- United States

- /

- Logistics

- /

- NasdaqGS:FWRD

With EPS Growth And More, Forward Air (NASDAQ:FWRD) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Forward Air (NASDAQ:FWRD), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Forward Air with the means to add long-term value to shareholders.

See our latest analysis for Forward Air

How Quickly Is Forward Air Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Forward Air's EPS has grown 26% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

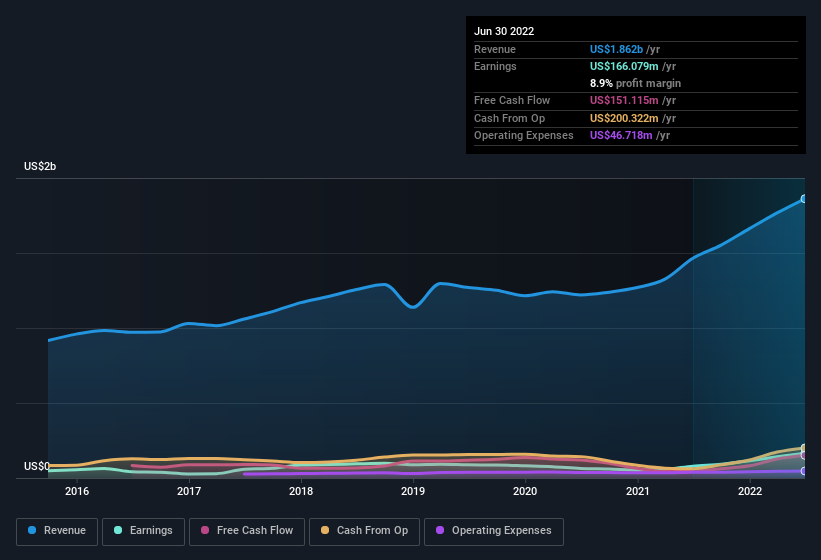

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Forward Air shareholders can take confidence from the fact that EBIT margins are up from 8.0% to 12%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Forward Air?

Are Forward Air Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Forward Air shareholders is that no insiders reported selling shares in the last year. Add in the fact that Javier Polit, the Independent Director of the company, paid US$9.9k for shares at around US$99.12 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

On top of the insider buying, it's good to see that Forward Air insiders have a valuable investment in the business. As a matter of fact, their holding is valued at US$31m. That's a lot of money, and no small incentive to work hard. Even though that's only about 1.1% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Forward Air Deserve A Spot On Your Watchlist?

For growth investors, Forward Air's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. Astute investors will want to keep this stock on watch. Of course, just because Forward Air is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Forward Air, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Forward Air, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FWRD

Forward Air

Operates as an asset-light freight and logistics company in the United States, Mexico, Europe, Asia, and Canada.

Undervalued low.

Similar Companies

Market Insights

Community Narratives