- United States

- /

- Airlines

- /

- NasdaqGS:AAL

Evaluating American Airlines (AAL) Valuation as Sector Optimism Rises After Delta’s Strong Quarter

Reviewed by Kshitija Bhandaru

See our latest analysis for American Airlines Group.

Momentum in American Airlines Group has shifted this week, with a lift in share price as sector optimism returns after Delta’s upbeat results and a fresh codeshare deal with Porter Airlines. Despite the resurgence in sentiment and new partnerships, American’s year-to-date share price return remains deeply negative at -30.94%. This reflects ongoing challenges. Its one-year total shareholder return of -1.10% shows that the longer-term picture, though still pressured, has been somewhat steadier. Investors appear watchful for a real turnaround as the company prepares to report quarterly earnings.

If renewed interest in airlines has you thinking bigger, now might be a good moment to broaden your view and discover fast growing stocks with high insider ownership

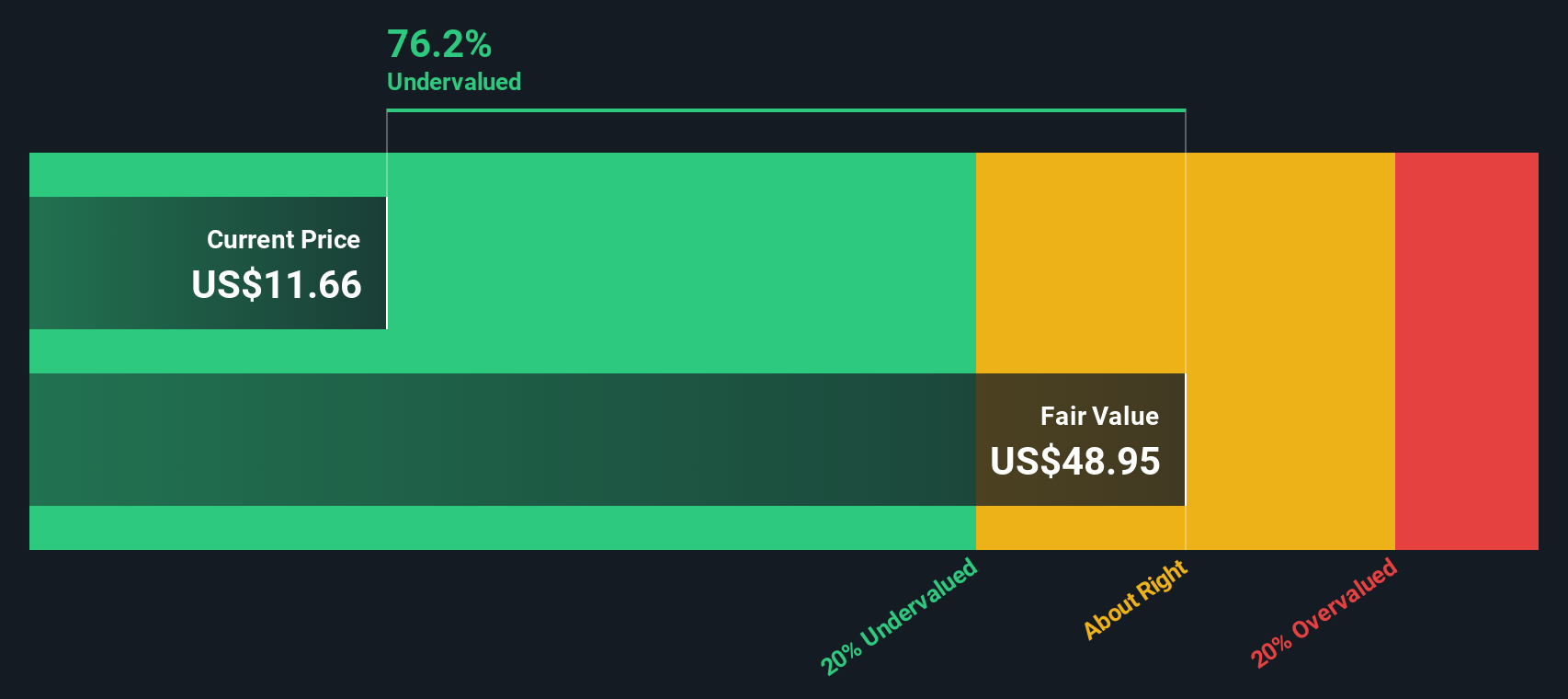

With Delta’s strong earnings and sector-wide optimism pushing American Airlines shares higher, the key question now is whether this rebound reveals a true bargain, or if the market has already factored in expectations for the company’s turnaround.

Most Popular Narrative: 10.7% Overvalued

According to PittTheYounger’s widely followed narrative, American Airlines Group’s fair value stands at $10.61, which is below its most recent close of $11.74. This view positions the stock as trading slightly above what the narrative considers justified, sparking debate about whether recent optimism is outpacing fundamental improvements.

There is a single reason why American is the least attractive of US legacy carriers, at least in terms of investing, and that is its balance sheet. If most airlines, and certainly those in the US, are loaded up to the hilt with debt, American goes so far as to boast negative equity. Any startup would go belly-up with a balance sheet such as this one.

The story behind this valuation is not what you might expect. The narrative’s calculations hinge on a controversial growth outlook and one key business shift that could make all the difference. Want to know why the balance sheet is not the only thing driving this fair value? Uncover the real reasons and see which assumptions turn this projection into a must-read.

Result: Fair Value of $10.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in travel demand or a change in credit conditions could quickly challenge these assumptions and change American Airlines' outlook.

Find out about the key risks to this American Airlines Group narrative.

Another View: Deep Discount According to DCF

While the popular narrative sees American Airlines as overvalued, our DCF model tells a very different story. Using projected cash flows, it estimates the airline's fair value at $46.40, which is far above the current price. Such a sharp gap suggests the market may be overlooking something important. Which approach will prove right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Airlines Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Airlines Group Narrative

If you see things differently or have your own insights to add, building your personal narrative can take just a few minutes. Do it your way

A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize your next opportunity by tapping into fresh strategies most investors overlook. Take the lead and choose your own path to smarter investments today.

- Uncover growth with these 894 undervalued stocks based on cash flows, which the market may have missed, and that could be primed for a potential rebound based on solid cash flows.

- Tap into tomorrow’s breakthroughs by accessing these 25 AI penny stocks and spot innovators at the intersection of artificial intelligence and high-impact industries.

- Boost your portfolio income with these 18 dividend stocks with yields > 3% offering yields above 3 percent, designed for investors focused on steady returns and financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives