Verizon Communications (VZ) Reports US$34 Billion Revenue In Q2 With US$5 Billion Net Income

Reviewed by Simply Wall St

Verizon Communications (VZ) recently reported solid financial growth for the second quarter of 2025 with increased revenues and earnings per share. Despite these strong results, Verizon’s share price moved 1.78% last week amidst a broader market that reached new highs, with indices like the S&P 500 and Nasdaq advancing. This decline might seem counterintuitive given the optimism surrounding its earnings report, but it aligns with market volatility and investor reactions in a week filled with economic events and trade talks. Verizon's continued advancements, like new partnerships within its Frontline program, support its long-term growth prospects.

Verizon's recent financial growth, highlighted by increased revenues and earnings per share, coincides with a 1.78% movement in its share price last week against market highs. This contrast aligns with broader market volatility and investor sentiment driven by economic events. Over the past three years, Verizon's total shareholder return, including share price and dividends, was 11.61%. However, when examined against the US Telecom industry, which returned 19% over the past year, Verizon underperformed, reflecting challenges in capturing the full market momentum.

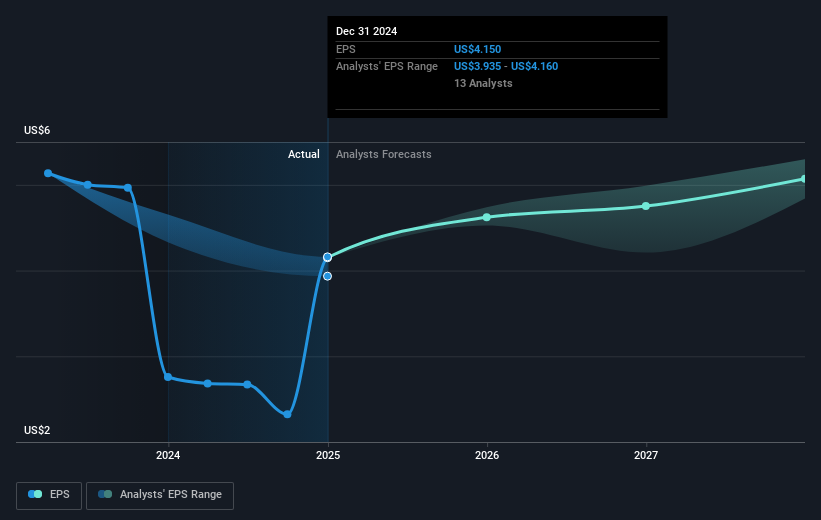

The ongoing focus on network convergence and consumer retention, as outlined in the narrative, suggests potential positive impacts on both revenue and earnings forecasts. Analysts expect Verizon's earnings to grow annually, projecting earnings of US$21.7 billion by 2028 from the current US$17.78 billion. With a current PE ratio of 10.5x, these forecasts, if realized, reinforce the analysts' consensus price target of US$48.07. Presently, the share price of US$40.84 represents a discount of approximately 18.6% to the target, indicating the market might be pricing in perceived risks, such as regulatory challenges and competitive pressures. Nonetheless, the focus on network convergence and new revenue streams could alleviate some of these concerns in the longer term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives