- United States

- /

- Wireless Telecom

- /

- NYSE:TDS

A Fresh Look at TDS (NYSE:TDS) Valuation After Modest Share Price Movement

Reviewed by Kshitija Bhandaru

Telephone and Data Systems (TDS) shares have seen modest movement lately, up just over 2% over the past month. Investors are curious about what is driving the stock’s recent performance, especially as the broader telecom sector faces ongoing competition and shifting consumer habits.

See our latest analysis for Telephone and Data Systems.

Over the past year, Telephone and Data Systems has delivered a total shareholder return of 72.6% and a robust 204% over three years. This is a clear sign that long-term momentum is still strong, even as the recent share price has seen only modest movement. That kind of performance suggests investors are gaining confidence in the company's future prospects, even as the telecom sector as a whole navigates shifting industry dynamics.

If you’re interested in broadening your search beyond telecom, now may be the perfect time to discover fast growing stocks with high insider ownership.

With long-term returns this strong, investors are now debating whether TDS is trading at a bargain or if the market has already priced in much of the company’s anticipated growth. Could this be a true buying opportunity?

Most Popular Narrative: 24.3% Undervalued

With the most widely followed narrative suggesting a fair value of $52 and shares last closing at $39.38, the narrative implies meaningful upside for investors eyeing potential value. What’s behind this bullish outlook, and how do internal catalysts and industry shifts feed into the current sentiment?

Large-scale, ongoing, and government-backed programs to expand rural broadband (such as E-ACAM and RDOF) are enabling TDS to rapidly increase fiber passings in underserved areas. This translates into a larger addressable base, high penetration rates in uncompetitive markets, and growing recurring service revenues.

Want to know what’s fueling this projected upside? The heart of the story is an aggressive push into fiber, a radical shift in profit expectations, and a valuation that hinges on bold revenue and margin targets. Dive in to learn which key assumptions underpin this optimistic price target.

Result: Fair Value of $52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in legacy business revenues and fierce broadband competition could undercut TDS’s momentum and challenge the bullish view on its future growth.

Find out about the key risks to this Telephone and Data Systems narrative.

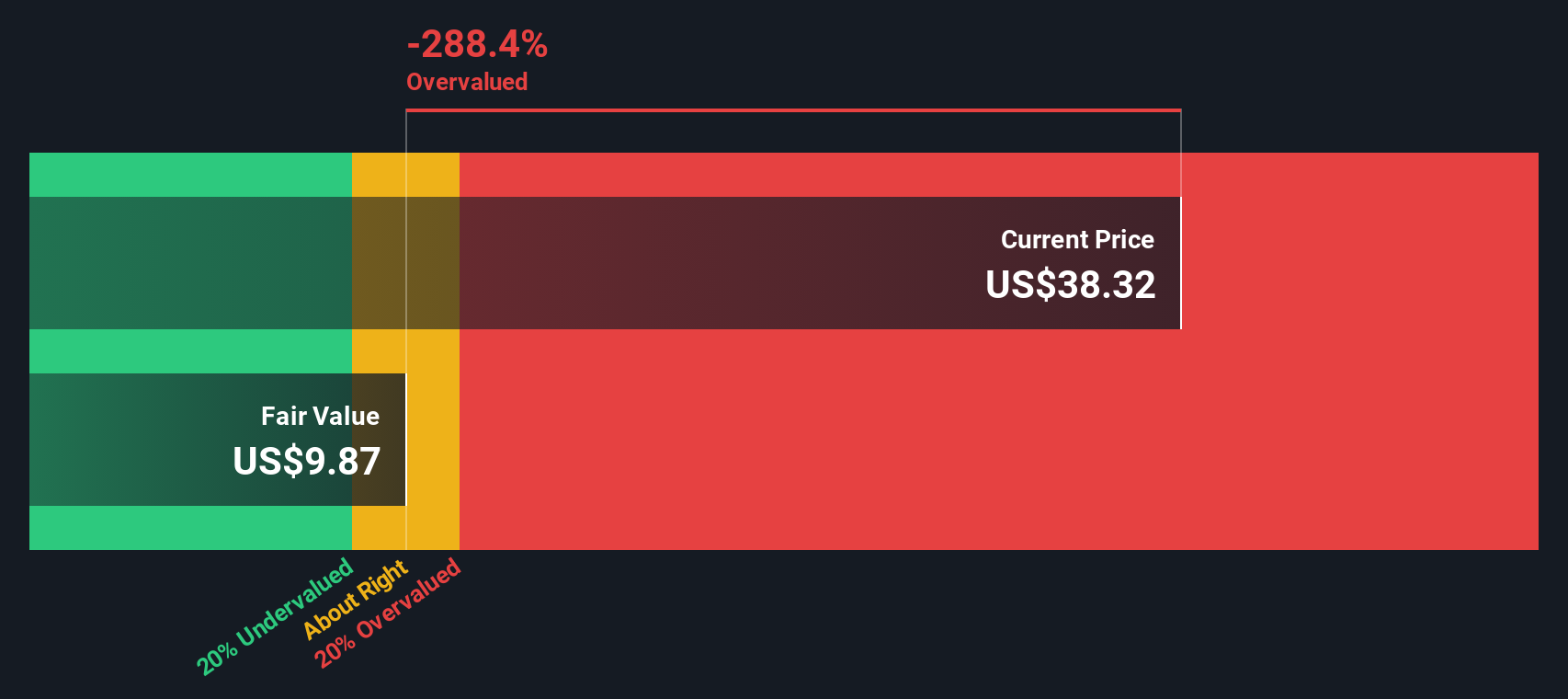

Another Perspective: SWS DCF Model Tells a Different Story

While the most-followed narrative suggests TDS is undervalued, the SWS DCF model arrives at a sharply different conclusion. According to our DCF analysis, TDS trades well above its estimated fair value. This casts doubt on the size of the potential upside. Could this mean risks are higher than they appear?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Telephone and Data Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Telephone and Data Systems Narrative

If you have a different perspective or want to dig into the numbers your own way, you can easily craft a personal view based on your own research in just a few minutes. Do it your way.

A great starting point for your Telephone and Data Systems research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors broaden their horizons with fresh strategies. Get ahead of the crowd and seize your next winning opportunity before everyone else catches on.

- Uncover income potential and steady cash flow by checking out these 19 dividend stocks with yields > 3% with yields greater than 3%.

- Access early-stage innovation and growth by reviewing these 3572 penny stocks with strong financials that feature strong financials and room to soar.

- Ride the waves of digital disruption and see which leaders emerge among these 78 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telephone and Data Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDS

Telephone and Data Systems

A telecommunications company, provides communications services to consumer, business, and government in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.