Verizon Communications (NYSE:VZ) Launches GenAI Assistant To Empower Small Businesses

Reviewed by Simply Wall St

Verizon Communications (NYSE:VZ) recently announced the launch of its GenAI Assistant for small businesses, incorporating Generative Artificial Intelligence to enhance customer interactions, which possibly played a part in the company's 7% share price increase over the past quarter. The company's FY 2024 earnings report indicated strong year-on-year growth in revenue and net income, perhaps supporting investor confidence. Additionally, Verizon's initiatives, such as integrating Nokia's 5G solutions and expanding IoT services, could have bolstered market sentiment despite broader market volatility, where indexes like the S&P 500 and Nasdaq Composite experienced declines due to economic concerns. In this period, Verizon maintained its dividend as well, which might appeal to income-focused investors amid market uncertainty. Overall, these developments contrast with the tech sector's struggles, marked by Tesla and Nvidia's stock pressures, highlighting investor interest possibly leaning towards more diversified telecom advancements by Verizon.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

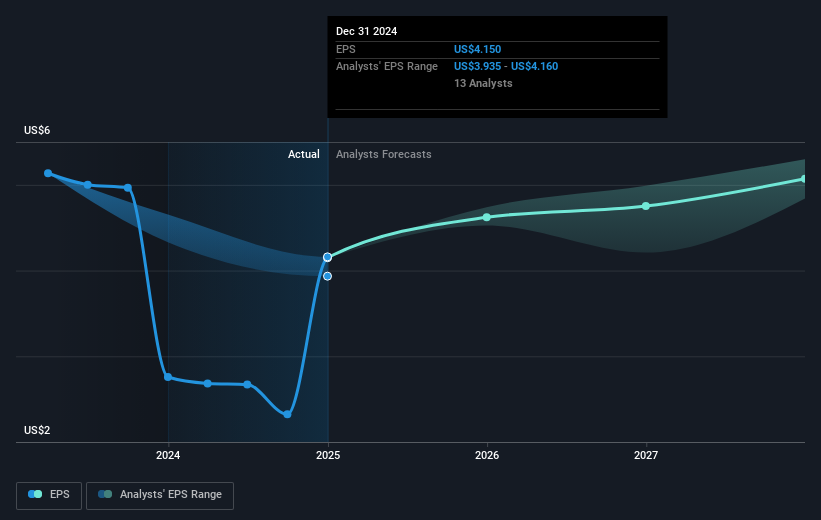

In the last year, Verizon Communications achieved a total shareholder return of 16.70%, including share price and dividends, despite underperforming the US Telecom industry, which saw a 29.5% gain. This performance matched the US Market's 10% return over the same period. Notably, Verizon undertook several key initiatives that may have influenced its long-term returns. The company's earnings growth accelerated significantly, with net profits rising to US$17.51 billion and revenues reaching US$134.79 billion in recent reporting. Verizon's efforts to maintain a reliable dividend yield of 6.21%, despite broader telecom sector challenges, could attract income-focused investors.

In terms of technological advancements, Verizon collaborated with Lockheed Martin and Nokia to integrate military-grade 5G solutions, strengthening its position in specialized markets. Furthermore, its partnerships with Singtel and Skylo to boost global IoT offerings and expanded cybersecurity protections through Allot indicate a focus on comprehensive service enhancements. Such moves may have helped offset the impact of a class action lawsuit filed in January 2025 regarding alleged patent infringements. These factors, combined with its relatively attractive valuation compared to industry peers, likely contributed to Verizon's overall performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Verizon Communications, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.