- United States

- /

- Marine and Shipping

- /

- NasdaqCM:ESEA

Uncovering November 2024's Hidden Gems in the United States

Reviewed by Simply Wall St

In the last week, the United States market has been flat, though it has experienced a significant 32% rise over the past year with earnings anticipated to grow by 15% annually in the coming years. In this dynamic environment, identifying stocks that are undervalued yet poised for growth can offer unique opportunities for investors seeking to capitalize on emerging trends and solid fundamentals.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| Nanophase Technologies | 40.87% | 24.19% | -9.71% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Euroseas (NasdaqCM:ESEA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Euroseas Ltd. offers ocean-going transportation services globally and has a market capitalization of $281.49 million.

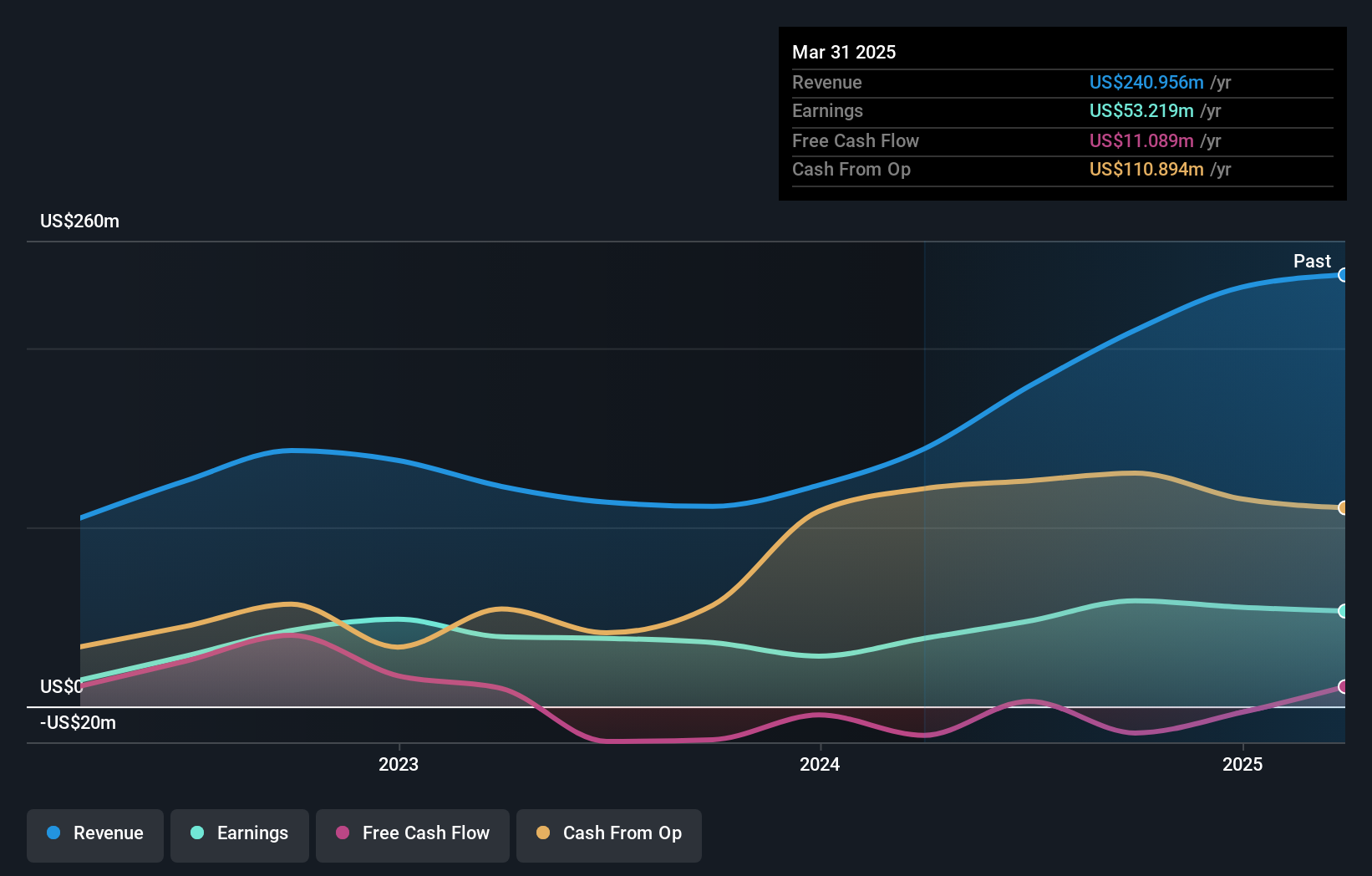

Operations: Euroseas Ltd. generates revenue primarily from its transportation-shipping segment, which amounted to $205.17 million.

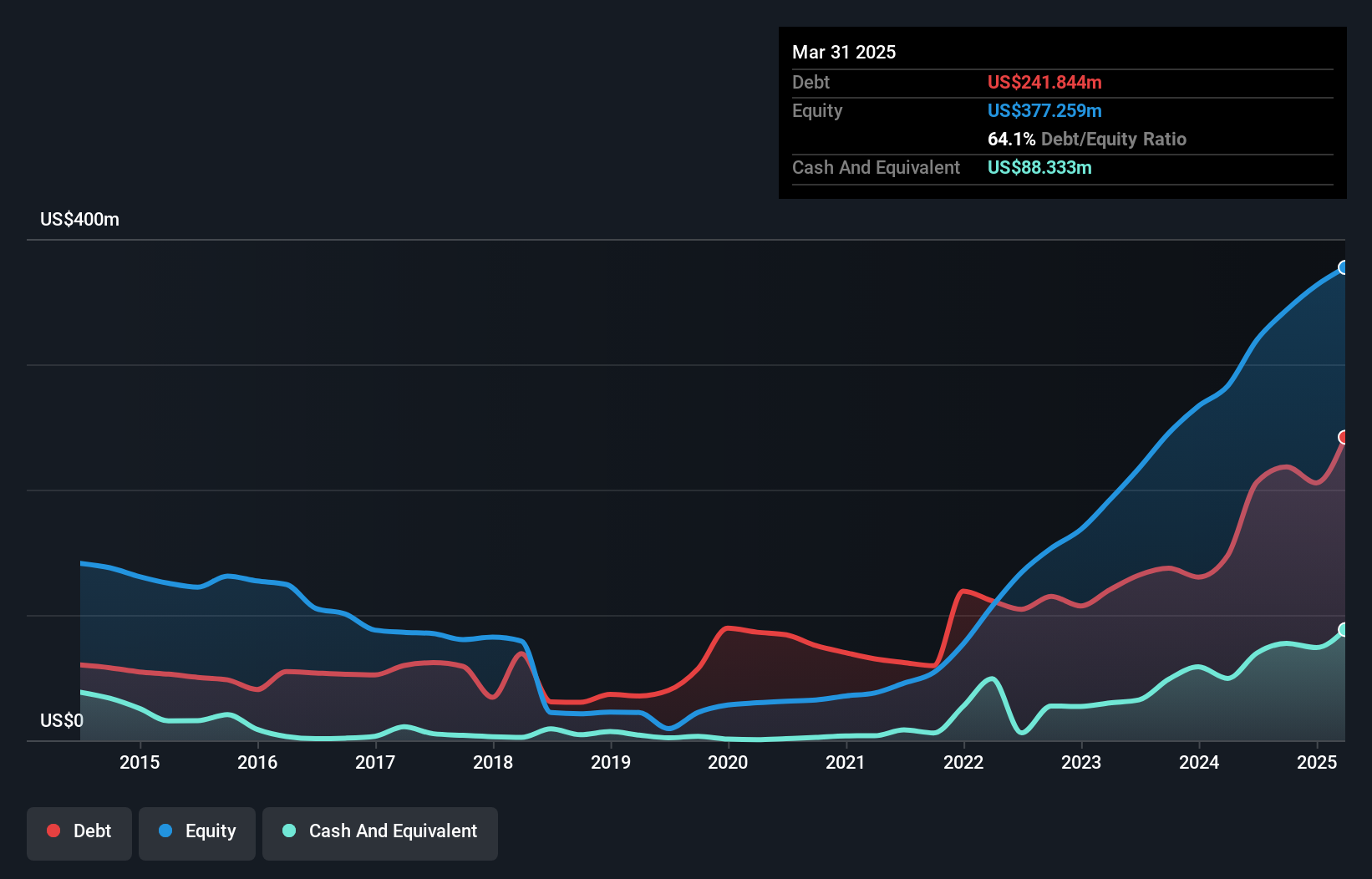

Euroseas, a dynamic player in the shipping industry, has seen its debt to equity ratio improve significantly from 428.1% to 64.5% over five years, reflecting stronger financial management. The company is trading at a substantial discount of 95.6% below estimated fair value, suggesting potential undervaluation in the market. Recent earnings growth of 14% surpasses the industry's -3%, showcasing resilience and competitive advantage. However, with high non-cash earnings and a net debt to equity ratio of 42.7%, financial leverage remains considerable but manageable given its robust charter contracts and strategic fleet modernization efforts focusing on eco-friendly vessels.

Pure Cycle (NasdaqCM:PCYO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pure Cycle Corporation designs, constructs, operates, and maintains water and wastewater systems in the Denver metropolitan area and Colorado Front Range in the United States with a market cap of $281.20 million.

Operations: The company generates revenue primarily from water and wastewater services, with a focus on the Denver metropolitan area. Its financial performance is influenced by its ability to manage operational costs effectively, impacting its net profit margin.

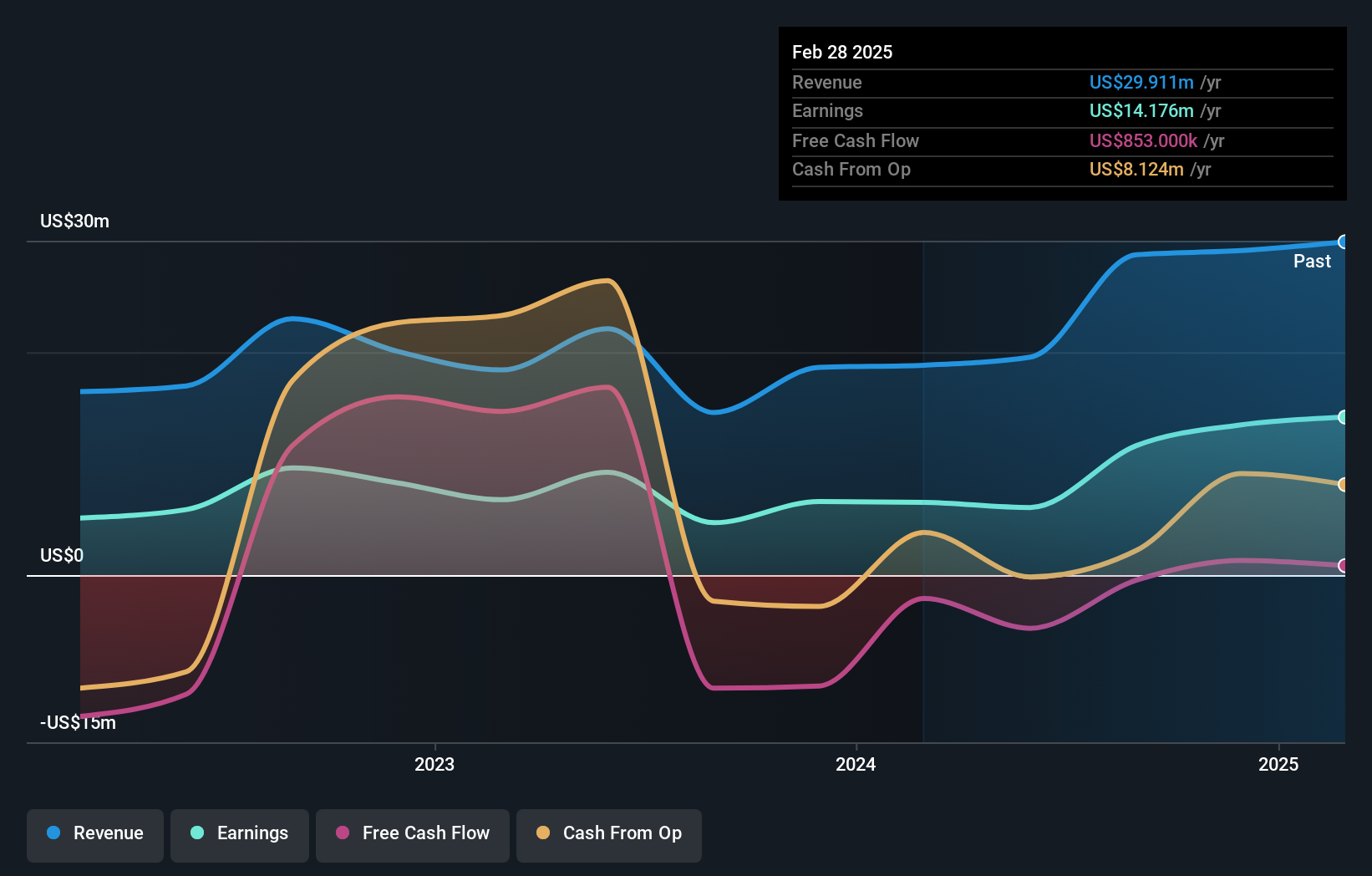

Pure Cycle, a notable player in the water utilities sector, has demonstrated impressive financial growth with earnings surging by 147% over the past year. This performance outpaced the industry's average growth of 6.8%. The company's recent annual report highlights sales reaching US$28.75 million, doubling from US$14.59 million last year, with net income climbing to US$11.61 million from US$4.7 million previously. Despite a debt-to-equity ratio increase to 5%, Pure Cycle's financial health remains robust as it holds more cash than total debt and achieves high-quality earnings while effectively covering its interest obligations through profits.

PrimeEnergy Resources (NasdaqCM:PNRG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: PrimeEnergy Resources Corporation, with a market cap of $307.24 million, focuses on the acquisition, development, and production of oil and natural gas properties in the United States through its subsidiaries.

Operations: PrimeEnergy Resources generates revenue primarily from its oil and gas exploration, development, operation, and servicing activities, amounting to $178.71 million. The company's financial performance is influenced by its operational efficiency and market conditions in the energy sector.

PrimeEnergy Resources, a nimble player in the energy sector, has shown impressive growth with earnings rising 25% over the past year. The company reported significant production increases for oil and natural gas, with oil output hitting 757,000 barrels this quarter compared to last year's 323,000 barrels. Its financial health is robust as it operates debt-free now versus a debt-to-equity ratio of 58.8% five years ago. Despite trading at what seems to be a bargain—95% below estimated fair value—recent insider selling might raise some eyebrows among investors looking for stability.

Turning Ideas Into Actions

- Investigate our full lineup of 227 US Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Euroseas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ESEA

Very undervalued with adequate balance sheet.