Verizon Communications (NYSE:VZ) Introduces Galaxy S25 Edge, Partners With Buffalo Bills Stadium

Reviewed by Simply Wall St

Verizon Communications (NYSE:VZ) recently introduced the Samsung Galaxy S25 Edge and partnered with the Buffalo Bills for exclusive 5G connectivity at Highmark Stadium. These initiatives align with Verizon's commitment to enhancing customer experience and expanding technological capabilities. The company's stock saw a 5% increase over the last quarter, a movement that aligns with the overall market's upward trend of 4% over the past 7 days and 12% over the last year. While these product launches and strategic partnerships provided positive news, the stock's movement largely mirrors the broader market shifts during the period.

Find companies with promising cash flow potential yet trading below their fair value.

Verizon Communications' recent introduction of the Samsung Galaxy S25 Edge and their partnership with the Buffalo Bills for exclusive 5G connectivity could enhance consumer engagement in the short term. These developments align with Verizon's focus on network convergence and may aid in subscriber growth and lower churn rates. Such initiatives are expected to improve customer loyalty, thereby potentially boosting long-term revenue. In terms of market performance, over the last year, the company's total return, including share price and dividends, was 12.43%, illustrating its returns over a longer timeframe. However, this still underperformed the broader US Market, which recorded a return of 11.6% over the same period. Similarly, the US Telecom industry saw a return of 27.4%, highlighting a performance gap when compared to peers.

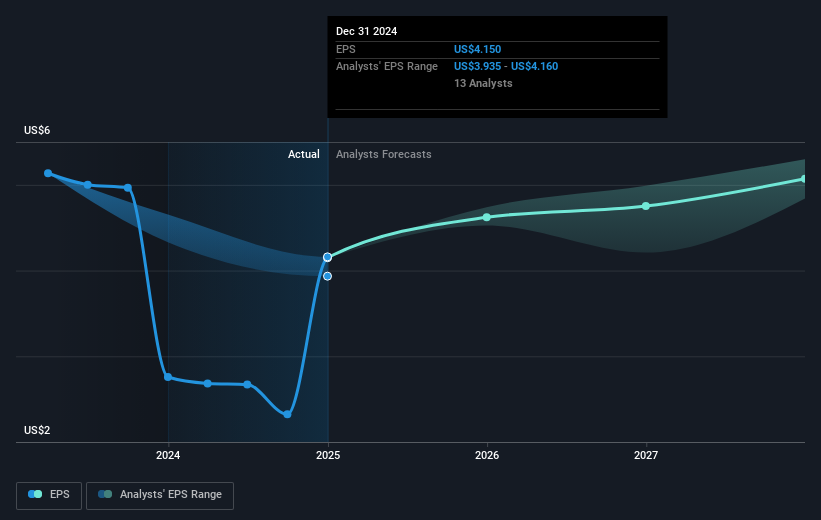

The substantial market activity, including strategic partnerships and product launches, is likely to influence revenue and earnings forecasts positively. Analysts forecast Verizon's revenue to grow at a modest 1.7% annually over the next three years, with earnings projected to rise from US$17.78 billion to US$21.7 billion by 2028. Despite these growth expectations, competition and regulatory challenges could impact these forecasts. Verizon's current share price of US$44.15 stands below the consensus analyst price target of US$48.07, indicating a valuation that could be based on growth and performance assumptions. As the company continues to pursue technological integration and customer retention strategies, these will play a critical role in aligning its financial performance with the analyst outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives