based on solid cash flow analysis and favorable fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBLU

Undervalued with minimal risk.

Market Insights

Community Narratives