- United States

- /

- Transportation

- /

- NasdaqGS:GRAB

Assessing Grab Holdings (NasdaqGS:GRAB) Valuation Following Upbeat Analyst Upgrades and Earnings Momentum

Reviewed by Kshitija Bhandaru

Grab Holdings (GRAB) caught investors’ attention after analysts increased their buy ratings and raised earnings forecasts. With quarterly revenue expected to climb sharply from a year ago, sentiment around the stock has turned more positive.

See our latest analysis for Grab Holdings.

After a rally earlier in the year, Grab’s recent 1-month share price return of 10.6% and 90-day gain of 17.2% show fresh momentum. The 1-year total shareholder return of nearly 61% highlights how sentiment has shifted decisively in favor of growth. With strong analyst optimism and a positive earnings outlook, investors appear to be taking a longer-term view on Grab’s potential, even as the share price experienced a modest pullback this week.

If you’re interested in more stocks showing signs of rapid growth and investor conviction, now’s a great time to discover fast growing stocks with high insider ownership

With impressive gains and upbeat analyst sentiment, the question remains: is Grab’s current share price still undervaluing its future potential, or has the market already priced in the expected surge in growth?

Most Popular Narrative: 28.5% Undervalued

Grab Holdings’ most widely followed valuation narrative places its fair value significantly above the last close of $5.86, suggesting a potential opportunity that diverges from current market pricing. According to BlackGoat, this narrative price target is based on a specific set of financial projections and market assumptions, which are revealed in detail below.

Applying a 35× PE multiple in year five, broadly in line with global ride-hailing peers such as Uber at about 30× and justified by Grab’s market leadership and growth runway, and discounting back at a 9% cost of equity, I arrive at a fair value of $6.02. With the stock trading today (21 August 2025) at $5.02, this implies more than 16% undervaluation.

Want to see what’s behind this bullish price? The answer is ambitious revenue and margin expansion, plus a tech multiple typically reserved for the global elite. The key drivers are unexpected and could shift how investors view Grab’s potential. Dive in to unlock the full formula behind this 28% discount.

Result: Fair Value of $8.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising incentive spending and delays in regulatory approvals for consolidation could quickly disrupt the bullish outlook and sentiment around Grab’s valuation.

Find out about the key risks to this Grab Holdings narrative.

Another View: What Do Market Ratios Signal?

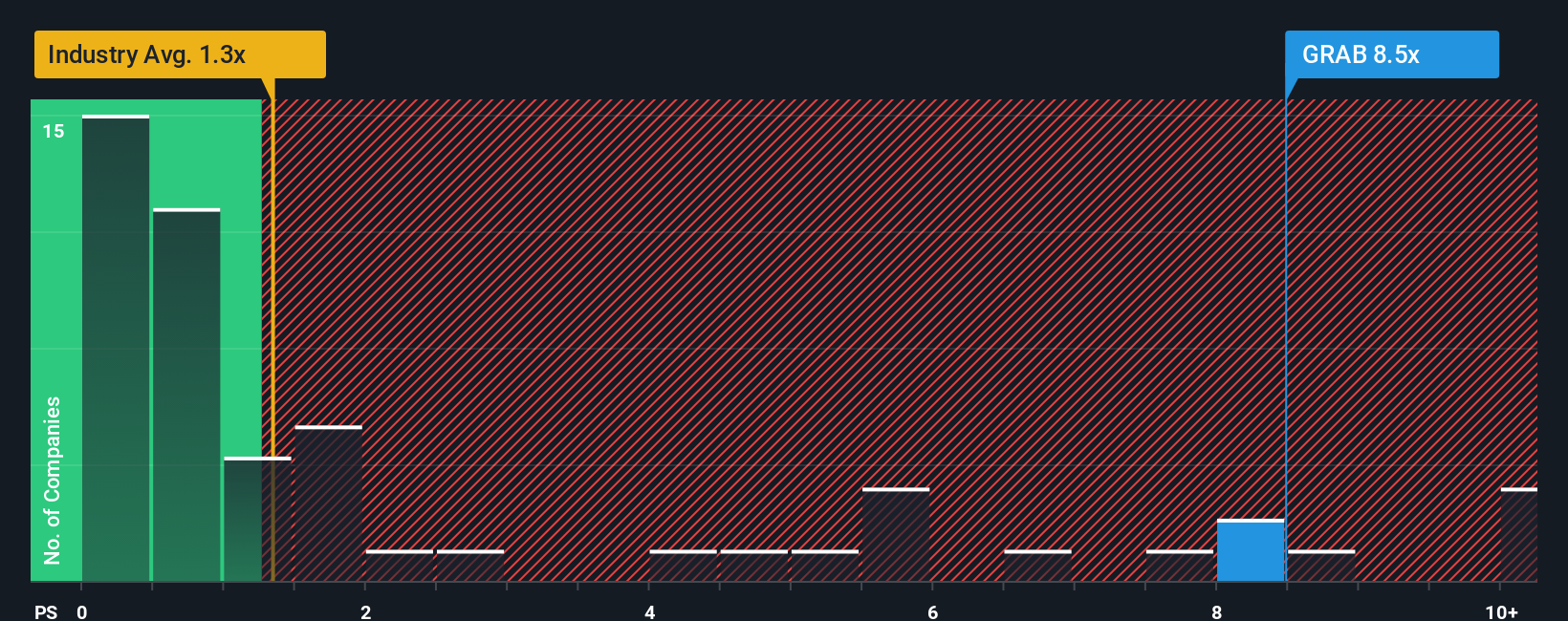

Looking through the lens of price to sales, Grab is trading at 7.8 times sales, much higher than both its industry average (1.3x) and the calculated fair ratio of 3.4x. This premium suggests investors are paying up for expected growth, but also exposes the stock to valuation risk if those expectations aren’t met. Could the share price adjust back toward the fair ratio if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grab Holdings Narrative

If you'd rather analyze the numbers yourself or challenge the consensus, you can easily shape your own valuation perspective in just minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Grab Holdings.

Looking for More Investment Ideas?

Step ahead of the crowd by uncovering stocks with powerful trends and untapped potential. The Simply Wall Street Screener can give you an investing edge others will miss.

- Accelerate your portfolio’s growth by tracking momentum in promising small caps with these 3581 penny stocks with strong financials, delivering both volatility and big opportunity.

- Tap into surging innovation by following the AI leaders of tomorrow. Find edge and excitement with these 24 AI penny stocks packed with tech disruptors.

- Boost your strategy with solid income plays that pay you as they grow. Start with these 19 dividend stocks with yields > 3% offering attractive yields and steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAB

Grab Holdings

Engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives