- United States

- /

- Logistics

- /

- NasdaqGS:HUBG

Assessing Hub Group (HUBG) Valuation: Is There Untapped Upside for Long-Term Investors?

Reviewed by Kshitija Bhandaru

Hub Group (HUBG) shares have been on the move this month, catching the eye of investors who track value opportunities in the transportation sector. The company’s recent performance has sparked a closer look at its outlook and fundamentals.

See our latest analysis for Hub Group.

While Hub Group’s share price has lost a little ground this year, longer-term investors have still seen a nearly 30% total shareholder return over five years. Recent downward momentum hints at shifting sentiment in the transport sector, possibly as investors weigh near-term risks against steady long-term fundamentals.

If you’re watching transport stocks for signals, now could be a smart time to broaden your investing radar and discover fast growing stocks with high insider ownership

With the stock trading below analyst price targets and showing a substantial discount to its calculated intrinsic value, the question remains: is Hub Group undervalued, or does the current share price already reflect all of its future growth potential?

Most Popular Narrative: 14.5% Undervalued

At $34.16 per share, Hub Group trades below the most-followed narrative’s estimated fair value of $39.94. The assumptions behind this number highlight a tug-of-war between expected profit growth and current sector pressures.

“Ongoing investments in digital transformation and automation, such as AI-driven decision-making platforms and tech upgrades across business lines, are enabling improved operational efficiencies, scalable customer onboarding, and network optimization. This is leading to cost reductions and supporting meaningful net margin expansion over time.”

Wondering what bold assumptions justify this higher fair value? The narrative hinges on a forecast of strong profit margin expansion and the company landing at a future earnings multiple rarely seen among its direct peers. Curious about the growth drivers and discount rate that set this price? Click to unlock the full story driving the numbers behind this valuation.

Result: Fair Value of $39.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in logistics revenue or a failure to keep pace with digital competitors could quickly challenge this optimistic outlook.

Find out about the key risks to this Hub Group narrative.

Another View: How Multiples Shape Up

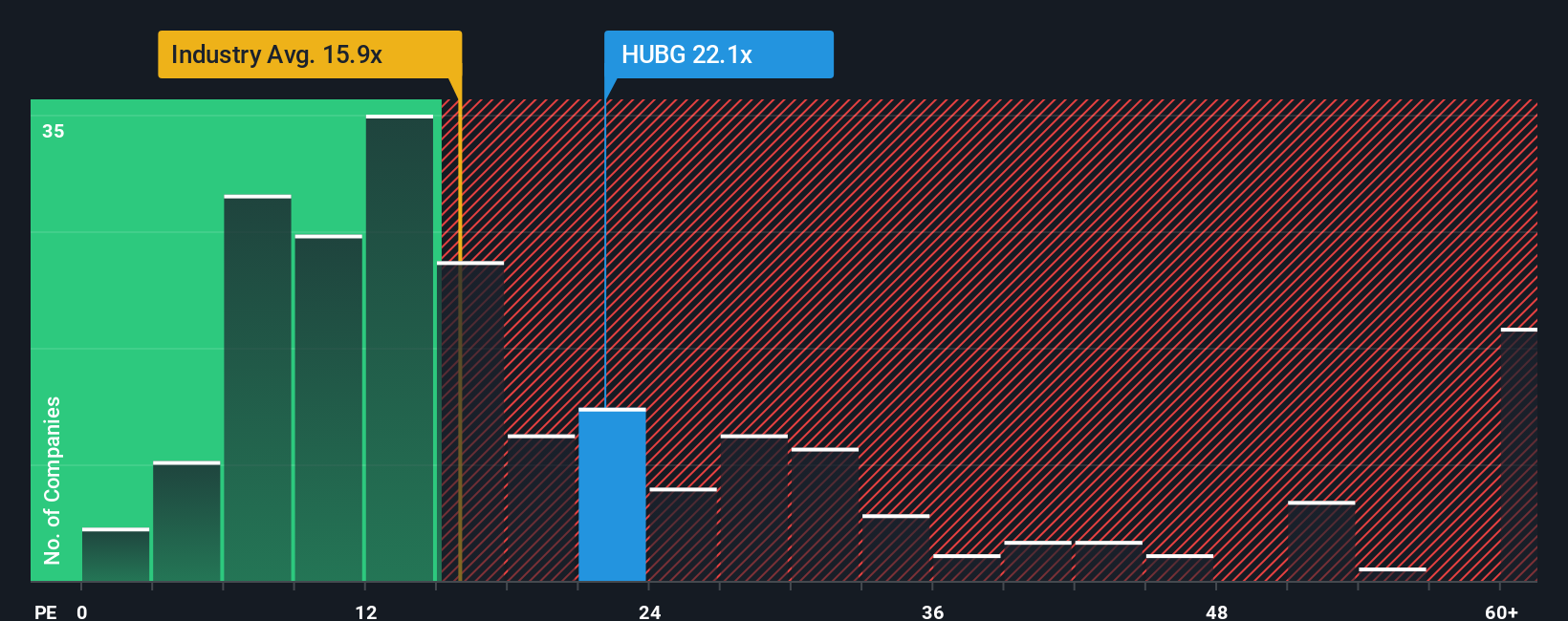

While the narrative suggests Hub Group is undervalued, the market’s view through a price-to-earnings lens tells a different story. Hub Group trades at 20.9 times earnings, which is more expensive than both the global logistics sector average (16x) and its fair ratio of 12.1x. Peers, however, average a far higher 40.7x.

This wider gap means investors must weigh the risk of a valuation correction against the potential for further upside. Is the premium justified, or is the value signal from the multiples lost in sector noise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hub Group Narrative

If you want to dig into the numbers and see the opportunity your own way, you can build and personalize a Hub Group narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Hub Group.

Looking for More Investment Ideas?

Step up your investment game and get ahead of the crowd by tapping into under-the-radar stock opportunities you won’t want to miss.

- Tap into some of the most lucrative yield opportunities by checking out these 19 dividend stocks with yields > 3%, which consistently reward investors with payouts over 3%.

- Jump on emerging tech trends by tracking these 24 AI penny stocks as they revolutionize industries with artificial intelligence advancements.

- Uncover rare value plays by browsing these 896 undervalued stocks based on cash flows, which are trading at compelling discounts based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hub Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUBG

Hub Group

A supply chain solutions provider, offers transportation and logistics management services in North America.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives