- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:GSAT

Could The Globalstar, Inc. (NYSEMKT:GSAT) Ownership Structure Tell Us Something Useful?

A look at the shareholders of Globalstar, Inc. (NYSEMKT:GSAT) can tell us which group is most powerful. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

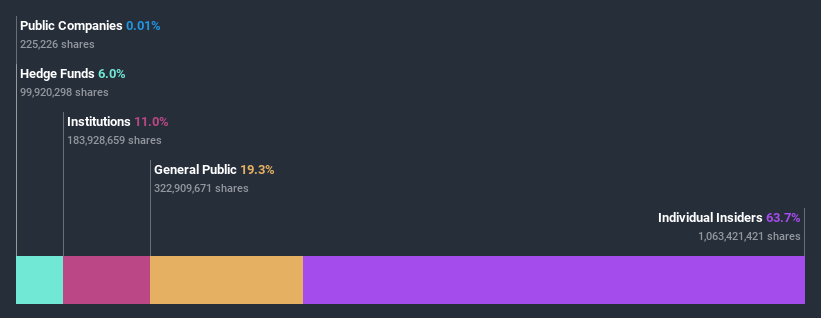

Globalstar is not a large company by global standards. It has a market capitalization of US$541m, which means it wouldn't have the attention of many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutions are noticeable on the share registry. Let's delve deeper into each type of owner, to discover more about Globalstar.

Check out our latest analysis for Globalstar

What Does The Institutional Ownership Tell Us About Globalstar?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

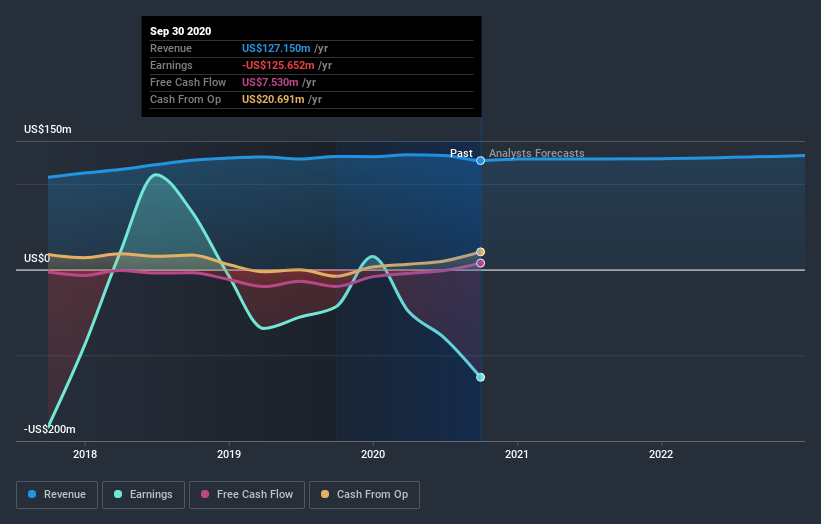

Globalstar already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Globalstar's earnings history below. Of course, the future is what really matters.

It looks like hedge funds own 6.0% of Globalstar shares. That's interesting, because hedge funds can be quite active and activist. Many look for medium term catalysts that will drive the share price higher. Our data suggests that James Monroe, who is also the company's Top Key Executive, holds the most number of shares at 63%. When an insider holds a sizeable amount of a company's stock, investors consider it as a positive sign because it suggests that insiders are willing to have their wealth tied up in the future of the company. With 6.0% and 3.0% of the shares outstanding respectively, Mudrick Capital Management, LP and The Vanguard Group, Inc. are the second and third largest shareholders.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of Globalstar

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems that insiders own more than half the Globalstar, Inc. stock. This gives them a lot of power. So they have a US$344m stake in this US$541m business. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public, with a 19% stake in the company, will not easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Globalstar better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Globalstar (of which 1 is concerning!) you should know about.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Globalstar or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Globalstar, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:GSAT

Globalstar

Provides mobile satellite services in the United States, Canada, Europe, Central and South America, and internationally.

Reasonable growth potential with adequate balance sheet.