- United States

- /

- Airlines

- /

- NasdaqGS:AAL

Is American Airlines’ A320 Software Fix Quietly Reframing Operational Risk Perceptions For AAL?

Reviewed by Sasha Jovanovic

- American Airlines Group has resolved a critical software issue affecting its Airbus A320 fleet, part of a wider global recall, with updates implemented in time to keep flights operating safely and with minimal disruption.

- This swift fix, alongside the company’s relatively young fleet and extensive Latin America–US network, reinforces perceptions of operational resilience and safety focus.

- We’ll now explore how resolving the A320 software glitch might influence American Airlines’ existing investment narrative around demand, margins, and risk.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

American Airlines Group Investment Narrative Recap

To own American Airlines, you generally have to believe that improving demand, a younger fleet and a stronger loyalty ecosystem can offset high debt and labor costs. The quick resolution of the A320 software issue appears operationally important but not a material change to the near term catalysts around demand recovery or the key risk of balance sheet pressure and constrained financial flexibility.

American’s upcoming presentations at the Goldman Sachs Industrials and Materials Conference and the Bernstein Industrials Forum give management a timely stage to frame this operational resilience alongside its guidance for modest fourth quarter revenue growth. For investors watching demand trends, cost control and execution on fleet and customer initiatives, these events may help clarify how management is prioritizing margins and risk after the A320 software episode.

But investors should be aware that the combination of high net debt and ongoing fleet capex still leaves American exposed if...

Read the full narrative on American Airlines Group (it's free!)

American Airlines Group's narrative projects $61.8 billion revenue and $1.8 billion earnings by 2028. This requires 4.5% yearly revenue growth and about a $1.2 billion earnings increase from $567.0 million today.

Uncover how American Airlines Group's forecasts yield a $15.07 fair value, a 6% upside to its current price.

Exploring Other Perspectives

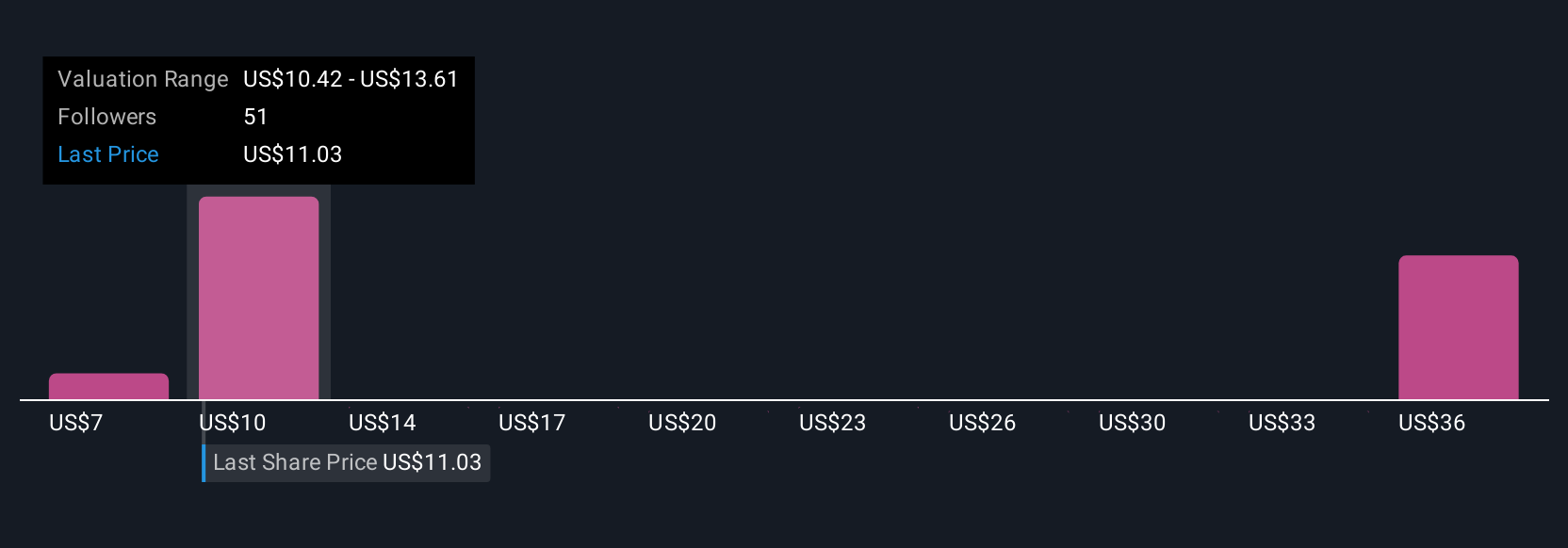

Eleven members of the Simply Wall St Community currently see American Airlines’ fair value between US$9 and about US$23, reflecting very different expectations. Set this against the ongoing risk that elevated labor and financing costs could strain margins and limit how much of any demand improvement reaches the bottom line, and you have good reason to compare several viewpoints before forming your own.

Explore 11 other fair value estimates on American Airlines Group - why the stock might be worth 37% less than the current price!

Build Your Own American Airlines Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Airlines Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Airlines Group's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026