Verizon Communications (NYSE:VZ) Enhances Cybersecurity With Allot and Achieves Breakthrough In Satellite Connectivity

Reviewed by Simply Wall St

In the past month, Verizon Communications (NYSE:VZ) experienced a share price increase of 10%, a notable movement against a backdrop of broader market downtrends, such as the S&P 500 and Nasdaq's declines over several consecutive days. Key events likely influencing Verizon's performance include their partnership with Allot Ltd. to bolster Verizon Business's cybersecurity capabilities and the successful trial of satellite communications with AST SpaceMobile. The U.S. Coast Guard contract, an 8-year task order worth up to $66 million for Wi-Fi and data services, provided a further positive catalyst. Meanwhile, market uncertainty and a slump in technology stocks didn’t hinder Verizon's gain, highlighting its resilience. Additionally, the company's strategic initiatives, including the launch of the iPhone 16e, might have enhanced investor sentiment despite general technology market relief, reflecting their varied approach to maintaining growth steadiness amidst fluctuating indexes.

Click here and access our complete analysis report to understand the dynamics of Verizon Communications.

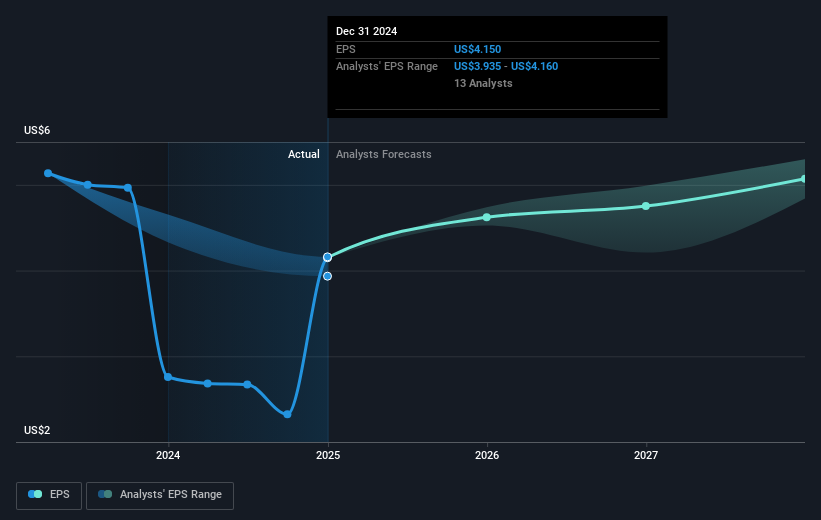

Over the past year, Verizon Communications generated a total shareholder return of 16.51%, incorporating both share price appreciation and dividends. Despite this positive return, Verizon underperformed the broader US market and the Telecom industry, returning 17.8% and 30.4%, respectively. The year was marked by substantial earnings growth; Verizon's profits surged over 50%, with significant improvements in net income reflected in the Q4 2024 earnings report where revenue increased to US$35.68 billion, and net income rose sharply from a loss in the previous year. Additionally, Verizon's robust dividend payouts remained attractive to income-focused investors.

Product innovations, such as the iPhone 16e launch, coupled with advancements like Enhanced Video Calling, further contributed to the company's market performance. The collaboration with notable partners, including Honeywell for enhancing technology solutions, underscored Verizon's focus on expanding service offerings. Throughout the year, despite a high level of debt, the company implemented measures like debt redemption and didn't engage in new stock buybacks, indicating a concentration on financial solidity and maintaining shareholder value. Legal challenges such as the class action lawsuit posed hurdles but did not substantially affect shareholder returns this past year.

- Analyze Verizon Communications' fair value against its market price in our detailed valuation report—access it here.

- Analyze the downside risks for Verizon Communications and understand their potential impact—click to learn more.

- Already own Verizon Communications? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives