- United States

- /

- Transportation

- /

- NasdaqGS:CSX

CSX (CSX) Explores M&A Options Following Union Pacific's US$72 Billion Acquisition

Reviewed by Simply Wall St

CSX (CSX) recently explored potential mergers as rumors surfaced about the company's collaboration with Goldman Sachs to participate in rail industry consolidation, which followed a significant merger between Union Pacific Corp. and Norfolk Southern Corp. CSX's openness to such discussions, along with its commitment to shareholder returns through share buybacks totaling over $3.5 billion, could have bolstered investor sentiment. Despite recent macroeconomic pressures, including market reactions to tariff uncertainties and weak labor reports, CSX's actions, like the repurchase program and stable dividends, may have played a part in its 24% stock appreciation over the last quarter.

We've spotted 1 risk for CSX you should be aware of.

The potential mergers and share buybacks discussed in the introduction might enhance CSX's operational efficiency and shareholder returns, aligning with its ongoing infrastructure projects like the Howard Street Tunnel. These initiatives could improve network fluidity and operational reliability, potentially translating to stronger revenue and earnings growth over time.

Over the past five years, CSX delivered a total return of 57.57%, which highlights the company's ability to generate value for its shareholders despite recent challenges. However, in the past year, CSX underperformed the market and the transportation industry, which returned 16.8% and 7.5% respectively. This underperformance suggests that there might be industry-specific or company-specific challenges impacting its short-term performance.

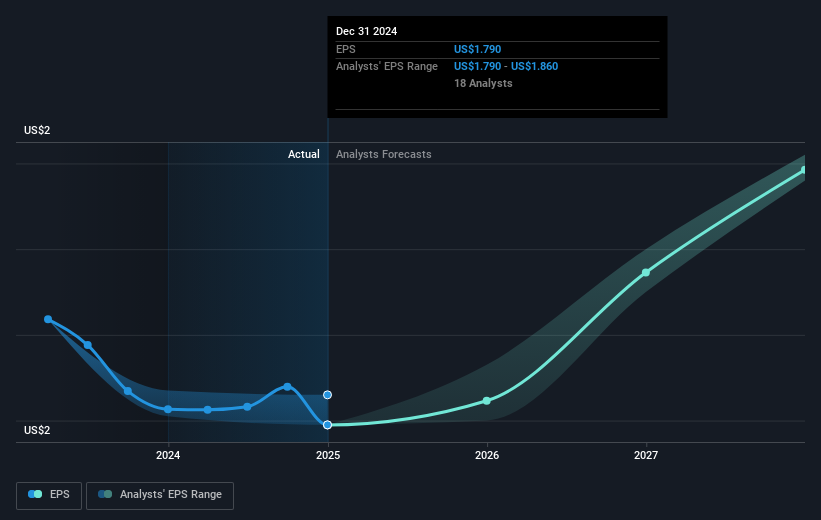

Regarding future revenue and earnings, if these infrastructure projects succeed, CSX could see improved profit margins and growth, with revenue expected to grow by 3.6% annually and earnings reaching US$3.9 billion by 2028. However, the current share price of $35.54 remains below the analyst consensus price target of $38.16, indicating potential upside but also requiring cautious evaluation of risks associated with economic uncertainties and project execution. Consider analysts' assumptions of a PE ratio and how the ongoing developments might justify these expectations.

Learn about CSX's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives