Does Verizon’s 2025 Valuation Reflect Its Strong Cash Flow and Earnings Potential?

Reviewed by Bailey Pemberton

How Has Verizon's Share Price Been Performing?

Verizon Communications has delivered a mixed performance for shareholders, with short term stability contrasting against more volatile longer term results. Looking at different time frames helps put the current share price in better context.

- Over the past week, Verizon's share price has been flat, with a 0.0% move.

- Over the last 30 days, the stock is up 2.2%, hinting at a modest improvement in sentiment compared to very recent trading.

- On a year to date basis, Verizon has gained 1.0%, which is not dramatic but does suggest the market has slightly warmed to the stock versus the start of the year.

- The longer term picture is more nuanced, with a 1 year return of -1.0%, a strong 3 year gain of 34.7%, and a 5 year decline of 10.8%. Investors may want to keep these figures in mind as they consider whether the current valuation leaves room for attractive future returns.

In the next sections, we will move from these share price moves to a deeper dive into Verizon's valuation, comparing different methods to see what they imply about potential upside or downside from here.

Find out why Verizon Communications's -1.0% return over the last year is lagging behind its peers.

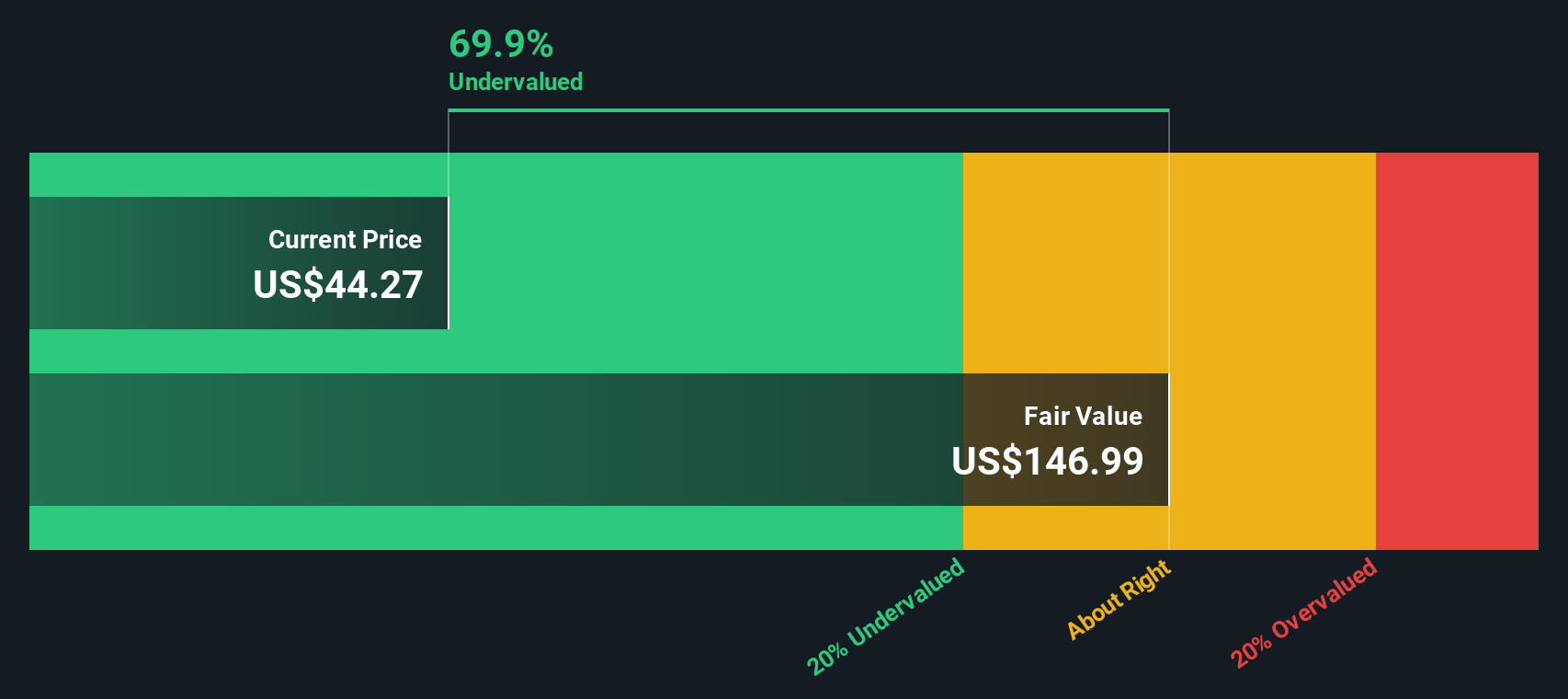

Approach 1: Verizon Communications Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present. For Verizon Communications, the model uses a 2 stage Free Cash Flow to Equity approach based on cash flow projections in $.

Verizon generated trailing twelve month free cash flow of about $17.0 billion, and analysts expect this to grow steadily, reaching around $23.4 billion by 2029. Beyond the explicit analyst horizon, Simply Wall St extrapolates further growth, with projected free cash flow rising to roughly $28.1 billion by 2035, then discounts each of these yearly figures back to today to reflect risk and the time value of money.

Putting all of those discounted cash flows together yields an estimated intrinsic value of $109.20 per share. Compared with the current market price, this implies Verizon is trading at a 62.8% discount to its DCF value. This suggests a significant margin of safety for long term investors who are comfortable relying on this cash flow outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Verizon Communications is undervalued by 62.8%. Track this in your watchlist or portfolio, or discover 935 more undervalued stocks based on cash flows.

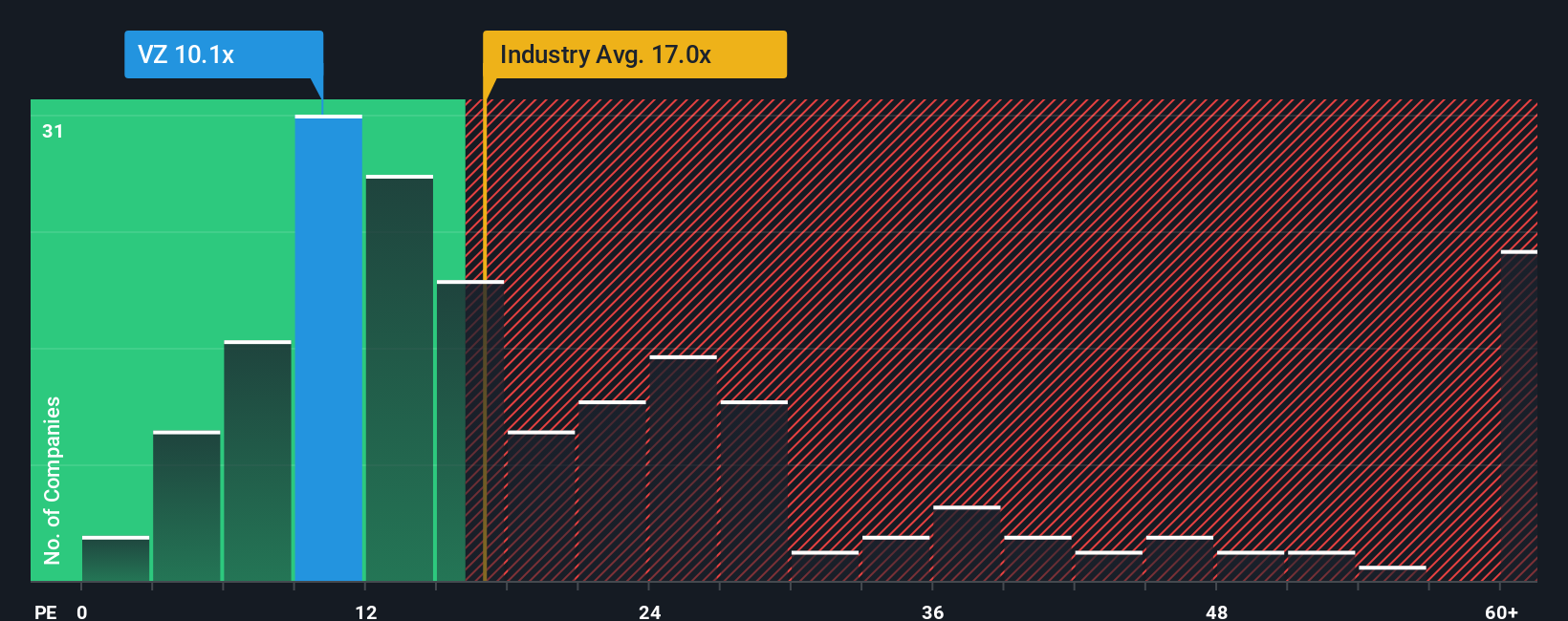

Approach 2: Verizon Communications Price vs Earnings

For a mature, consistently profitable business like Verizon, the price to earnings, or PE, ratio is a useful way to gauge whether investors are paying a reasonable price for each dollar of profit. In general, companies with stronger growth prospects and lower perceived risk tend to justify a higher PE, while slower growth or higher risk usually calls for a lower, more conservative multiple.

Verizon currently trades at around 8.63x earnings, which is slightly above the peer average of about 8.50x, but well below the broader Telecom industry average of roughly 16.16x. To go beyond these broad comparisons, Simply Wall St calculates a Fair Ratio for Verizon of 13.88x. This reflects what investors might reasonably pay given its earnings growth outlook, margins, industry positioning, size and risk profile. This proprietary Fair Ratio is more tailored than a simple peer or industry check because it explicitly considers company specific drivers rather than assuming one size fits all.

Comparing the current 8.63x PE to the Fair Ratio of 13.88x suggests the market is pricing Verizon at a meaningful discount to what its fundamentals would justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

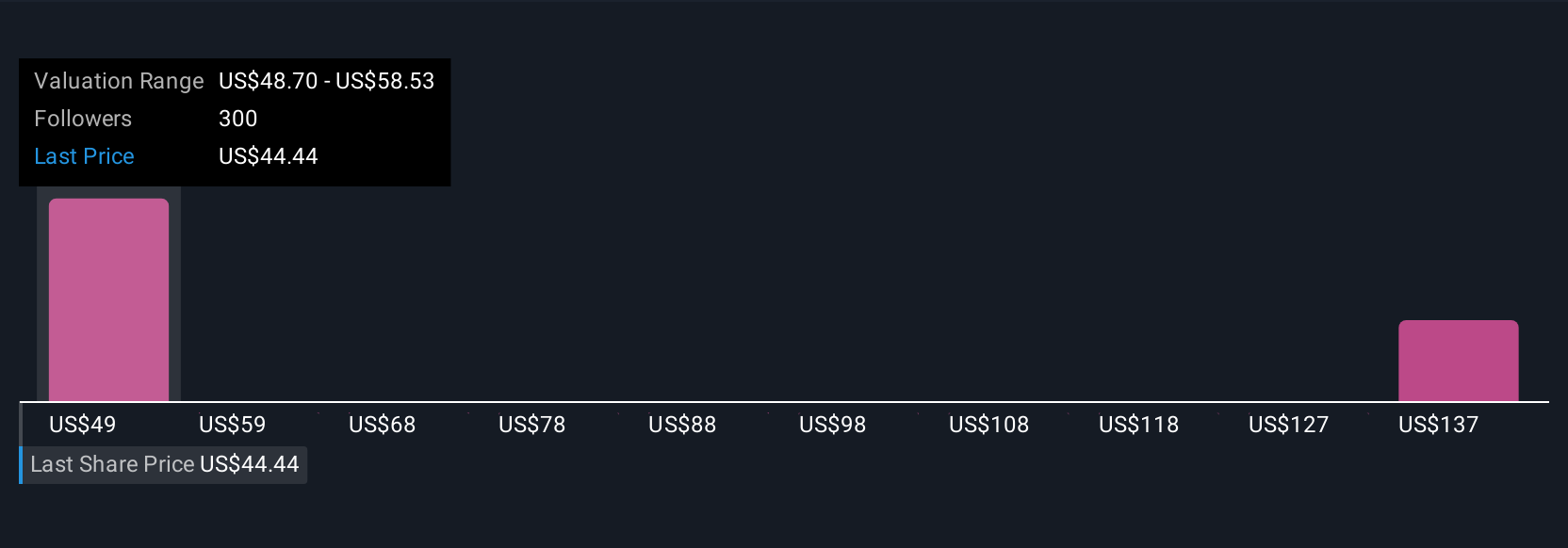

Upgrade Your Decision Making: Choose your Verizon Communications Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple stories that investors create on Simply Wall St’s Community page to explain their view of a company and link that story to a concrete forecast for revenue, earnings, margins and ultimately a fair value estimate that can be compared with the current share price to decide whether to buy, hold or sell, and that automatically updates when new information like news or earnings is released. For Verizon, one investor might build a bullish Narrative around 5G, broadband expansion and cost reductions to justify a fair value closer to the most optimistic price target of about $58, while another might focus on competition, high debt and a saturated wireless market to support a more cautious fair value near the low end around $42.

Do you think there's more to the story for Verizon Communications? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026