Former PayPal CEO Dan Schulman to Lead Verizon Communications: Might Change The Case For Investing In VZ

Reviewed by Sasha Jovanovic

- Verizon Communications announced in the past week that Dan Schulman, former CEO of PayPal and longstanding Verizon board member, has been appointed as its new Chief Executive Officer, effective October 6, 2025. Schulman's appointment comes as outgoing CEO Hans Vestberg transitions to a special advisor role supporting the integration of Frontier Communications and will remain on the board until Verizon's 2026 annual meeting.

- Schulman's extensive experience leading digital transformation and operational change at global technology and financial companies is expected to bring a different leadership lens to Verizon as it faces a shifting telecom landscape.

- We'll examine how this high-profile leadership transition, and the uncertainty it brings, could reshape the company's investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Verizon Communications Investment Narrative Recap

To be a Verizon shareholder today, you need confidence in the company’s ability to capitalize on expanding fixed wireless and fiber broadband demand, while managing challenges around subscriber churn and heavy capital spending as the US wireless market matures. The appointment of Dan Schulman as CEO brings new leadership that may influence Verizon’s near-term execution on the critical Frontier integration, but the announcement does not materially change the immediate importance of maintaining subscriber retention or the risk from elevated competitive pressure.

Among recent announcements, Verizon’s declaration of a quarterly dividend increase, rising to 69 cents per share, underscores the board’s commitment to shareholder returns amid executive changes. This action is especially meaningful given investors’ focus on stable income and free cash flow management during transitional periods, and could help bolster confidence alongside operational catalysts like broadband expansion.

By contrast, investors should be aware of how prolonged competition-driven churn could affect Verizon’s ability to grow earnings if price wars persist and...

Read the full narrative on Verizon Communications (it's free!)

Verizon Communications is projected to reach $144.5 billion in revenue and $22.1 billion in earnings by 2028. This outlook assumes 1.8% annual revenue growth and a $3.9 billion increase in earnings from $18.2 billion currently.

Uncover how Verizon Communications' forecasts yield a $48.61 fair value, a 17% upside to its current price.

Exploring Other Perspectives

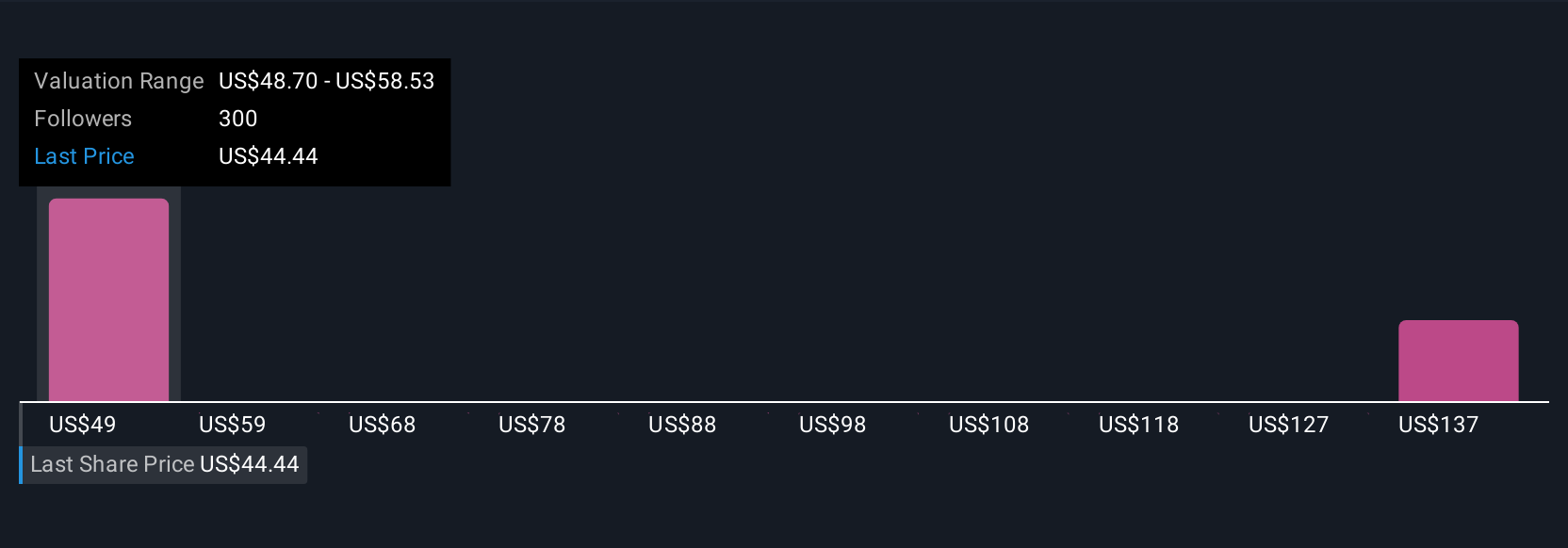

Fair value estimates from 18 Simply Wall St Community members range widely from US$42.83 to US$134.87 per share. With this breadth of views, keep the risk of sustained subscriber churn in mind as it could significantly affect future returns.

Explore 18 other fair value estimates on Verizon Communications - why the stock might be worth over 3x more than the current price!

Build Your Own Verizon Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verizon Communications research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verizon Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verizon Communications' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives