- United States

- /

- Logistics

- /

- NasdaqGS:CHRW

C.H. Robinson (CHRW): Valuation in Focus After Rating Upgrades Highlight Tech-Driven Operational Gains

Reviewed by Kshitija Bhandaru

C.H. Robinson Worldwide (CHRW) is getting attention after Barclays and S&P Global Ratings both raised their outlook for the company. Each highlighted how technology and artificial intelligence are driving recent operational gains.

See our latest analysis for C.H. Robinson Worldwide.

C.H. Robinson’s embrace of automation and AI has sparked renewed interest, showing up not just in recent rating upgrades but also in the way the market views its risk profile. The company’s latest $134.77 share price reflects stable momentum, with total shareholder return up nearly 31% over the past year. While last month’s removal from the FTSE All-World Index marked a brief setback, underlying performance suggests that operational improvements may yet provide fresh upside.

If C.H. Robinson’s technological pivot has you considering broader opportunities, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

But with the share price holding steady near recent highs, investors are left to wonder whether C.H. Robinson is undervalued based on its fundamentals or if the market has already priced in the company's newfound growth potential.

Most Popular Narrative: 13% Overvalued

With C.H. Robinson closing at $134.77, the most widely followed narrative suggests a fair value of $118.88, putting today's price noticeably above consensus expectations. Here is what is shaping that calculation and why analysts see potential pushback against the current rally.

Significant progress in cost reduction and automation is leading to higher operating efficiencies and positioning the company for accelerated market share gains and earnings growth. Improved productivity and advancements in the technology stack are seen as setting up C.H. Robinson for outsized performance when the freight market rebounds.

Curious what powerful upgrades and unstoppable efficiency moves underpin this bold fair value? Find out which margin drivers and future ambitions analysts are betting on. There is more beneath this headline than meets the eye. Dive deeper to discover what C.H. Robinson must deliver to justify the price and which numbers could flip the script.

Result: Fair Value of $118.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade policy uncertainty and intensifying tech-driven competition could reduce margin gains and challenge the narrative supporting C.H. Robinson's premium valuation.

Find out about the key risks to this C.H. Robinson Worldwide narrative.

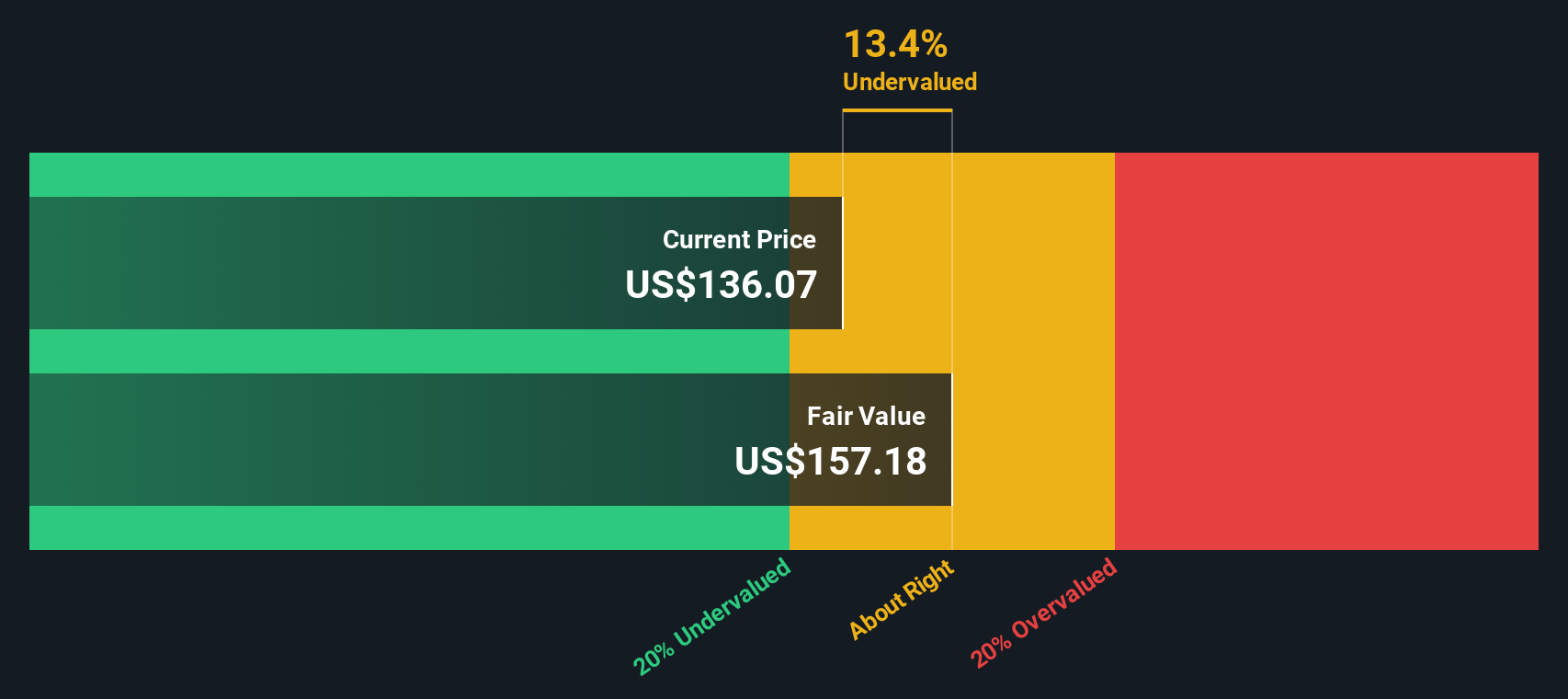

Another View: DCF Model Signals Upside

Looking at C.H. Robinson from the perspective of our SWS DCF model, the story changes direction. The DCF suggests the shares are currently undervalued by nearly 13% at $134.77. This implies the market is not fully recognizing the company’s long-term cash flow potential. Might the real opportunity be hiding in the numbers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out C.H. Robinson Worldwide for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own C.H. Robinson Worldwide Narrative

If you have a different take or want to dig into the details yourself, shaping your own perspective is straightforward and only takes a few minutes, so why not Do it your way

A great starting point for your C.H. Robinson Worldwide research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

Don’t settle for just one stock when the market offers so many compelling paths. Move beyond the obvious and seize your chance to uncover standout ideas tailored to your goals.

- Capture high yields for steady income streams by checking out these 19 dividend stocks with yields > 3% with returns over 3%.

- Unleash your curiosity for disruptive technology and jump into these 26 quantum computing stocks that could transform industries in the years ahead.

- Catch early-stage potential by scanning these 3568 penny stocks with strong financials showing strong financials and promising upside before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHRW

C.H. Robinson Worldwide

Provides freight transportation and related logistics and supply chain services in the United States and internationally.

Solid track record established dividend payer.

Market Insights

Community Narratives