Debt & the Telecom Giants: Why Spreading the Risk May be Important in an Economic Decline

Reviewed by Michael Paige

Summary:

- VZ seems to be the most fundamentally stable of the peers, but it's hard to tell if the stock is undervalued.

- Investors hoping for a T recovery must keep an eye on the debt level, which seems to be heavily impacting the market value.

- TMUS investors may experience the largest earnings growth, but much of it is already priced in the stock and returns on capital need to see improvement.

AT&T Inc. ( NYSE:T ), T-Mobile US ( NASDAQ:TMUS ), and Verizon ( NYSE:VZ ) are the three key telecom operators in the US. The stocks had lackluster performance, with TMUS delivering 6.8% in the last 12 months, T experiencing a deep drop of 38.4% and VZ losing some 23.3%. In this article we will discuss the effects of debt, 5G and consumer spending on the valuations of these stocks as well as see how their fundamentals compare.

Keep in-mind that dividends are a key reason for the appeal of some of these stocks, and investors can find an analysis of the dividend quality in each of the individual stock reports.

Overview of the Telecom Industry

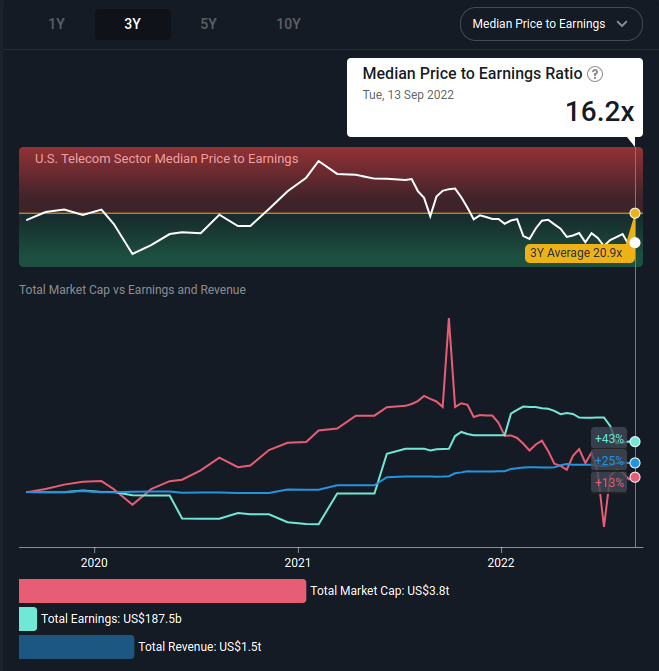

Starting from the top-down, the telecom industry has a median PE of 16.2x, well below the historical median of 20.9x, indicating that some stocks may be undervalued. The chart below shows the change in market sentiment for this sector:

Looking at the forward estimates, we find that analysts are most optimistic on the Wireless Telecom industry , expecting annual earnings growth of 38% over the next 5 years - T-Mobile US is part of this industry. In contrast, the Integrated Telecom Services industry is estimated to see its earnings grow by 3.5% per year over the next few years, which includes AT&T and Verizon.

Comparing the Fundamentals

Analysts seem to be relatively neutral on revenues and estimate a slow growth for Verizon and T-Mobile US, while AT&T is expected to drop to $125b in 2023 and then stabilize after the spinoff.

The table below outlines key metrics for the three telecom stocks. In billions USD, unless specified:

| Ticker | T | TMUS | VZ |

| Market Cap | $119.9 | $172.7 | $175.3 |

| + Debt | $138.5 | $70.9 | $151.2 |

| - Cash | $4.1 | $3.2 | $1.9 |

| Enterprise Value | $254.3 | $240.4 | $324.6 |

| Revenue TTM | $156.6 | $80.2 | $134.3 |

| Revenue est. for 2024 | $122.4 | $83.5 | $138.6 |

| EV to Sales | 1.6 | 3 | 2.4 |

| Debt to Market Cap | 115% | 41% | 86.3% |

The average EV to Sales for Telecom stocks is 2.8x, which means that only AT&T is a significant outlier, however, if we price in the expected revenues after the spinoff (2024 estimates), we get an EV to Sales figure of 2, indicating that the stock is closer to the average than it may seem at first glance.

We can see that debt is a large portion of the risk in telecom stocks. This is exacerbated by the rising interest rates that can make debt refinancing more expensive and erode the bottom line for investors. It is therefore no surprise that the value of the equity of these stocks has been declining. This may continue to deteriorate if inflation doesn't stabilize, as interest rates are sensitive to rising prices.

5G May Have Been Rushed

Telecom stocks tend to have stable revenues and profits, so the key problem they need to manage are expenses such as CapEx and interest on debt. These companies have committed to expand their 5G infrastructure in a bid to improve the quality of their service. However, investors need to ask, "What is the marginal benefit from adopting 5G?" Companies may quickly find that they are having trouble increasing the package pricing of the additional service, which can result with a lower return on capital from their 5G spending.

The case for implementing 5G is certainly clear - if they don't, then competitors will utilize it and acquire more users for the same pricing. However, the case for rushing with 5G infrastructure is not as apparent. The initial wave of deployment was expensive and best practices have not been developed yet to ensure a cost-effective approach. This may lead to overspending cash that belongs to investors.

Returns on capital employed relates to this and are an important metric to follow. If ROCE is at or below the cost of capital, then the companies are not effective in their decision-making. For our three telecom companies, we note the following ROCE:

- AT&T : 8.7%, up from 6% three years ago.

- T-Mobile US : 5.7%, down from 8.3% three years ago.

- Verizon : 8.3%, down from 12.8% three years ago.

Management may argue that these projects have yet to pay off, and that investors should be patient with the investments. This may well be true, but it is always good to know the current baseline for individual companies.

From the list above, we can see that AT&T and Verizon have the highest ROCE values, which are likely above their cost of capital. T-Mobile US noted a decline to 5.7%, which may still be around their cost of capital, as telecom stocks tend to be less risky and have an average cost of capital around 6%.

It seems that Verizon and AT&T are currently managing their businesses for stability, while T-Mobile US may have overextended on growth projects.

Debt is Pressuring the Valuations

Telecom companies are notorious for funding their projects with debt financing. This is great in a low interest rate environment. However, things become complicated when long term rates move to 3+%. The table comparison shows that these companies are heavily relying on debt financing, with AT&T being 115% levered up against its market cap, while T-Mobile has a much more manageable 41% ratio.

It is clear that deleveraging is a high priority for AT&T, otherwise the equity of the company may continue to suffer. AT&T reduced $72.8b of total debt since last quarter, but the remaining balance will take some time to stabilize, especially as higher interest payments leave a smaller room for the company to pay down its debt. Verizon is somewhere in the middle, and we can expect inflation news to have a lesser impact on the stock.

There are many indicators available to analyze when assessing the risk of debt. In our case, we went with "Debt to Market Value of Equity", as it is an up-to-date and actual measure of the value of equity of a company. Tradition and inertia sometimes prompt investors to use debt to (book value of) equity, however companies cannot sell assets or issue shares at their book value, and therefore are not helpful for investors.

Negative Consumer Sentiment Is Also In Play

It is also important to be mindful that we are in an economic downtrend, where changes in consumer spending can influence revenues of these companies. In times like these, we can expect consumers to retain core services, but cut down on discretionary spending and add-on services. The current (July) personal savings rate of 5% may delay this effect, but investors should be aware that consumers have less cash to spend and may be incentivized to reallocate their spending.

Conclusion: Bundling Up May Help

Verizon seems to be the most stable stock amongst its largest peers, while AT&T seems to be the most cheaply priced.

Investors that are considering AT&T are wagering that management can revitalize the company and bring it to financial stability - something that doesn't necessarily have a good track record. On the other hand, should management steer the company in the right direction, AT&T shareholders stand to gain the most based on the company's current bargain prices.

T-Mobile US is well managed, but may currently be expensive for shareholders and has to justify their growth projects with increased profits.

Investors in telecom stocks are betting on the future bottom line for these stocks, which may not hold up as well as anticipated. This is partly the reason why some of them seem to be so cheap at the moment. An alternative way to mitigate some of the risks is to look at all these companies as a bundle, rather than placing high hopes on individual picks.

Investors that want more telecom alternatives can also view our list of largest telecom stocks .

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:T

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion