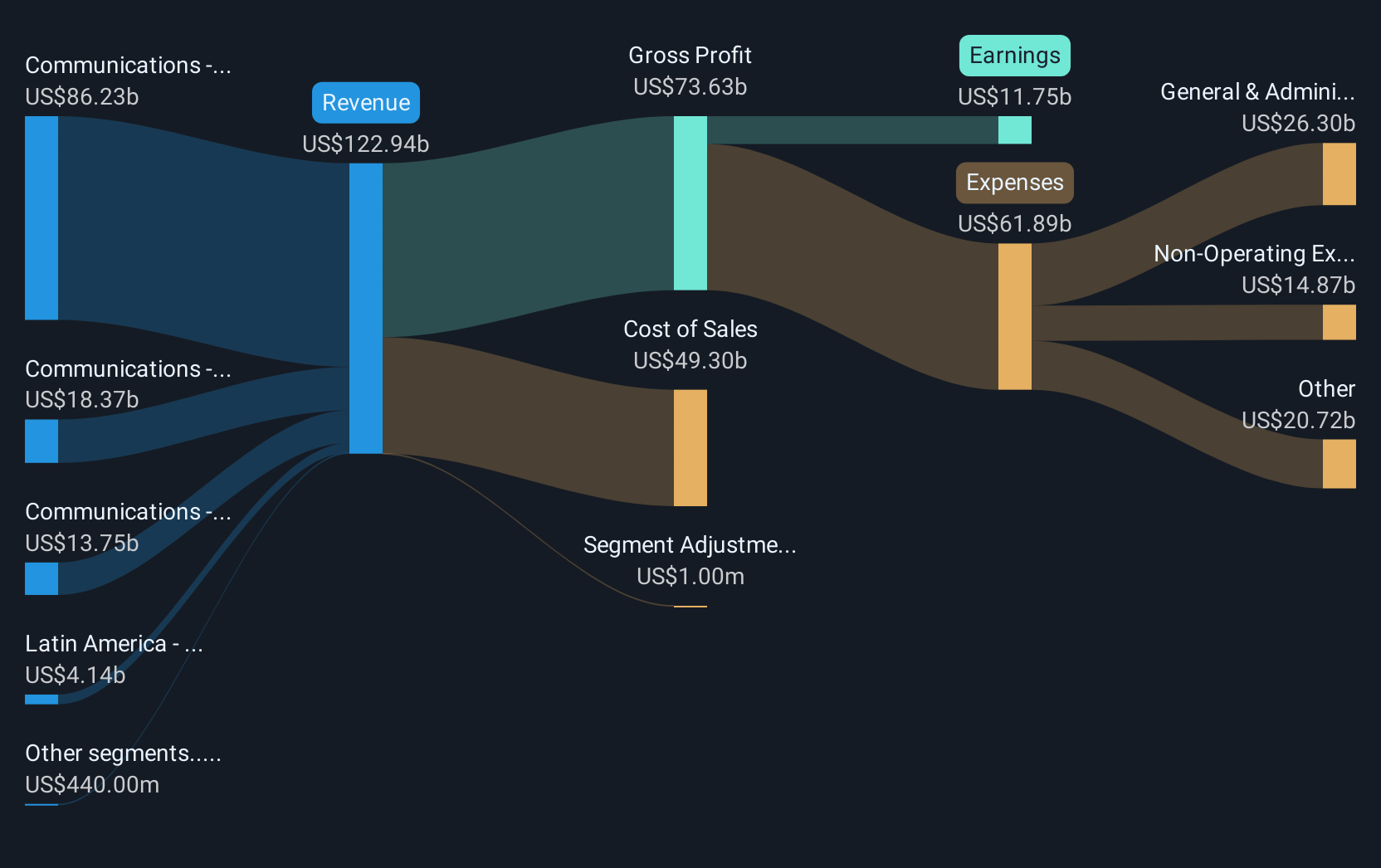

AT&T (T) Reports US$61 Billion Six-Month Revenue, Completes US$1,300 Million Buyback

Reviewed by Simply Wall St

AT&T (T) posted a modest 1.48% price increase last week amid its announcement of impressive earnings growth and the completion of a significant share buyback program. The company's Q2 results highlighted a strong revenue increase to $30,847 million with net income rising to $4,500 million, contributing positively to overall shareholder returns. Despite these developments, AT&T's performance moved broadly in line with the overall market, which also saw an upswing due to optimistic sentiment around corporate earnings and a U.S.-Japan trade deal. These positive financial updates likely supported AT&T's price movement against the backdrop of a buoyant market.

Every company has risks, and we've spotted 3 warning signs for AT&T you should know about.

AT&T's recent announcement of earnings growth and a completed share buyback program has reinforced the company's long-term strategic investments in 5G and fiber, aligning with the existing narrative of network enhancement and cost efficiency. Over the past three years, AT&T's total shareholder return, including dividends, reached a remarkable 78.58%. This long-term performance underscores the company's commitment to value creation despite recent challenges.

The company's performance over the past year, exceeding the US Market's return of 14.6%, indicates resilience in the face of increased competition and regulatory pressures. The US$30.85 billion revenue and US$4.5 billion net income reported recently could potentially uplift future revenue and earnings forecasts. Investments in 5G and fiber are expected to boost revenue growth and improve operating margins, fostering a stronger financial position.

In the context of the share price, which currently stands at $27.42, the recent rise aligns with the support from positive earnings results. However, the price remains below the consensus price target of $29.93, indicating a discount of approximately 9% to target. This gap suggests potential upside if the company's strategic investments translate into the anticipated growth. The favorable analyst price target suggests future optimism but requires cautious monitoring against evolving industry dynamics and market conditions.

Assess AT&T's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:T

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives