Is AT&T’s Share Slide a Temporary Blip or a Fresh Opportunity for 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your AT&T shares? You’re not alone. The stock has been on quite a ride, rising 24.3% over the past year and a striking 103.3% in the last three years. Of course, there have been some short-term bumps, with a 7.8% slide in the last week and a 12.6% dip over the past month. But if you zoom out, the longer-term momentum is hard to ignore. Even after the recent pullback, AT&T remains up 13.3% year-to-date. These swings reflect shifting market sentiment, new opportunities in telecom, and changing perceptions of risk, all widely covered in headlines across the sector.

Where does that leave investors eyeing today’s $25.87 closing price? The real story could lie not just in the chart, but in the valuation itself. AT&T scores a solid 5 out of 6 on our value checklist, suggesting there may be more room to run, especially if market nervousness dies down. So how do these valuation checks stack up, and what can they tell us about whether AT&T is an opportunity or a value trap? We’ll break down the key methods next, and reveal an even sharper way to think about stock value at the end of this article.

Approach 1: AT&T Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This process helps investors understand what AT&T’s future cash generation is actually worth at present.

AT&T’s current Free Cash Flow stands at $21.57 Billion, and analysts expect this figure to remain robust, with projected Free Cash Flow reaching $23.33 Billion by 2035. While direct analyst estimates usually cover only five years, further projections, such as for 2029’s $19.69 Billion, are extrapolated by Simply Wall St to provide a longer runway for valuation.

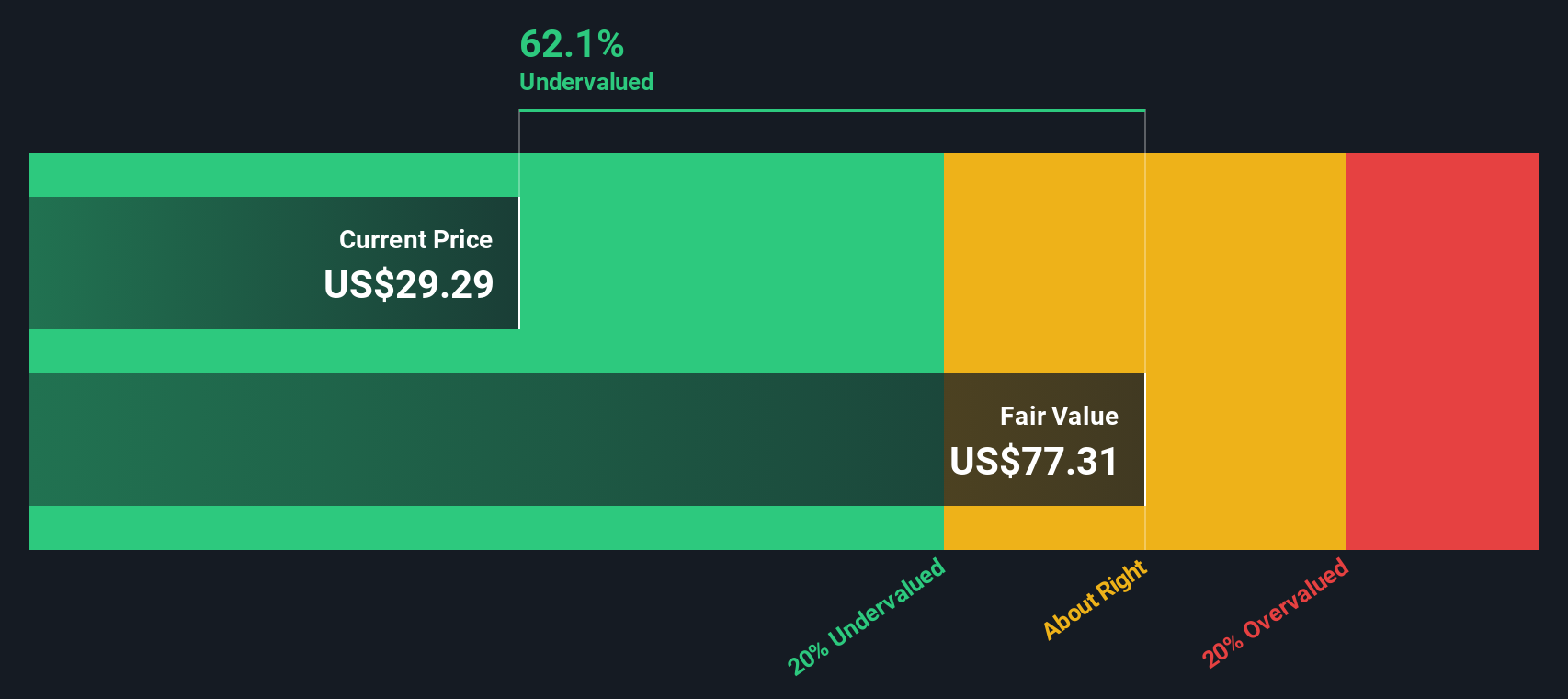

Running these numbers through the DCF approach suggests AT&T’s fair value is $67.35 per share. Compared to the current price of $25.87, this implies the stock trades at a 61.6% discount. In other words, the shares appear significantly undervalued based on expected future cash flows.

With such a steep discount, the DCF analysis points to a notable potential upside, at least on paper, especially for investors who believe in the staying power of AT&T’s cash generation in the years ahead.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AT&T is undervalued by 61.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: AT&T Price vs Earnings

For companies with consistent profits like AT&T, the Price-to-Earnings (PE) ratio is a classic and reliable way to gauge valuation. The PE shows how much investors are paying today for each dollar of the company’s current earnings. This makes the ratio especially useful when those earnings are steady and predictable.

What counts as a “fair” PE ratio depends on a mix of factors. Fast-growing companies or those with less risk typically command higher PEs, while slow growers or riskier businesses will usually trade at lower multiples. Broader market and industry trends also play a big role in setting expectations.

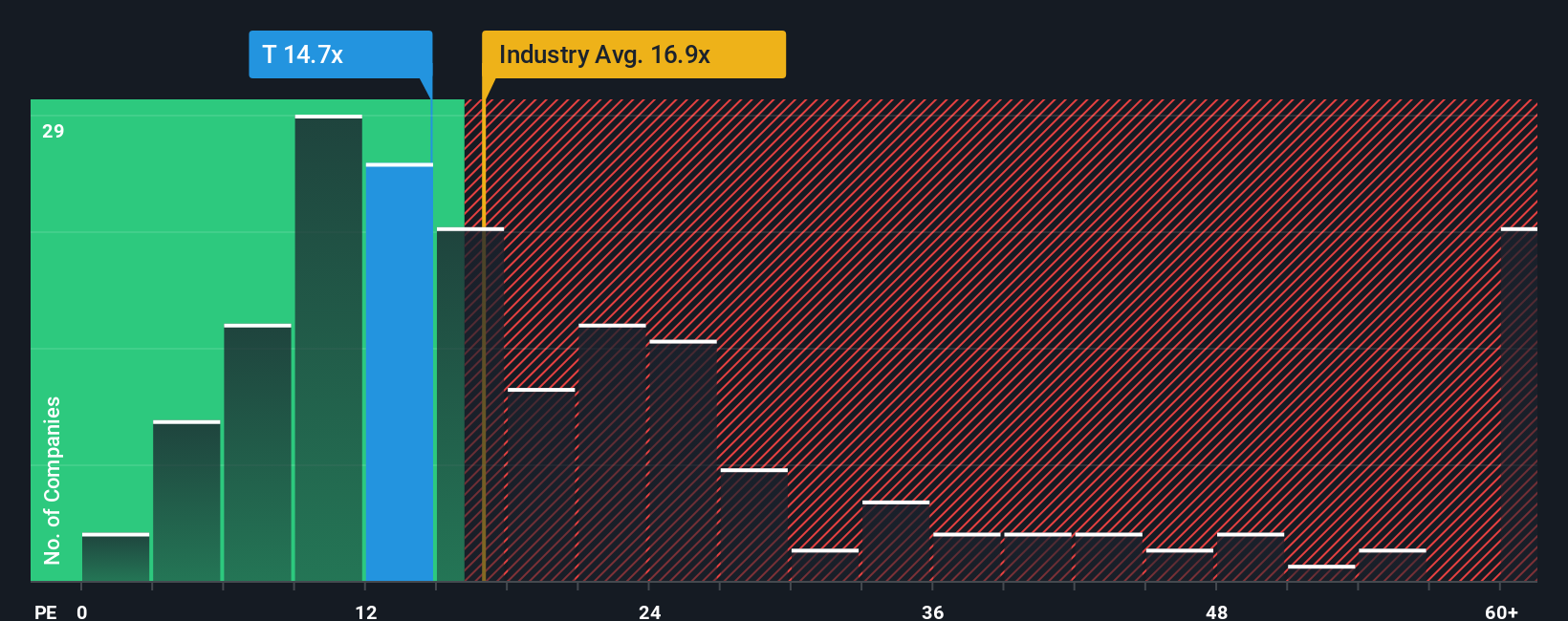

AT&T currently trades on a PE ratio of 14.6x. That sits comfortably below the Telecom industry average of 17.0x and well beneath the peer group average of 23.3x. By traditional benchmarks, the stock is clearly on the cheaper side. However, these comparisons do not tell the whole story.

Simply Wall St’s proprietary “Fair Ratio” dives deeper by weighing AT&T’s earnings growth, profit margins, market cap, risk profile and more to calculate a tailored multiple. This approach produces a Fair Ratio of 16.0x for AT&T, which provides a more precise target than broad industry averages or even peer group figures that may not reflect the company’s unique qualities.

With AT&T’s actual PE less than 0.1 different from its Fair Ratio, the stock appears to be priced about right based on its earnings profile and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AT&T Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story or perspective about a company like AT&T, combining your assumptions about its prospects, its likely future revenue, profit margins, and risks, to arrive at your own sense of fair value beyond just the numbers. Narratives connect these beliefs directly to a financial forecast and a suggested value for the stock, helping you clarify why you think a stock is a buy, hold, or sell at its current price.

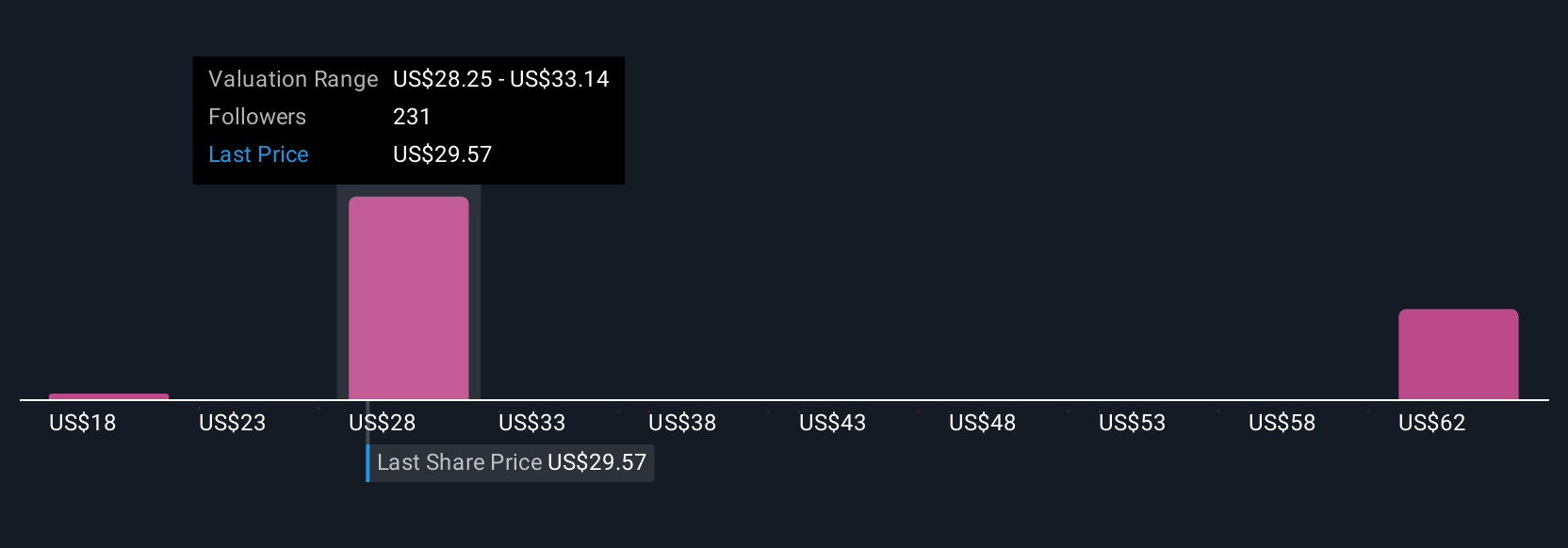

This approach is easy to use and available to everyone on Simply Wall St's platform within the Community page, where millions of investors create, compare, and update Narratives in real time. As news or earnings are released, each Narrative is updated dynamically, meaning your investment view can always be based on the latest information. Narratives are especially helpful for comparing your Fair Value estimate to AT&T’s current share price, making buy or sell decisions smarter and more transparent. For example, some investors see AT&T's fair value as high as $32.00 while others take a more cautious stance with targets as low as $15.49, showing just how much outlooks can differ based on each person's Narrative.

Do you think there's more to the story for AT&T? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:T

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives