Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So when we looked at the ROCE trend of Forward Air (NASDAQ:FWRD) we really liked what we saw.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Forward Air, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.24 = US$259m ÷ (US$1.2b - US$166m) (Based on the trailing twelve months to March 2023).

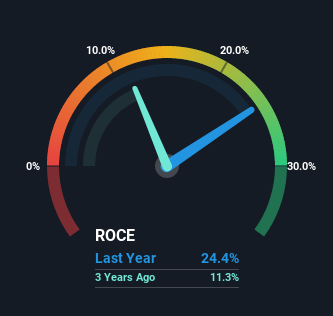

Thus, Forward Air has an ROCE of 24%. In absolute terms that's a great return and it's even better than the Logistics industry average of 12%.

Check out our latest analysis for Forward Air

In the above chart we have measured Forward Air's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Forward Air here for free.

SWOT Analysis for Forward Air

- Earnings growth over the past year exceeded the industry.

- Debt is not viewed as a risk.

- Dividends are covered by earnings and cash flows.

- Dividend is low compared to the top 25% of dividend payers in the Logistics market.

- Annual earnings are forecast to grow for the next 2 years.

- Trading below our estimate of fair value by more than 20%.

- Annual earnings are forecast to grow slower than the American market.

What Does the ROCE Trend For Forward Air Tell Us?

Investors would be pleased with what's happening at Forward Air. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 24%. Basically the business is earning more per dollar of capital invested and in addition to that, 70% more capital is being employed now too. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

The Key Takeaway

To sum it up, Forward Air has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. Since the stock has returned a solid 71% to shareholders over the last five years, it's fair to say investors are beginning to recognize these changes. So given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist.

While Forward Air looks impressive, no company is worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether FWRD is currently trading for a fair price.

Forward Air is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FWRD

Forward Air

Operates as an asset-light freight and logistics company in the United States, Mexico, Europe, Asia, and Canada.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026