- United States

- /

- Wireless Telecom

- /

- NYSE:TDS

Should You Buy Telephone and Data Systems, Inc. (NYSE:TDS) For Its Upcoming Dividend?

It looks like Telephone and Data Systems, Inc. (NYSE:TDS) is about to go ex-dividend in the next 3 days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. In other words, investors can purchase Telephone and Data Systems' shares before the 14th of June in order to be eligible for the dividend, which will be paid on the 30th of June.

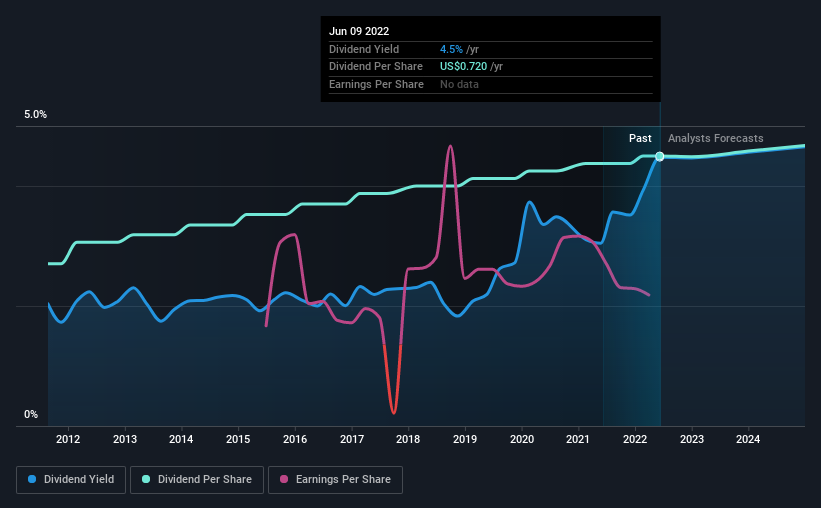

The company's next dividend payment will be US$0.18 per share. Last year, in total, the company distributed US$0.72 to shareholders. Based on the last year's worth of payments, Telephone and Data Systems stock has a trailing yield of around 4.5% on the current share price of $16.07. If you buy this business for its dividend, you should have an idea of whether Telephone and Data Systems's dividend is reliable and sustainable. As a result, readers should always check whether Telephone and Data Systems has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Telephone and Data Systems

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Its dividend payout ratio is 78% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. We'd be worried about the risk of a drop in earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Luckily it paid out just 17% of its free cash flow last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. For this reason, we're glad to see Telephone and Data Systems's earnings per share have risen 18% per annum over the last five years. The company paid out most of its earnings as dividends over the last year, even though business is booming and earnings per share are growing rapidly. Higher earnings generally bode well for growing dividends, although with seemingly strong growth prospects we'd wonder why management are not reinvesting more in the business.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Telephone and Data Systems has delivered an average of 5.2% per year annual increase in its dividend, based on the past 10 years of dividend payments. Earnings per share have been growing much quicker than dividends, potentially because Telephone and Data Systems is keeping back more of its profits to grow the business.

To Sum It Up

Is Telephone and Data Systems an attractive dividend stock, or better left on the shelf? We like Telephone and Data Systems's growing earnings per share and the fact that - while its payout ratio is around average - it paid out a lower percentage of its cash flow. Telephone and Data Systems looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

On that note, you'll want to research what risks Telephone and Data Systems is facing. For example, Telephone and Data Systems has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Telephone and Data Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TDS

Telephone and Data Systems

A telecommunications company, provides communications services to consumer, business, and government in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026