- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

US November 2024's Estimated Discounted Stocks For Value Investors

Reviewed by Simply Wall St

As the U.S. stock market rides a wave of optimism, fueled by recent election results and interest rate cuts, major indices like the S&P 500 have reached unprecedented highs. In this environment, identifying undervalued stocks becomes crucial for value investors looking to capitalize on potential discrepancies between a company's intrinsic worth and its current market price.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $50.60 | $99.93 | 49.4% |

| UMB Financial (NasdaqGS:UMBF) | $126.50 | $245.25 | 48.4% |

| First National (NasdaqCM:FXNC) | $22.84 | $45.19 | 49.5% |

| Synovus Financial (NYSE:SNV) | $58.73 | $115.23 | 49% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.92 | $63.96 | 48.5% |

| XPEL (NasdaqCM:XPEL) | $45.67 | $91.12 | 49.9% |

| Pinterest (NYSE:PINS) | $30.39 | $59.50 | 48.9% |

| QuinStreet (NasdaqGS:QNST) | $23.42 | $46.52 | 49.7% |

| STAAR Surgical (NasdaqGM:STAA) | $30.42 | $59.65 | 49% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $279.82 | $546.39 | 48.8% |

Let's take a closer look at a couple of our picks from the screened companies.

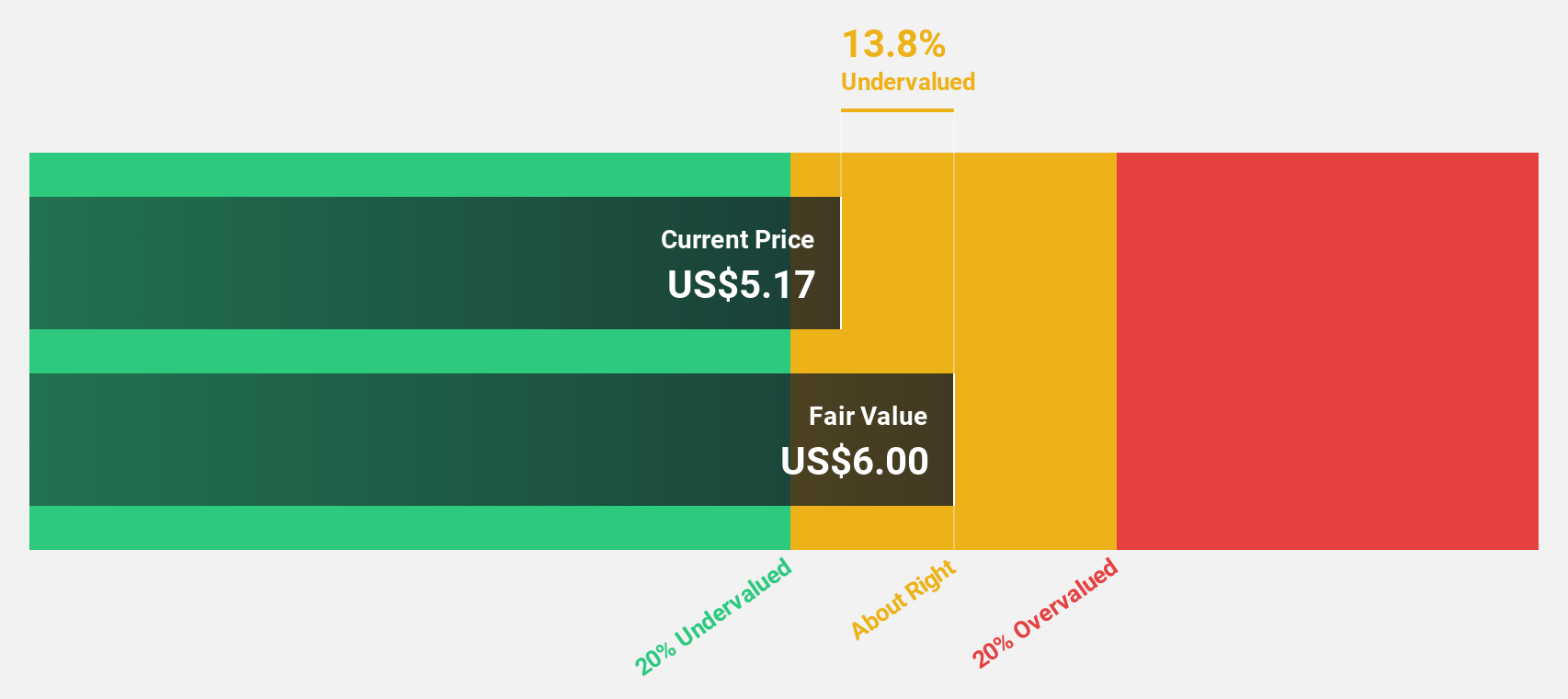

Grab Holdings (NasdaqGS:GRAB)

Overview: Grab Holdings Limited operates as a superapp provider across Southeast Asia, offering a range of services including transportation, food delivery, and digital payments in countries such as Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam; it has a market cap of approximately $16.75 billion.

Operations: The company's revenue is primarily derived from three segments: Mobility ($959 million), Deliveries ($1.29 billion), and Financial Services ($224 million).

Estimated Discount To Fair Value: 26.7%

Grab Holdings is trading at US$4.38, below its estimated fair value of US$5.98, suggesting it may be undervalued based on cash flows. The company has raised its 2024 revenue guidance to US$2.76 billion - US$2.78 billion, indicating strong growth prospects with expected annual profit growth above the market average over the next three years. However, its forecasted Return on Equity remains low at 8.3%.

- The analysis detailed in our Grab Holdings growth report hints at robust future financial performance.

- Get an in-depth perspective on Grab Holdings' balance sheet by reading our health report here.

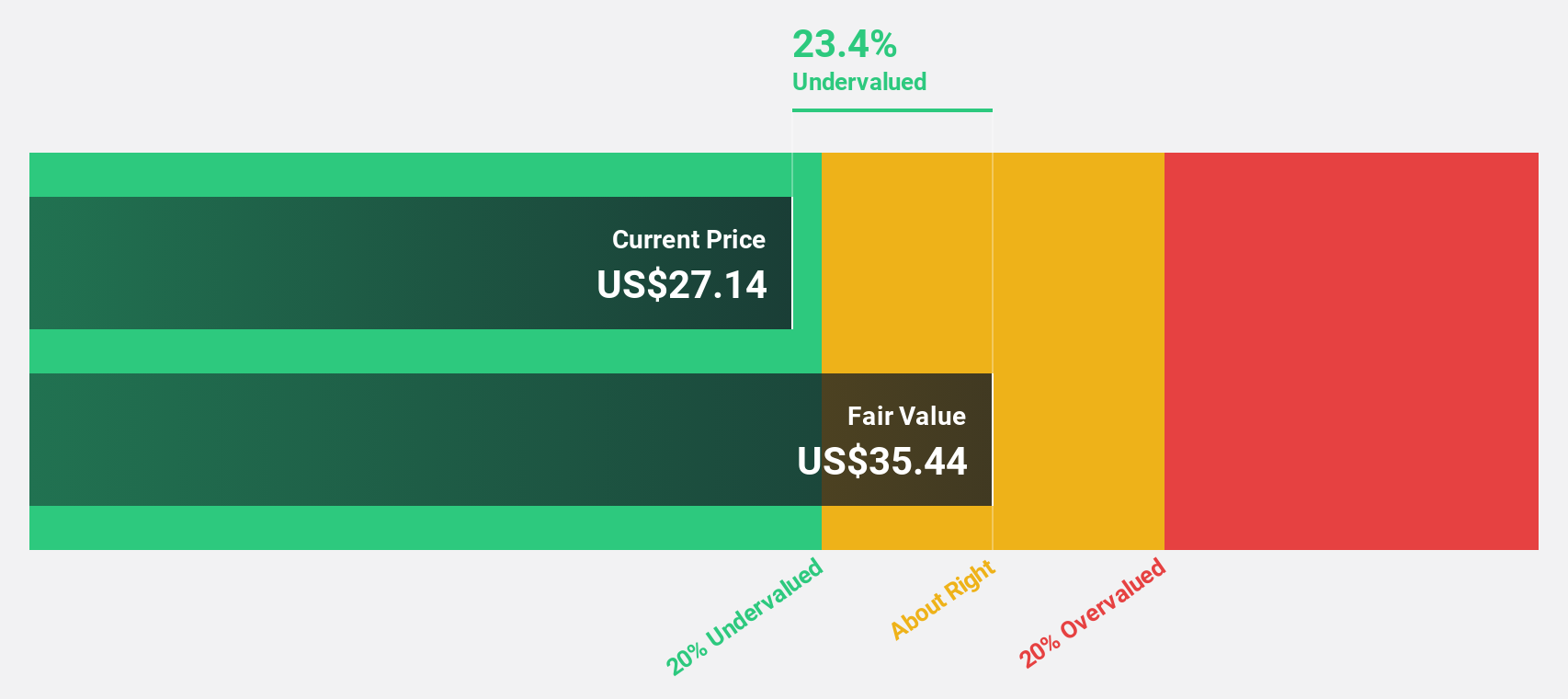

Sportradar Group (NasdaqGS:SRAD)

Overview: Sportradar Group AG, along with its subsidiaries, offers sports data services to the sports betting and media industries across various countries including the United Kingdom, United States, Malta, and Switzerland; it has a market cap of approximately $4.73 billion.

Operations: Sportradar Group AG generates its revenue from providing sports data services tailored for the sports betting and media sectors globally.

Estimated Discount To Fair Value: 21.4%

Sportradar Group's current trading price of $16.54 is beneath its estimated fair value of $21.05, highlighting potential undervaluation based on cash flows. The company has recently raised its 2024 revenue guidance to at least €1.09 billion, reflecting strong growth expectations with earnings projected to grow significantly above the market average over the next three years. Despite this, its forecasted Return on Equity remains modest at 10.7%.

- According our earnings growth report, there's an indication that Sportradar Group might be ready to expand.

- Click to explore a detailed breakdown of our findings in Sportradar Group's balance sheet health report.

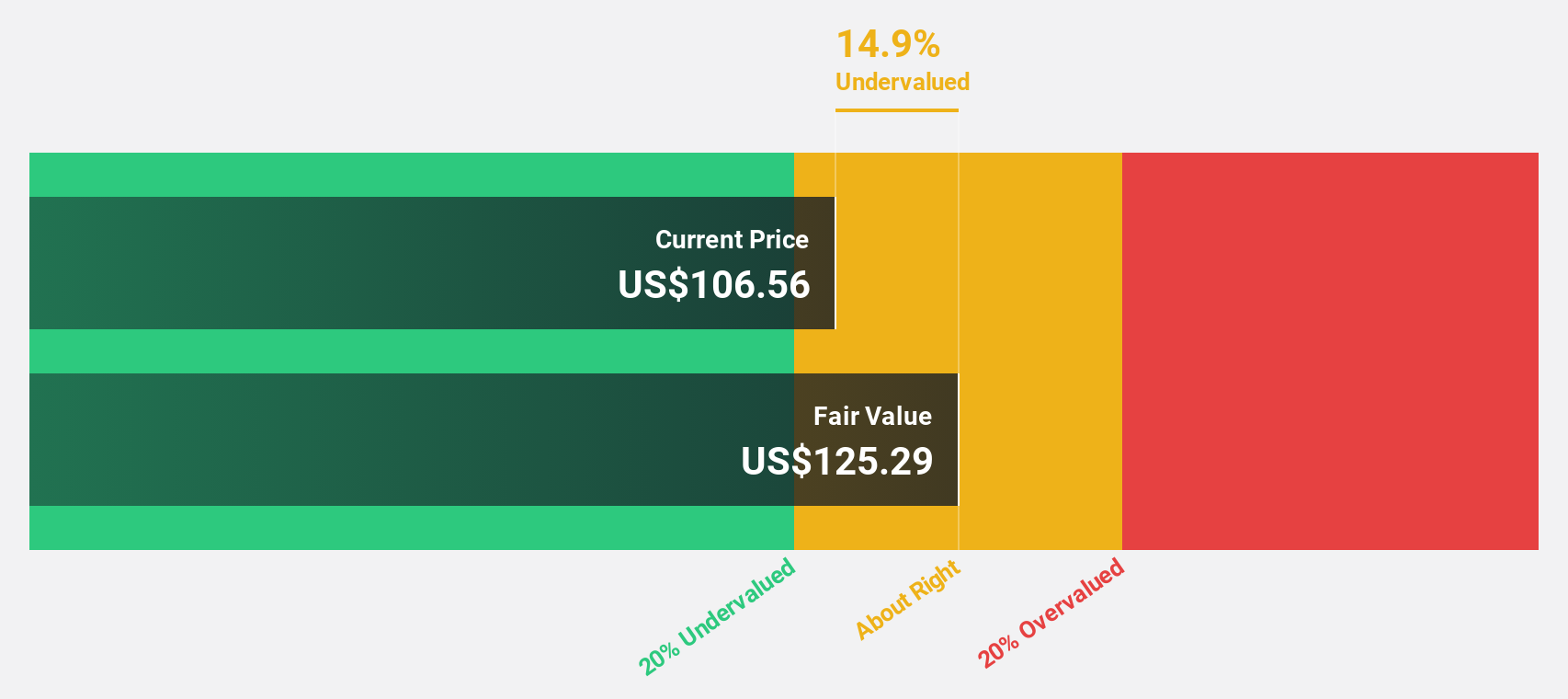

Shift4 Payments (NYSE:FOUR)

Overview: Shift4 Payments, Inc. offers software and payment processing solutions both in the United States and internationally, with a market cap of approximately $8.93 billion.

Operations: The company's revenue is primarily generated from its data processing segment, which amounts to $2.92 billion.

Estimated Discount To Fair Value: 10.1%

Shift4 Payments is trading at US$104.91, slightly below its estimated fair value of US$116.63, suggesting potential undervaluation based on cash flows. The company's revenue and earnings are forecast to grow significantly faster than the market average, despite having a high level of debt and recent shareholder dilution. Recent strategic partnerships in Europe and innovations like cryptocurrency payment acceptance could enhance growth prospects by expanding Shift4's reach and capabilities in key markets.

- Our expertly prepared growth report on Shift4 Payments implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Shift4 Payments.

Taking Advantage

- Navigate through the entire inventory of 198 Undervalued US Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Provides software and payment processing solutions solutions in the United States and internationally.

High growth potential with mediocre balance sheet.