Analysis Indicates that AT&T Inc. (NYSE:T) Will Stabilize and Pay a High Dividend Yield

AT&T Inc. ( NYSE:T ) has been in a relative bear market possibly since 2017. The company took two major hits, including the March 2020 drop, and the WarnerMedia spinoff with Discovery, Inc ( NASDAQ:DISC.A ). Most retail shareholders were invested in AT&T because of the hefty historical dividend yield between 8.7% and 4.6% in the last decade. We will now evaluate how attractive will the future AT&T be for investors.

The company finally revealed that the expected future dividend per share is US$1.11. The current $24.5 price per share results in a future dividend yield of 4.5% (1.11/24.5*100).

This is a high yield relative to what shareholders can expect from the market. The market's lowest 25% of companies yield 1.4%, while the top 25% payers yield 3.6%. The telecom industry does have an average of 6.6% dividend yield, which is higher than the 4.5% investors can expect from AT&T.

Other notable dividend payers in the telecom industry found with our Snowflake Screener are:

- Verizon Communications ( NYSE:VZ ), yield 4.85%

- Vodacom Group ( JSE:VOD ), yield 5.72%

- Deutsche Telekom ( XTRA:DTE ), yield 3.61%

- Mobile TeleSystems ( NYSE:MBT ), yield 12.6%

In order for investors to be confident with their positions, we need to make a fundamental analysis and see how well can the company cover its dividends.

Fundamentals

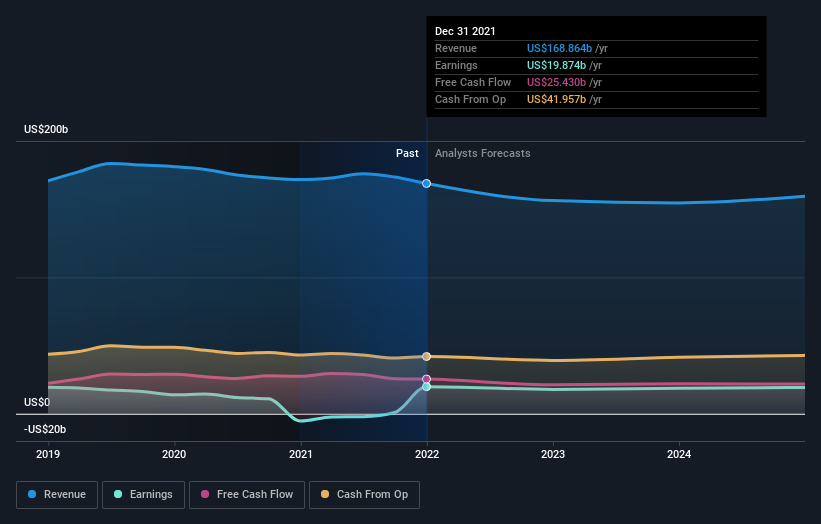

AT&T recently reported its annual numbers.The result was positive overall - although revenues of US$169b were in line with what the analysts predicted, AT&T surprised by delivering a statutory profit of US$2.76 per share, modestly greater than expected.

We also gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

See our latest analysis for AT&T

Taking into account the latest results, the 15 analysts covering AT&T provided consensus estimates of US$156.3b revenue in 2022, which would reflect a noticeable 7.5% decline on its sales over the past 12 months. This decline is partly attributable to the spinoff, so it is not necessarily a forecast for a bad business year.

Statutory earnings per share are forecast to fall 11% to US$2.48 in the same period.

The price target is $29.5 which is quite close to the current trading price. This might mean that analysts are conservative with their future estimates, since the company has been in a long downtrend.

Now let's see the viability of dividends.

Dividend Analysis

Last year, AT&T paid out 75% of its profits as dividends. This payout ratio limits the funds available for future investments. That is why, the company announced that it expects to decrease the payout ratio to 40% and focus on capital investments in 5G and fiber.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend.

The company paid out 59% of its free cash flow, which also means that the company has more cash flow than profits - this can indicate that profits are understated (see the violet line in our graph above).

It's positive to see that AT&T's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Moving to the balance sheet, some investors might be concerned about the close to 100% debt to book value of equity. While debt can be a problem, mature and reliably profitable companies can manage high debt ratios. In fact, the company is exerting tax benefits from the interest expenses on debt, which allow it to borrow more in order to fund growth projects or acquisitions - on the other hand, one can argue that this is what got the company into trouble in the first place.

All of this suggests that AT&T will have enough funds to cover future dividends, and their advertising of the $1.11 dividend per share indicates that they will be dedicated to attracting investors in the future.

Conclusion

The market is slowly pricing in the Discovery spinoff, and with the latest announcement, investors have a clearer picture of what the company is expected to look like in the future. This will allow them to build more stable models, and there is a chance that many investors will find the company to be currently undervalued. Waiting for the company to split, might be a bit late if you are considering an investment.

The company will cut the dividend to US1.11, but this still results in a high 4.5% yield, and our analysis shows that AT&T can easily cover that expense.

The company is mature but still has capacity to improve, and it will be moving to develop further its fiber network and 5G infrastructure.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:T

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)