- United States

- /

- Marine and Shipping

- /

- NasdaqGS:CCEC

How Investors Are Reacting To Capital Clean Energy Carriers (CCEC) Board Refresh and S&P Global BMI Inclusion

Reviewed by Sasha Jovanovic

- At its Annual Meeting of Shareholders on September 22, 2025, Capital Clean Energy Carriers Corp. announced the retirement of Mr. Abel Rasterhoff from its Board of Directors and the appointment of Mr. Martin Houston, an industry veteran with over four decades of global energy leadership, as his successor.

- The coinciding addition of Mr. Houston, who has served on boards of listed companies worldwide and brings a deep background in LNG and clean energy, alongside the company's recent inclusion in the S&P Global BMI Index, signals increased governance strength and institutional visibility for the company.

- We'll examine how Martin Houston's board appointment could reshape Capital Clean Energy Carriers' governance and future investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Capital Clean Energy Carriers Investment Narrative Recap

Investors in Capital Clean Energy Carriers need to believe in the company’s ability to secure long-term contracts for its specialized fleet and manage interest rate pressures on its considerable floating-rate debt. The recent appointment of Martin Houston to the board brings deep LNG and energy experience, which may support efforts to increase institutional confidence, but does not materially affect the most immediate catalyst, securing employment for newbuild vessels, or the biggest risk, which remains interest rate volatility.

The company’s inclusion in the S&P Global BMI Index just days before Houston’s appointment is likely to draw increased attention from institutional investors, which could help improve liquidity and potentially broaden its shareholder base. While this may support the near-term outlook, the critical catalyst remains successful contract signings in the company’s core clean energy shipping segments.

However, with much of its debt exposed to variable interest rates, the risk to earnings stability if rates stay elevated is something investors should be mindful of...

Read the full narrative on Capital Clean Energy Carriers (it's free!)

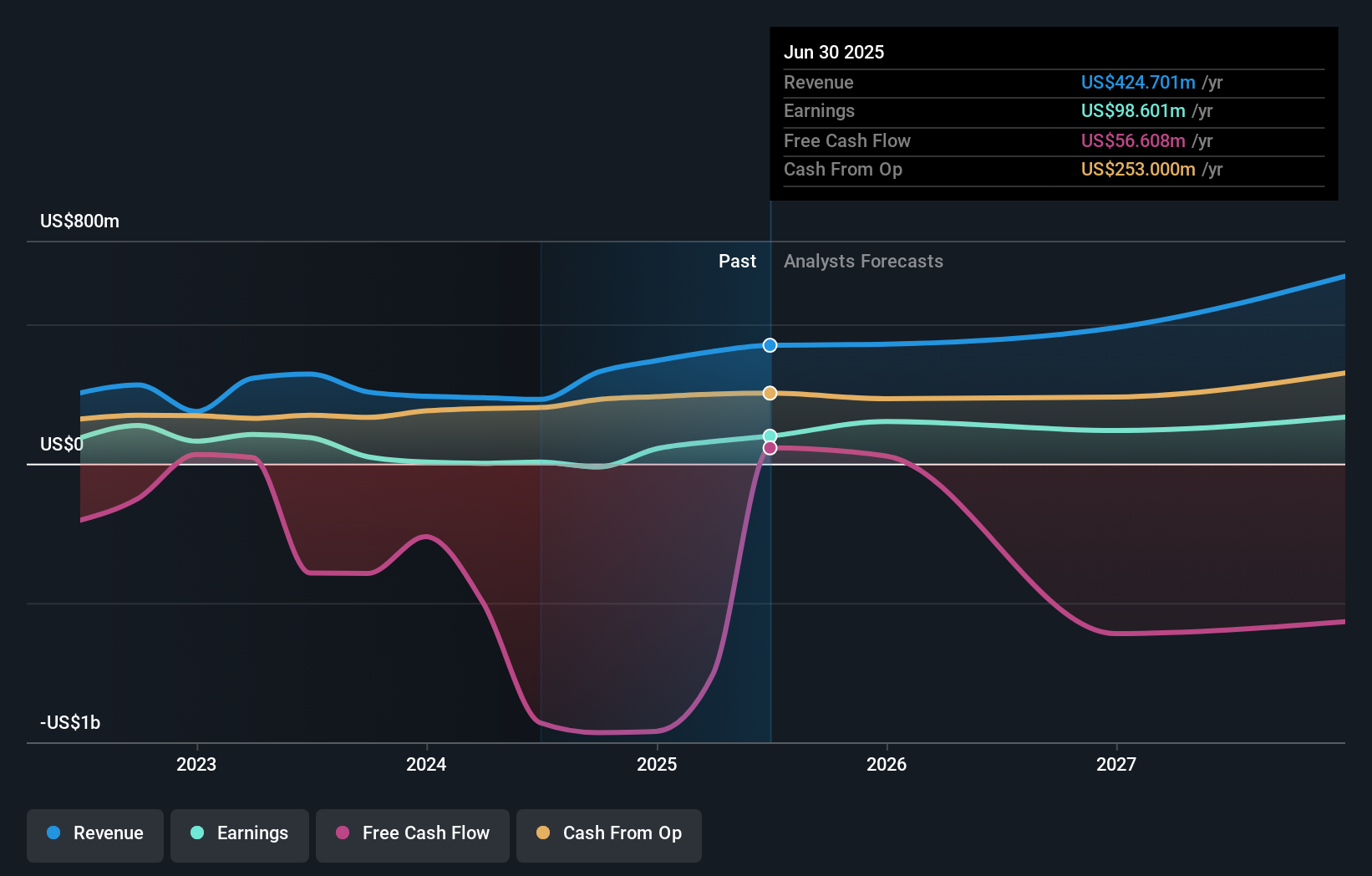

Capital Clean Energy Carriers is projected to achieve $683.8 million in revenue and $161.0 million in earnings by 2028. This outlook assumes a 17.2% annual revenue growth rate and a $62.4 million increase in earnings from the current $98.6 million.

Uncover how Capital Clean Energy Carriers' forecasts yield a $25.80 fair value, a 21% upside to its current price.

Exploring Other Perspectives

All 1 fair value estimate from the Simply Wall St Community puts Capital Clean Energy Carriers’ value at US$25.80. While community consensus is consistent, persistent interest rate risk remains a focus that could shape future returns. Explore more viewpoints below.

Explore another fair value estimate on Capital Clean Energy Carriers - why the stock might be worth as much as 21% more than the current price!

Build Your Own Capital Clean Energy Carriers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital Clean Energy Carriers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Capital Clean Energy Carriers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital Clean Energy Carriers' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCEC

Capital Clean Energy Carriers

A shipping company, provides marine transportation services in Greece.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives